USD/JPY PRICE, CHARTS AND ANALYSIS:

Most Read: US Q3 GDP Revised Lower Dragging the Dollar Index Along, Gold Rises

Recommended by Zain Vawda

How to Trade USD/JPY

USD/JPY FUNDAMENTAL BACKDROP

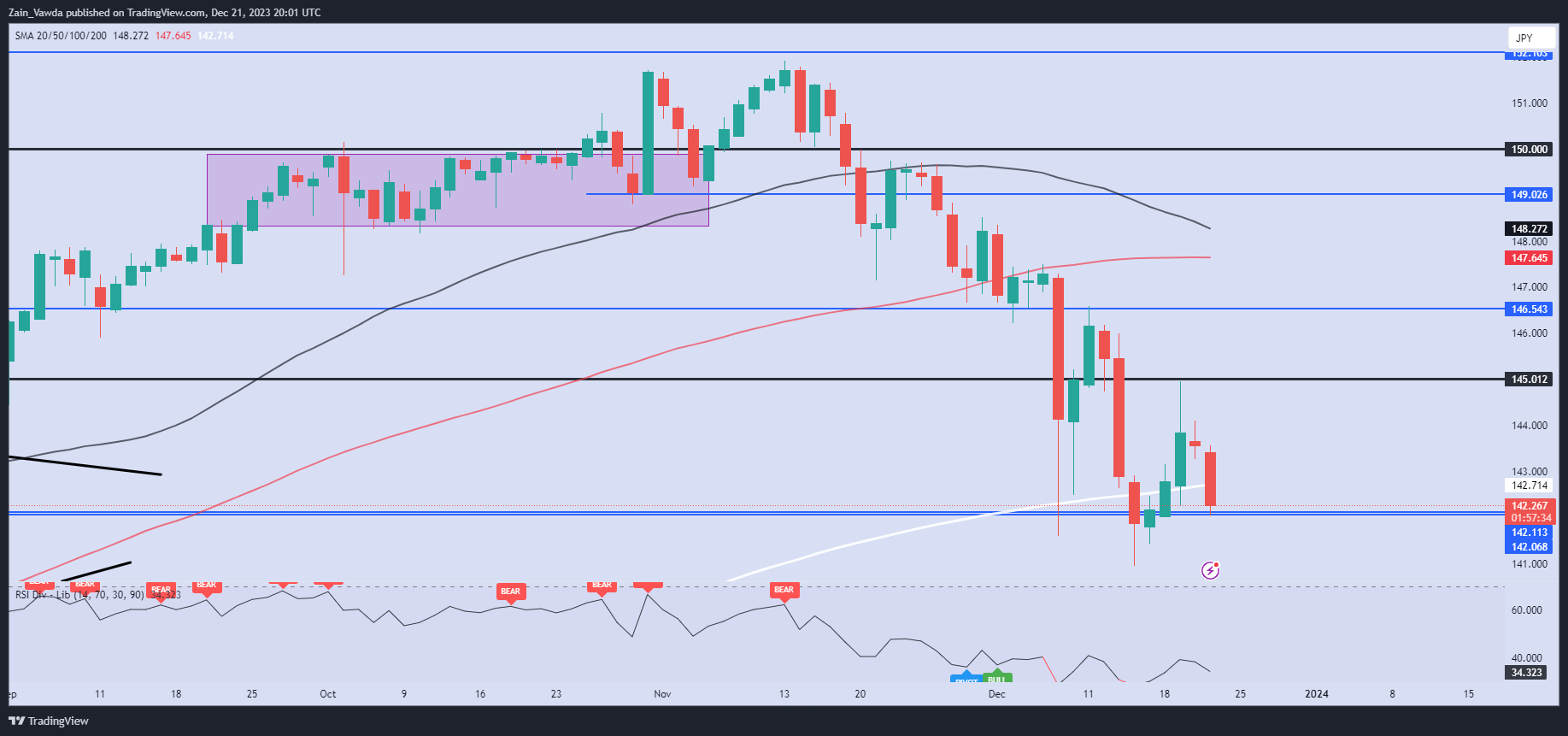

USDJPY resumed its selloff today helped in part by a downward revision to US Q3 GDP. As we speak USDJPY is testing the 142.00 support area with a break below opening up the potential for further downside ahead of the year end.

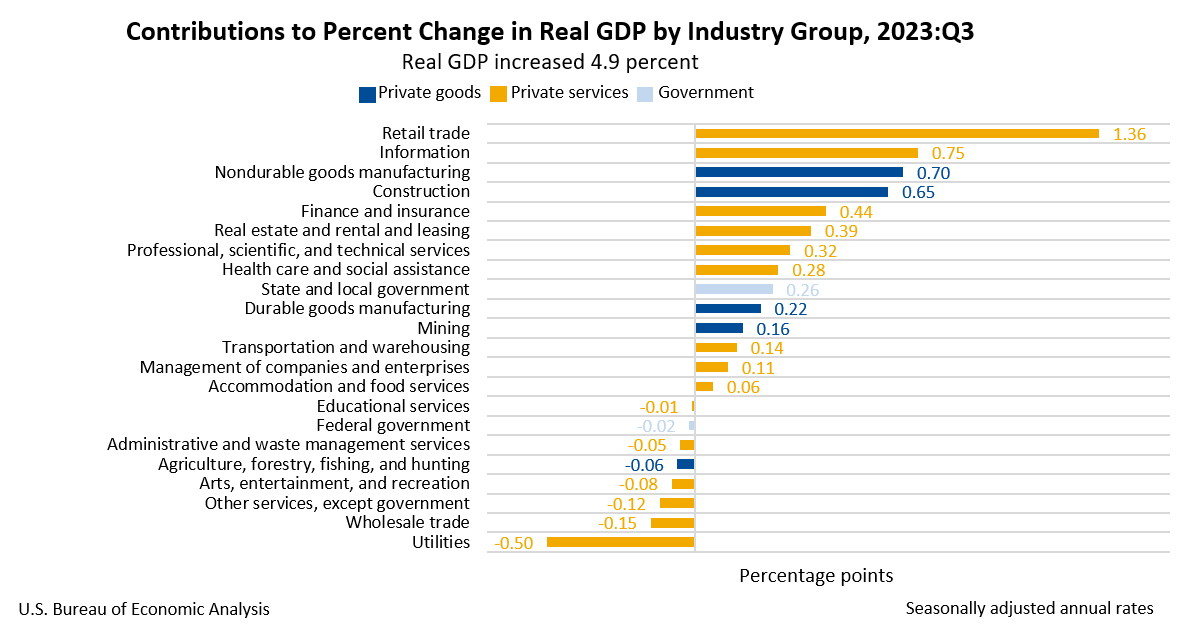

The final Q3 GDP number was revised downward today which showed a slowdown in consumer spending. Other data from the US today also missed estimates with the Philadelphia Fed Manufacturing Survey revealed that business conditions worsened with a print of -10.5, well above the forecasted figure of -3. On a positive note, the job market remains resilient with initial jobless claims growing by 205k beating estimates of 215k.

Source: US Bureau of Economic Analysis

The BoJ really did a number this week reiterating their commitment to the current easy monetary policy stance. As things stand and even with US Dollar weakness, I see limited downside for USDJPY until we get more concrete comments around a policy shift. Japanese inflation this week also showed sign of stickiness which does not help the BoJ as they look to get wage growth to outpace inflation. This will be the key factor in determining when the BoJ may be ready to finally effect the long-awaited shift in monetary policy.

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

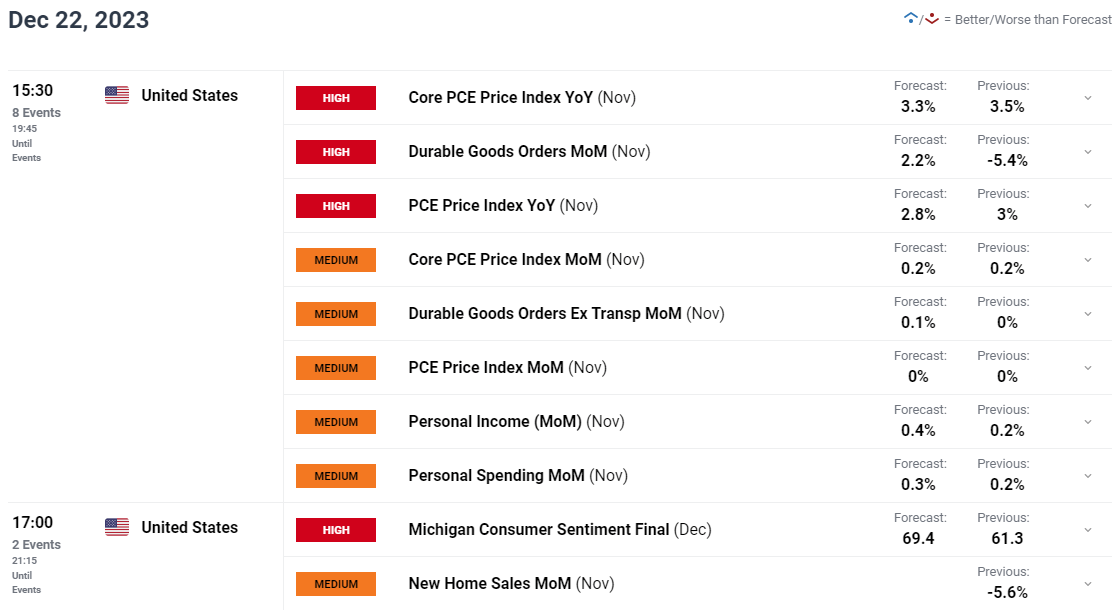

RISK EVENTS AHEAD

The economic calendar is thinning out as the year end approaches but we do have US PCE Data tomorrow which could have a massive impact on rate cut expectations. A significant drop-off may lead to market participants price in even more rate hikes than they already have, and this would thus push the USD Index lower. Core PCE Price Index YoY is expected to come in at 3.3%.

For all market-moving economic releases and events, see the DailyFX Calendar

PRICE ACTION AND POTENTIAL SETUPS

USDJPY

USDJPY from a technical perspective is attempting to break below the 142.00 support area before eyeing the psychological 140.00 handle. Personally, I think downside will be limited, particularly following stickier Japanese inflation and recent comments from the BoJ. However, US PCE data tomorrow could assist in providing a catalyst for a move lower.

Alternatively, a push higher here faces its first significant area of resistance around the 144.00 mark before the psychological 145.00 level comes into focus.

Key Levels to Keep an Eye On:

Support levels:

- 142.00

- 141.00

- 140.00

Resistance levels:

- 144.00

- 145.00

- 146.50

USD/JPY Daily Chart

Source: TradingView, prepared by Zain Vawda

IG CLIENT SENTIMENT

Taking a quick look at the IG Client Sentiment Data whichshows retail traders are 64% net-short on USDJPY. Given the contrarian view adopted here at DailyFX, is USDJPY destined to rise back toward the 145.00 handle?

For tips and tricks regarding the use of client sentiment data, download the free guide below.

| Change in | Longs | Shorts | OI |

| Daily | 7% | -5% | -1% |

| Weekly | -8% | 13% | 4% |

— Written by Zain Vawda for DailyFX.com

Contact and follow Zain on Twitter: @zvawda