Most Read: British Pound Trade Setups & Technical Analysis – GBP/USD, EUR/GBP, GBP/JPY

Trading environments often tempt us to follow the herd – buying into soaring prices and selling off in moments of widespread fear. However, savvy, and experienced traders understand the potential opportunities that lie within contrarian strategies. Tools like IG client sentiment offer a unique window into the market’s overall mood, potentially identifying instances where excessive optimism or pessimism might signal a contrarian setup and impending reversal.

Of course, contrarian signals aren’t a guarantee of success. They gain their true power when integrated within a well-rounded trading strategy. By carefully blending contrarian observations with technical and fundamental analysis, traders develop a richer understanding of the forces shaping the market – dynamics that the masses might easily overlook. Let’s explore this idea by examining IG client sentiment and its potential impact on the Japanese yen across three crucial pairs: USD/JPY, EUR/JPY, and GBP/JPY.

For an extensive analysis of the yen’s medium-term prospects, which incorporate insights from fundamental and technical viewpoints, download our Q2 trading forecast now!

Recommended by Diego Colman

Get Your Free JPY Forecast

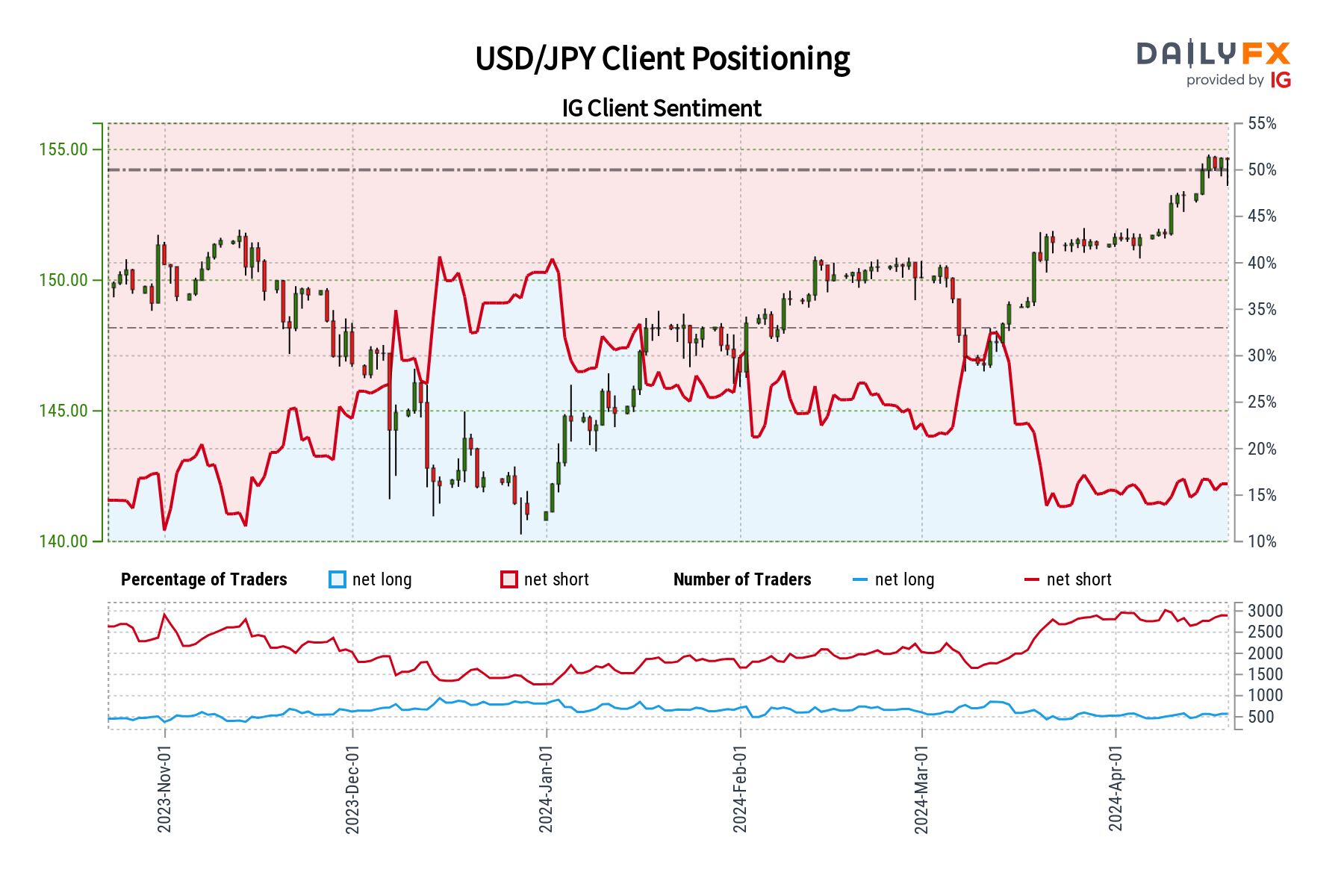

USD/JPY FORECAST – MARKET SENTIMENT

IG data reveals a heavily bearish stance towards USD/JPY, with 84.98% of clients holding net-short positions. This translates to a substantial short-to-long ratio of 5.66 to 1.

Our trading approach often favors a contrarian viewpoint. This overwhelming bearish sentiment hints at a potential continuation of the USD/JPY’s upward trajectory. The fact that traders are even more bearish than yesterday and last week strengthens this bullish contrarian outlook.

Important Reminder: While contrarian signals offer a unique perspective on market sentiment, it’s crucial to integrate them into a broader analytical framework. Combine contrarian insights with technical and fundamental analysis for a more informed approach to trading USD/JPY.

Wondering where the euro might be headed over the coming months? Explore our second-quarter outlook for expert insights and analysis. Request your free guide today!

Recommended by Diego Colman

Get Your Free EUR Forecast

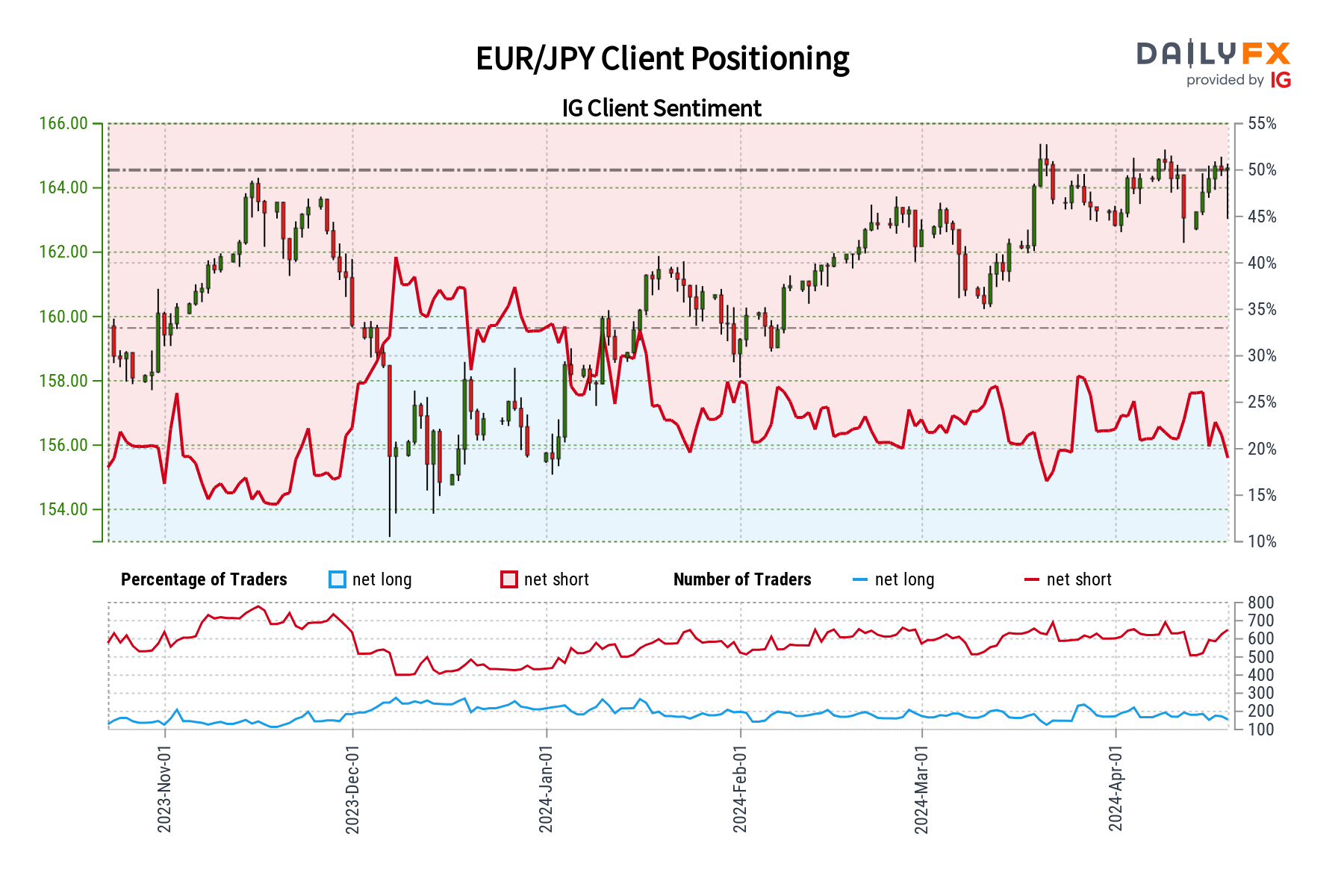

EUR/JPY FORECAST – MARKET SENTIMENT

IG data indicates a strong bearish bias towards EUR/JPY, with a substantial 83.24% of clients currently holding net-short positions. This results in a short-to-long ratio of 4.97 to 1.

Our trading strategy often incorporates a contrarian perspective. This prevalent bearishness on EUR/JPY suggests the potential for further upward movement in the pair. The increasing number of net-short positions compared to yesterday and last week reinforces this bullish contrarian outlook.

Crucial Note: While contrarian signals can offer valuable insights, they are most powerful when integrated into a comprehensive trading approach. Always consider technical and fundamental analysis alongside sentiment data for the most informed decisions about EUR/JPY.

Want to understand how retail positioning may impact GBP/JPY’s trajectory in the near term? Our sentiment guide holds all the answers. Don’t wait, download your free guide today!

| Change in | Longs | Shorts | OI |

| Daily | -27% | -9% | -13% |

| Weekly | -18% | 7% | 0% |

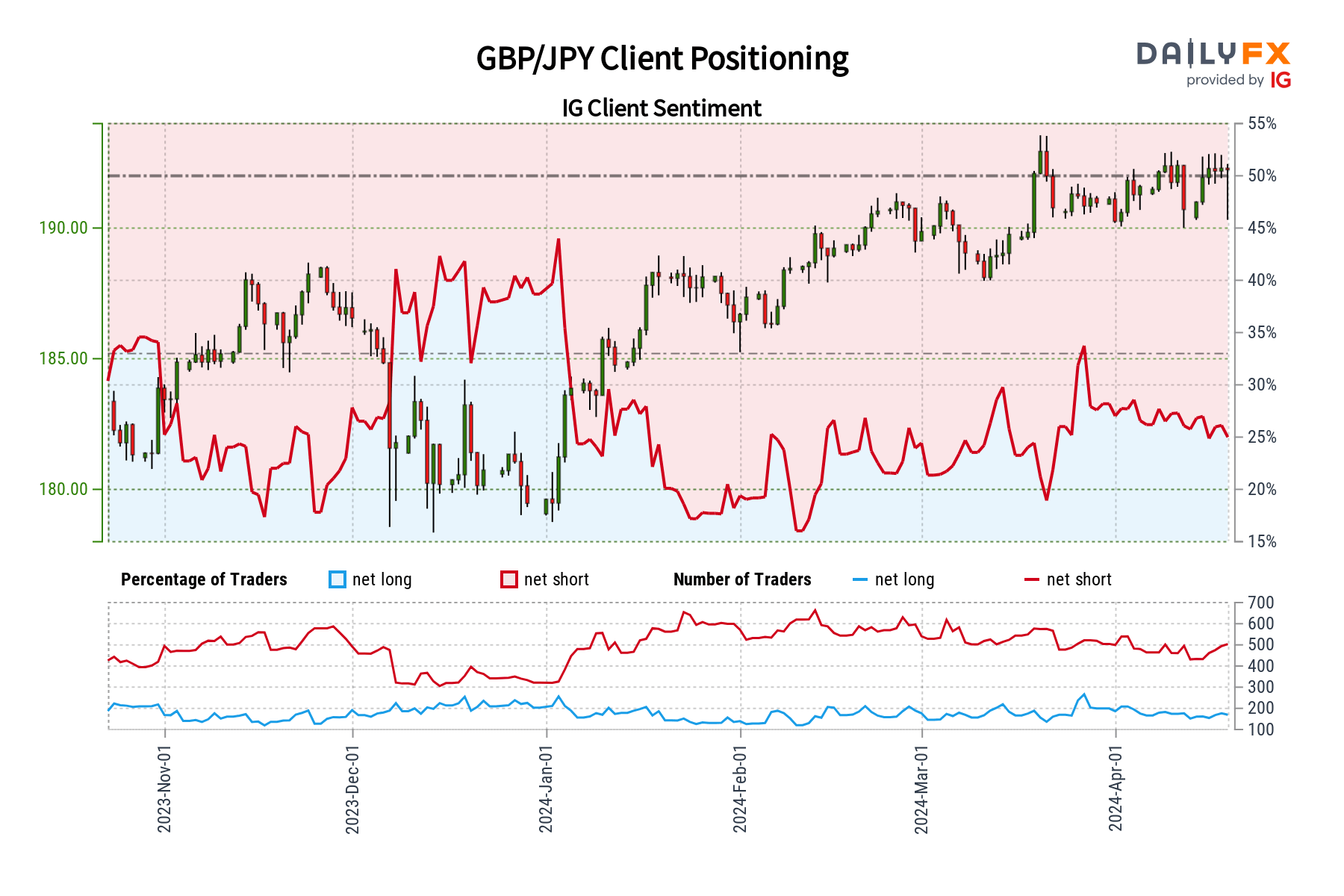

GBP/JPY FORECAST – MARKET SENTIMENT

IG data reveals a significant bearish tilt among traders towards GBP/JPY. Currently, 79.34% hold net-short positions, resulting in a short-to-long ratio of 3.84 to 1.

We often employ a contrarian approach to market sentiment. This widespread pessimism towards GBP/JPY suggests additional gains may be in store for the pair before any type of meaningful pullback. The continued increase in net-short positions strengthens this bullish contrarian outlook.

Important Point: Remember that contrarian signals are just one tool in a trader’s arsenal. A comprehensive trading strategy should also incorporate technical and fundamental analysis for a well-rounded approach to GBP/JPY.