GBP/USD – Prices, Charts, and Analysis

- Attention is already turning to the mid-December central bank bonanza.

- Sterling needs to do some work of its own.

- November NFPs take the edge of GBP/USD.

Recommended by Nick Cawley

Get Your Free GBP Forecast

Most Read: British Pound Latest – GBP/USD Prints a Fresh Multi-Month High

The financial markets have given UK PM Rishi Sunak a fairly easy start to his time at No.10 so far but with the ghosts of Liz Truss and Kwasi Kwarteng now fully in the past, Sterling is going to need some positive news if it is to continue its recent rally. And with little UK economic data or events next week to help the Pound then traders will look towards the December 15 Bank of England MPC meeting for the next potential driver.

The UK is not the only central bank announcing its latest policy decision in mid-December with the Fed meeting on December 14, while the ECB, the Swiss National Bank, and the Norges Bank all reveal their latest decisions on December 15 as well. These meetings will set the tone for a range of currencies in the weeks ahead.

For all central bank policy decision dates see the DailyFX Central Bank Calendar

Recommended by Nick Cawley

How to Trade GBP/USD

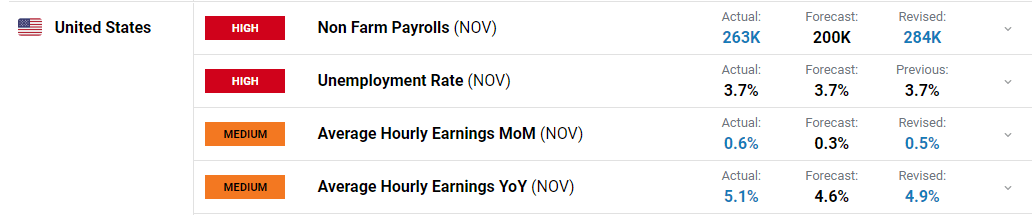

The latest US Jobs Report (NFP) beat market expectations with 263k new jobs created compared to expectations of 200k. The unemployment rate remained the same, 3.7%, while average hourly earnings y/y rose to 5.1% vs expectations of 4.6% and a revised higher October rate of 4.9%.

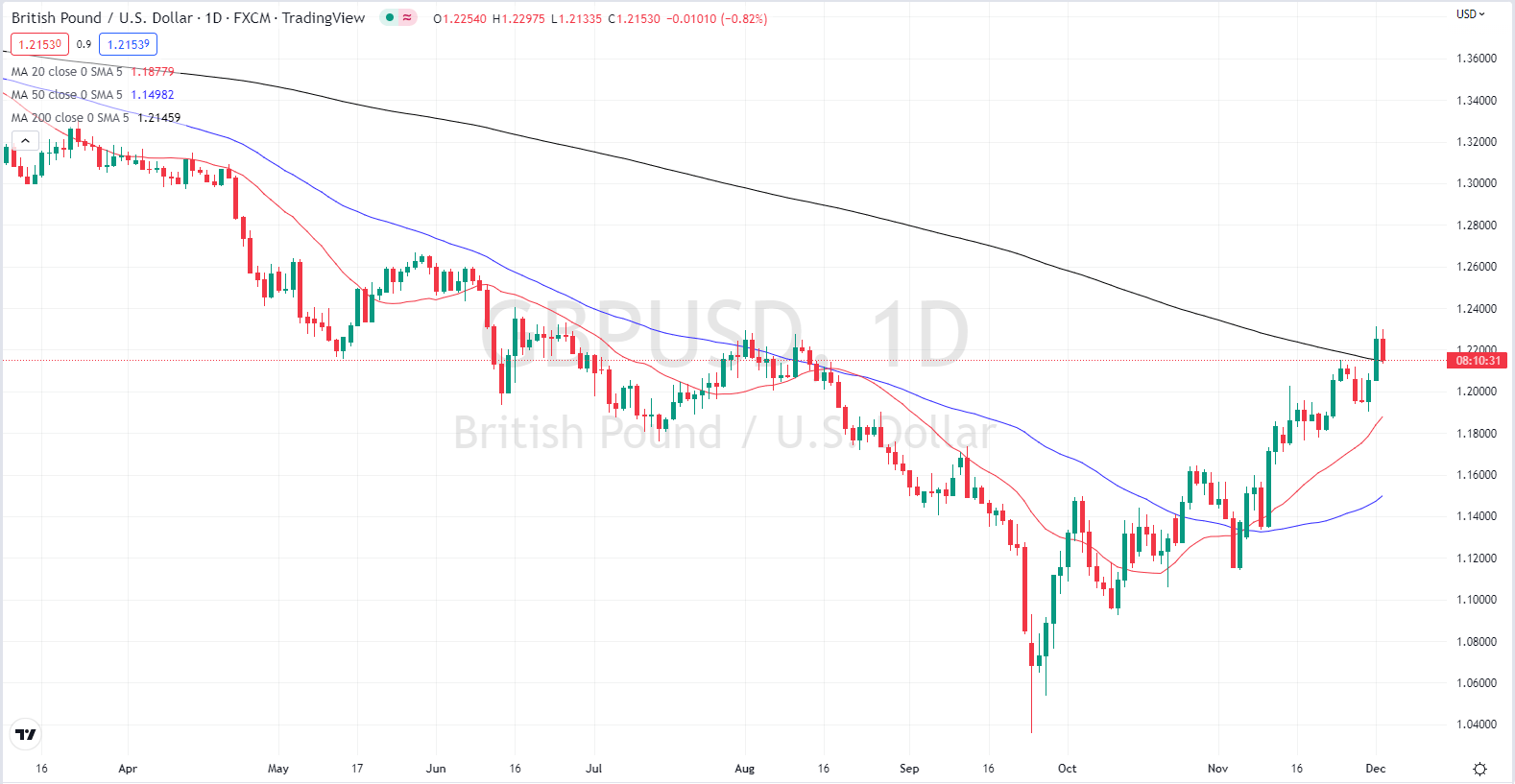

The jobs numbers propped up the US dollar post-release and helped to stem some of this week’s losses. On Thursday, cable touched a multi-month high of 1.2311, breaking above the 200-day moving average in the process. The NFP release sent the pair 120 pips lower and back to the previously mentioned longer-dated moving average. Looking ahead, short-term support is seen around the 1.2000/1.2050 area before 1.1900 comes into play.

GBP/USD Daily Price Chart – December 2, 2022

Chart via TradingView

Retail Traders Cut Longs, Increase Short-Term Shorts

| Change in | Longs | Shorts | OI |

| Daily | 0% | -6% | -4% |

| Weekly | -11% | -5% | -7% |

Retail trader data show 36.32% of traders are net-long with the ratio of traders short to long at 1.75 to 1.The number of traders net-long is 13.16% lower than yesterday and 10.88% lower from last week, while the number of traders net-short is 16.11% higher than yesterday and 4.03% lower from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-short suggests GBP/USD prices may continue to rise. Traders are further net-short than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger GBP/USD-bullish contrarian trading bias.

What is your view on the British Pound – bullish or bearish?? You can let us know via the form at the end of this piece or you can contact the author via Twitter @nickcawley1.