EUR/USD Forecast – Prices, Charts, and Analysis

Recommended by Nick Cawley

How to Trade EUR/USD

The ECB hiked rates yesterday by 25 basis points across the board, the central bank’s tenth consecutive increase, as it strives to bring inflation back to target. The latest Staff Projections suggest that this may be harder than previously thought as they raised their average inflation forecasts to 5.6% this year and to 3.2% in 2024, both 0.2% higher than the June projections. While the interest rate hike was not unexpected, the mildly dovish tone of the announcement was. ECB President Christine Lagarde said that

‘Based on its current assessment, the Governing Council considers that the key ECB interest rates have reached levels that, maintained for a sufficiently long duration, will make a substantial contribution to the timely return of inflation to the target.’

EUR Breaking News: ECB Hikes Rates by 25bps, Hints Rates Have Peaked

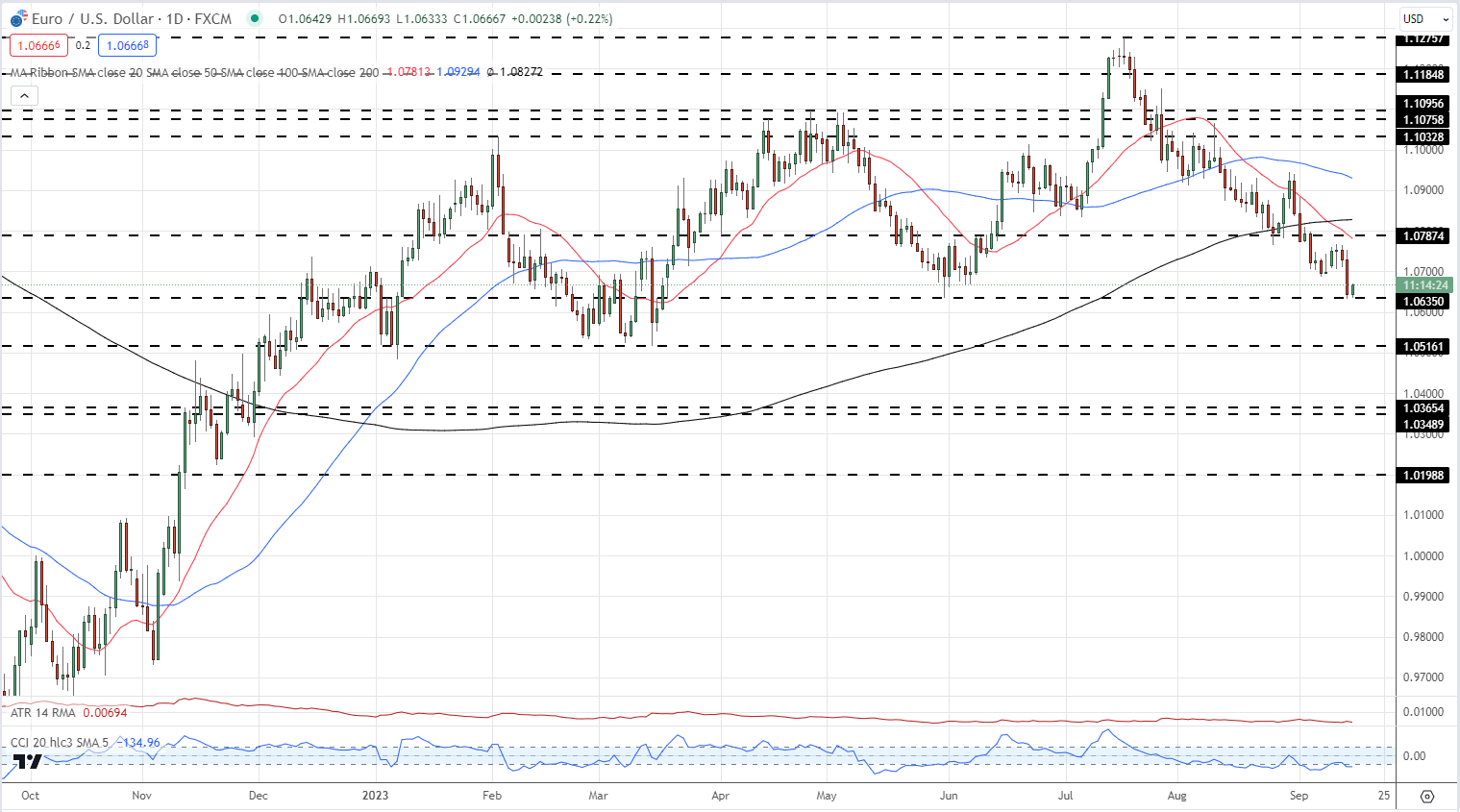

This dovish twist, suggesting rates may have peaked in the short-term at least, sent the single currency tumbling and back below 1.0700 against the US dollar.

Next week, the Federal Reserve will announce its latest monetary policy decision with the Fed fully expected to leave interest rates unchanged at 525-550. The commentary at the Fed’s post-decision press conference however is not so easy to predict and may well spark a bout of US dollar volatility. If chair Powell points to the recent weakness in the jobs market, then the market may well decide that rates are at their terminal rate, while if Powell cites recent strong US economic data then markets may look for the US central bank to hike again later this year.

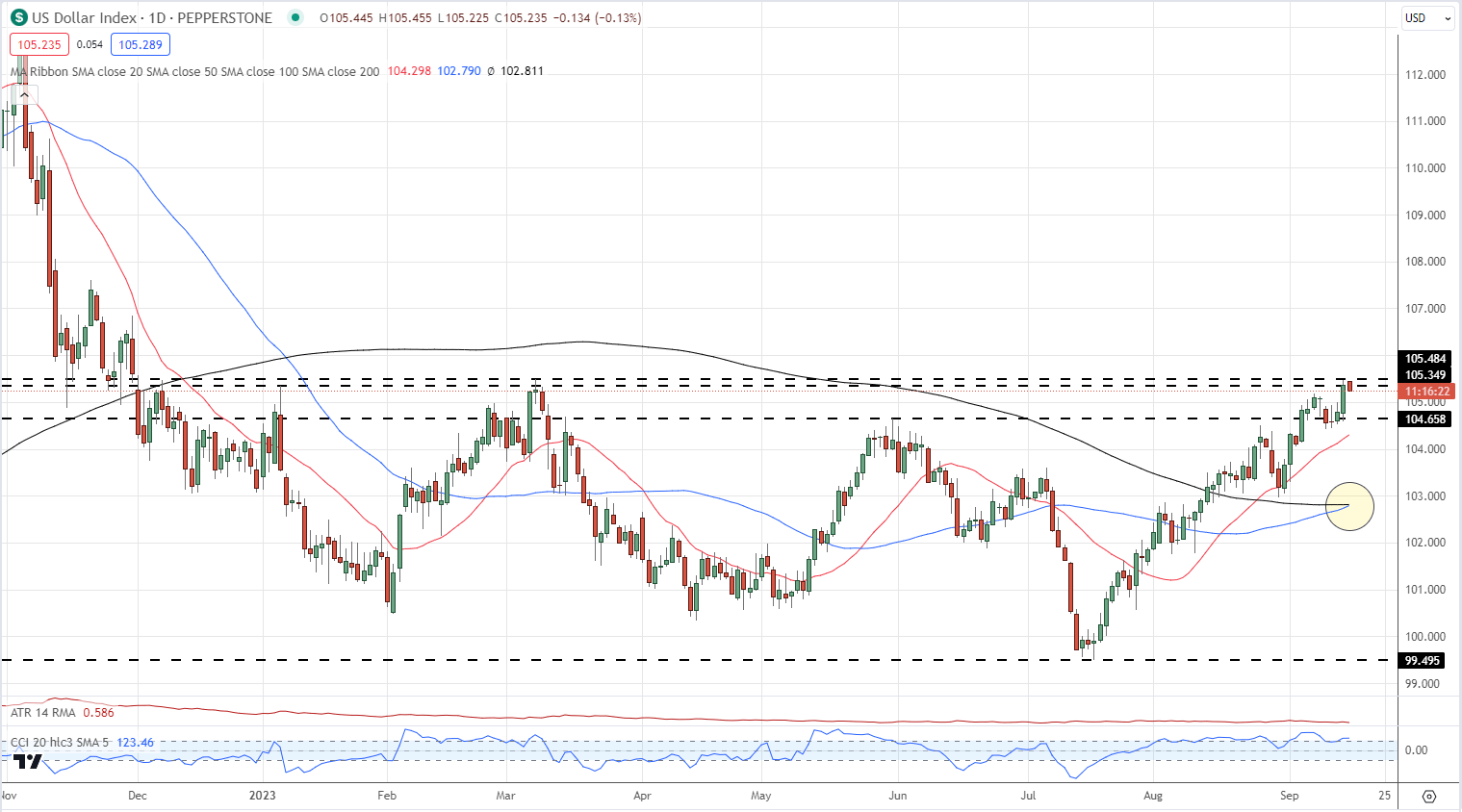

Looking at the daily US Dollar Index chart shows the greenback touching the March 8 multi-month high, while the impending 50-day/200-day sma crossover – a golden cross – suggests that the greenback has further upside.

US Dollar Index Daily Chart

Recommended by Nick Cawley

The Fundamentals of Breakout Trading

EUR/USD today tested, and rejected, a prior level of support at 1.0635. A close and open below this level would leave 1.0516 the next target. The pair looks likely to struggle to break above 1.0787 if any bullish momentum returns.

EUR/USD Daily Price Chart – September 15, 2023

Charts via TradingView

Download the Latest EUR/USD Sentiment Guide

| Change in | Longs | Shorts | OI |

| Daily | 16% | -13% | 5% |

| Weekly | 7% | -9% | 2% |

What is your view on the EURO – bullish or bearish?? You can let us know via the form at the end of this piece or you can contact the author via Twitter @nickcawley1.