EUR/USD Underpinned by Better-Than-Expected Euro Area PMIs, Weak US Dollar

- Euro Area composite PMI beats expectations but caution needed

- German manufacturing woes continue

- Can Powell support an ailing US dollar?

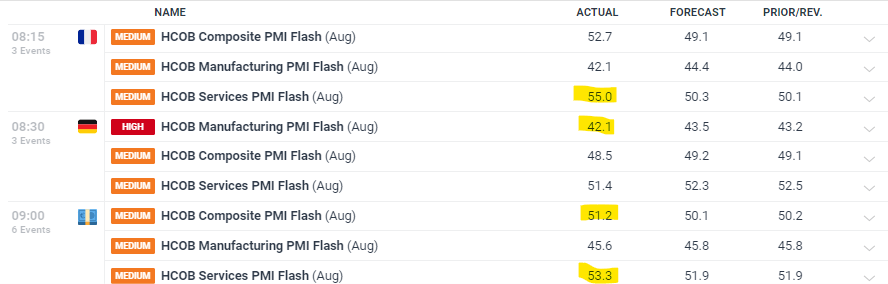

Economic activity in the Euro Area picked up in August, according to the latest HCOB PMIs, but a closer look at the numbers ‘reveals that the underlying fundamentals might be shakier than they appear,’ according to HCOB chief economist Dr. Cyrus de la Rubia.

‘It’s a tale of two worlds. The manufacturing sector remains mired in recession, while the services sector still appears to be growing at a decent clip. But with the temporary Olympic boost in France fading and signs of waning confidence across the Eurozone’s service industry, it’s likely only a matter of time before the struggles of the manufacturing sector start weighing on services too.’

Recommended by Nick Cawley

Trading Forex News: The Strategy

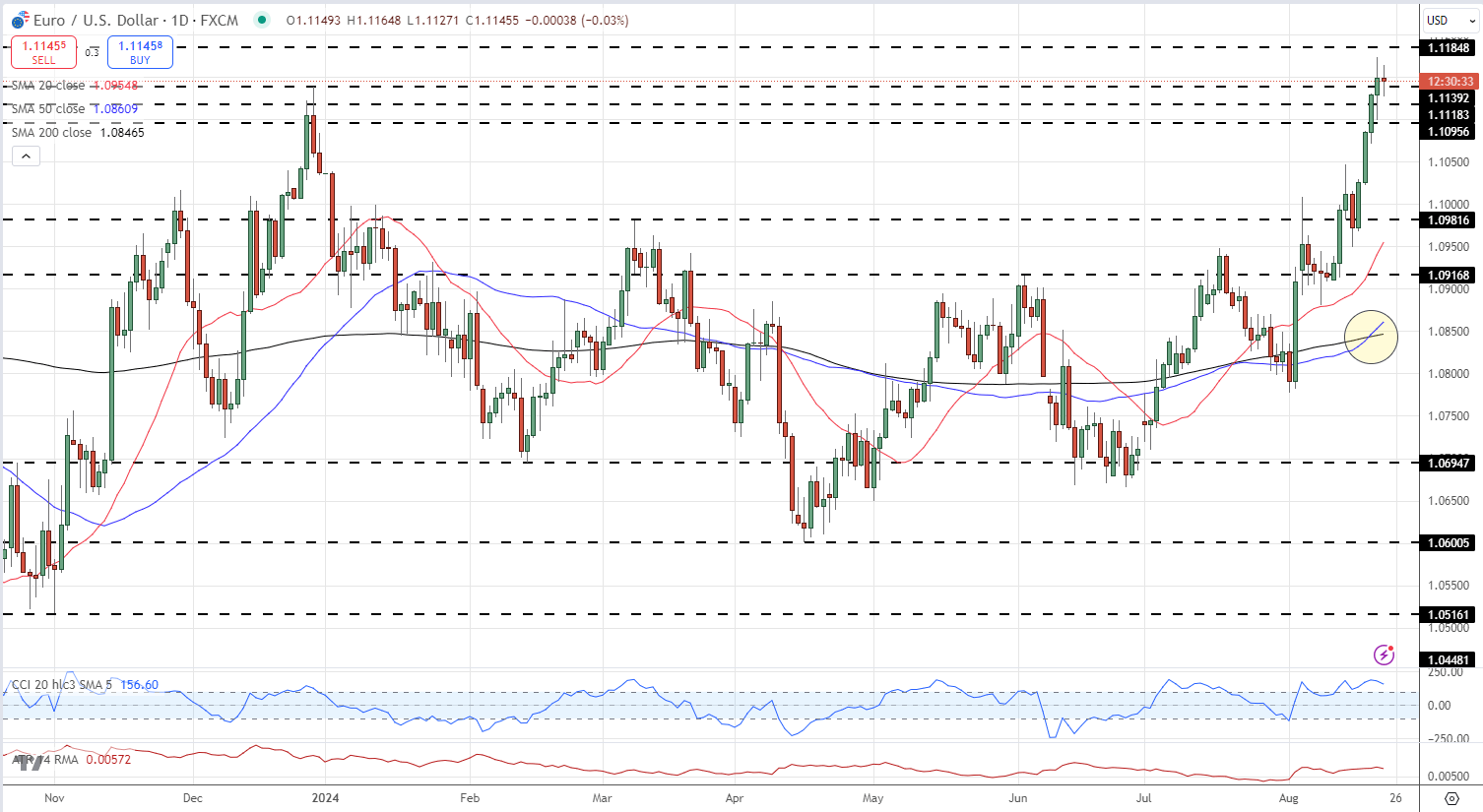

The Euro posted a fresh 13-month high against the US dollar on Monday and remains within touching distance of posting another high today. The US dollar remains weak as the Federal Reserve prepares a series of interest rate cuts that are expected to start in September. Friday’s appearance by Fed chair Jerome Powell at the Jackson Hole Symposium may give the market a better understanding of the central bank’s current thinking and the expected tempo of rate cuts going forward.

Today’s EUR/USD price action is likely to remain within Monday’s range – 1.1099-1.1174 – with yesterday’s high the more likely to be tested.

EUR/USD Daily Chart

Chart Using TradingView

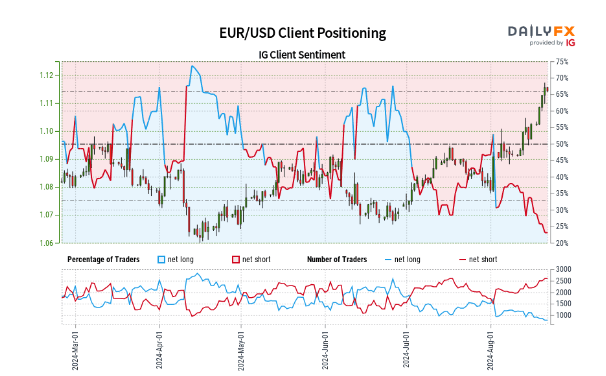

Retail trader data shows 22.77% of traders are net-long with the ratio of traders short to long at 3.39 to 1.The number of traders net-long is 5.47% lower than yesterday and 23.95% lower from last week, while the number of traders net-short is 1.73% higher than yesterday and 7.93% higher from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-short suggests EUR/USD prices may continue to rise. Traders are further net-short than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger EUR/USD-bullish contrarian trading bias.

| Change in | Longs | Shorts | OI |

| Daily | 8% | -6% | -2% |

| Weekly | 55% | -15% | 1% |