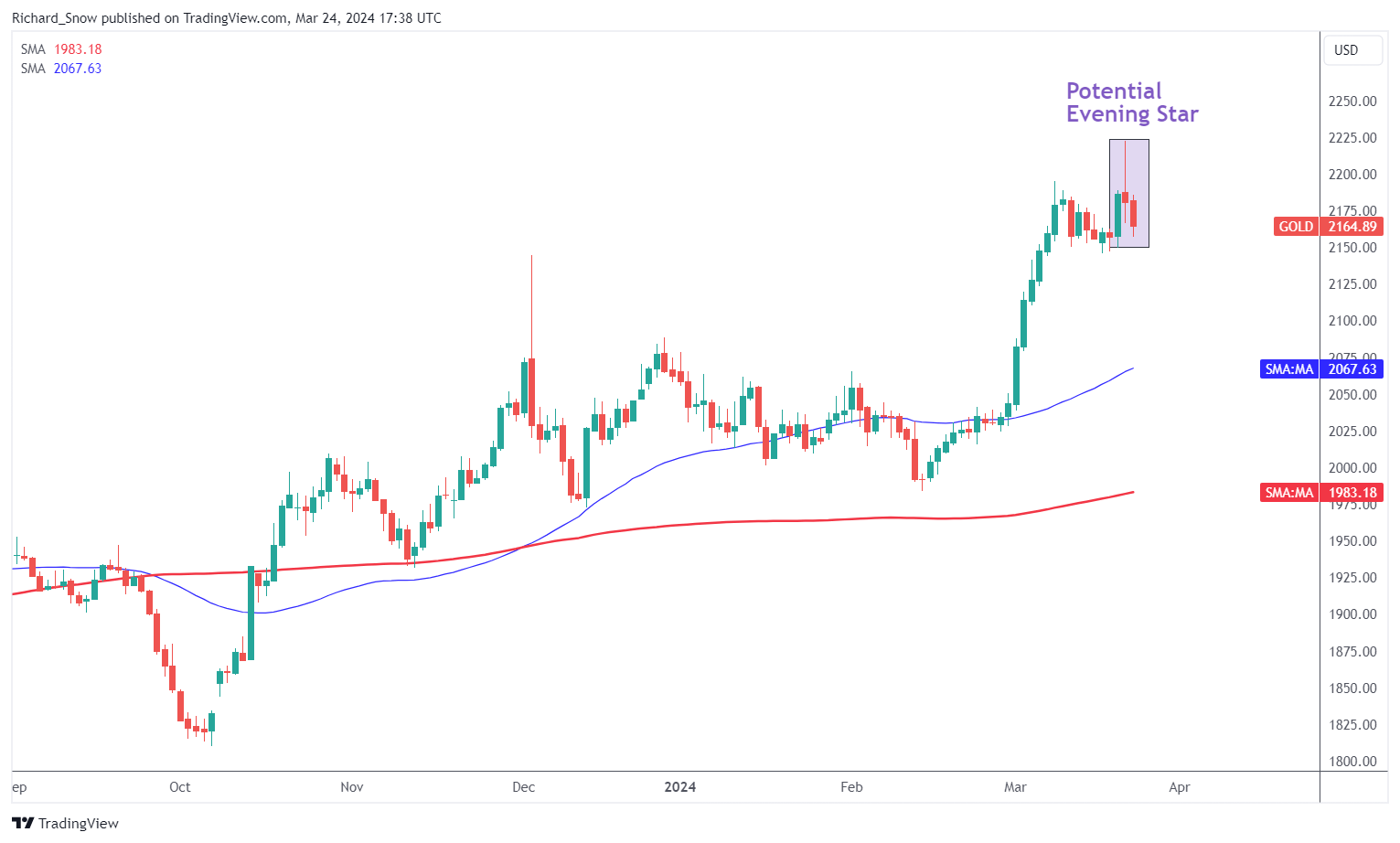

Gold Whipsaws and Signals a Potential Momentum Shift

The precious metal rose phenomenally in the wake of the FOMC meeting and updated summary if economic projections. The US dollar acted as the release valve for all the hawkish sentiment that had been priced into the market. US activity, jobs and inflation data printed on the higher side of estimates in the lead up to the March meeting, resulting in some corners of the market speculating the Fed may feel obliged to remove one rate cut from the calendar.

This view helped the spur on the dollar. However, the Fed narrowly maintained their December projection of requiring three 25 basis point cuts for 2024, sending the greenback sharply lower and gold higher – to a new all-time high.

Now that markets have has a few days to digest the data and Fed guidance, the greenback has resumed the more medium-term uptrend, sparking a sharp reversal for gold. The potential evening start suggests that gold prices may continue to moderate in the week to come.

Gold Daily Chart

Source: TradingView, prepared by Richard Snow

Gold trading involves not only a sound application of technical principles but also a comprehensive understanding of the various fundamental drivers of the precious metal. Learn the basics that all gold traders ought to know:

Recommended by Richard Snow

How to Trade Gold

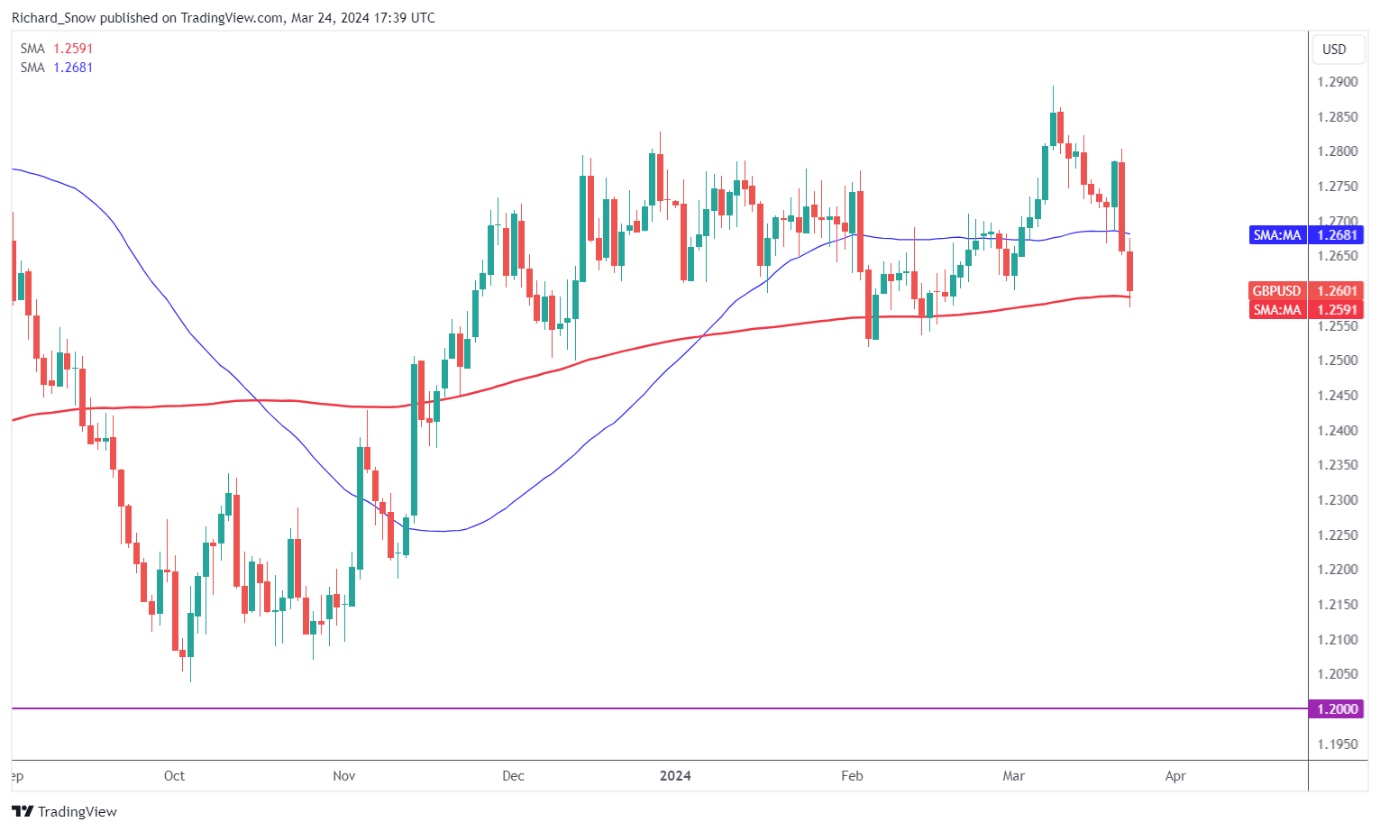

Sterling Sinks after Hawkish MPC Members Give in

The Bank of England kept the bank rate on hold, as expected, but markets were more interested in the vote split after the February meeting revealed a three-way split in the decision to hike, hold or cut interest rates.

Most Read: Bank of England Leaves Rates Unchanged, Vote Split Turns Dovish, GBP/USD Slips

However, the encouraging February inflation print appears to have convinced the two remaining hawks on the committee to vote for a hold, with the votes tallying 8 in favour of a hold and the single vote to cut from well-known dove Swati Dhingra. The coming week is very quiet form the perspective of scheduled risk events, with Good Friday rendering it a shorter trading week for a number of western nations, including the US and UK. PCE data on Friday amid what is likely to be less liquid conditions has the potential to raise volatility into the weekend.

GBP/USD Daily Chart

Source: TradingView, prepared by Richard Snow

If you’re puzzled by trading losses, why not take a step in the right direction? Download our guide, “Traits of Successful Traders,” and gain valuable insights to steer clear of common pitfalls:

Recommended by Richard Snow

Traits of Successful Traders

Technical and Fundamental Forecasts – W/C March 25th

US Dollar Forecast: PCE Data to Steal Show; EUR/USD, USD/JPY, GBP/USD Setups

This article analyzes the outlook for the U.S. dollar, focusing on three of the most traded currency pairs: EUR/USD, USD/JPY and GBP/USD. Key tech levels worth keeping an eye on in the coming days are discussed in depth.

Gold Weekly Forecast: Gold Spike Reveals Overzealous Fed Reaction

Gold prices have been reigned in after the massive push to another new all-time high. However, recent price action and a stronger dollar suggest more cooling to come

British Pound Weekly Forecast – GBP, Gilt Yields Slide, FTSE 100 Rallies Further

The holiday-shortened week ahead has little in the way of important data or events to move Sterling assets. Sterling remains under short-term pressure.

Stay up to date with breaking news and themes driving the market by signing up to out weekly newsletter below:

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

— Written by Richard Snow for DailyFX.com

Contact and follow Richard on Twitter: @RichardSnowFX