POUND STERLING ANALYSIS & TALKING POINTS

- Lackluster USD could be stimulated next week leaving GBP vulnerable.

- Stacked economic calendar for both UK and U.S..

- Rising wedge break looms.

Recommended by Warren Venketas

Get Your Free GBP Forecast

GBP/USD FUNDAMENTAL FORECAST: BEARISH

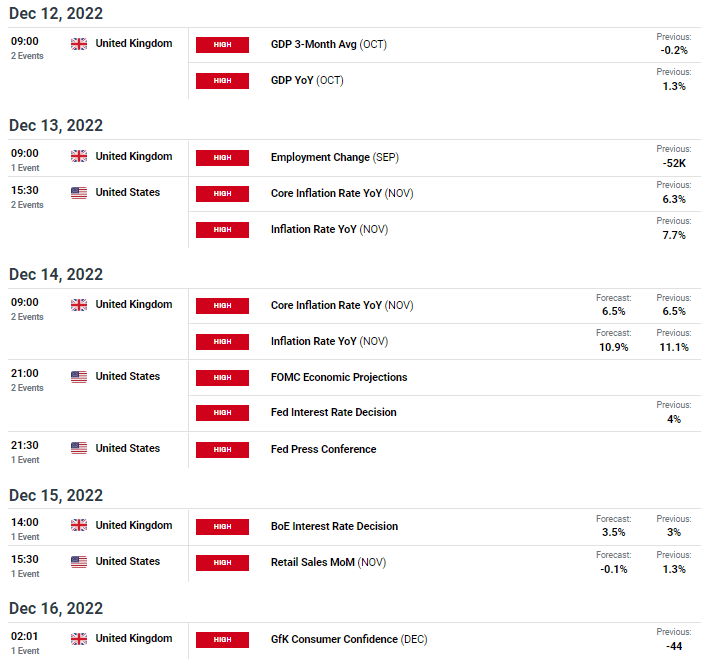

The British pound heads into a central bank fueled week relatively stout after the USD failed to capitalize on better than expected economic data (PPI and Michigan consumer sentiment) last Friday. This comes after robust labor data (NFP) and strong ISM services PMI data. It seems as if markets are holding off on this data in preparation for the plethora of data points scheduled next week – see economic calendar below. While there is much in the way of UK centric data, the U.S. core inflation read and Federal Reserve interest rate decision will likely be the focal point for global markets. The Fed has been divided by the aforementioned positive data and contrasting softer inflation without the guidance from Fed officials during this FOMC blackout period.

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

GBP/USD ECONOMIC CALENDAR

Source: DailyFX Economic Calendar

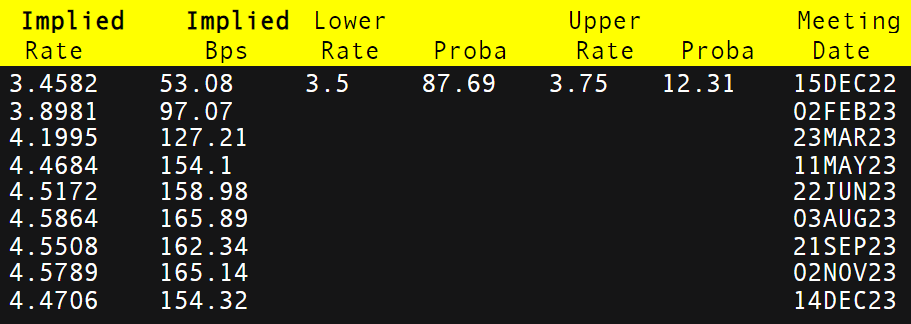

From a UK perspective, housing prices have been exhibiting a decline due to tightening monetary policy and with fiscal policy in line with the Bank of England (BoE), next week’s rate decision is likely to remain at the 50bps mark. Currently, money markets are in agreement with this conjecture with an almost 88% probability (refer to table below). The same is true for the Fed which leaves little in the way of a surprising announcement by either central bank. The Fed press conference will be take center stage with markets awaiting Fed Chair Jerome Powell’s statement. His prior statement mentioned moderating future rate hikes and was naturally taken in a dovish manner. The U.S. core inflation read could change this rhetoric should it beat estimates, highlighting inflationary pressures in the region and the need for tight monetary policies.

BANK OF ENGLAND INTEREST RATE PROBABILITIES

Source: Refinitiv

TECHNICAL ANALYSIS

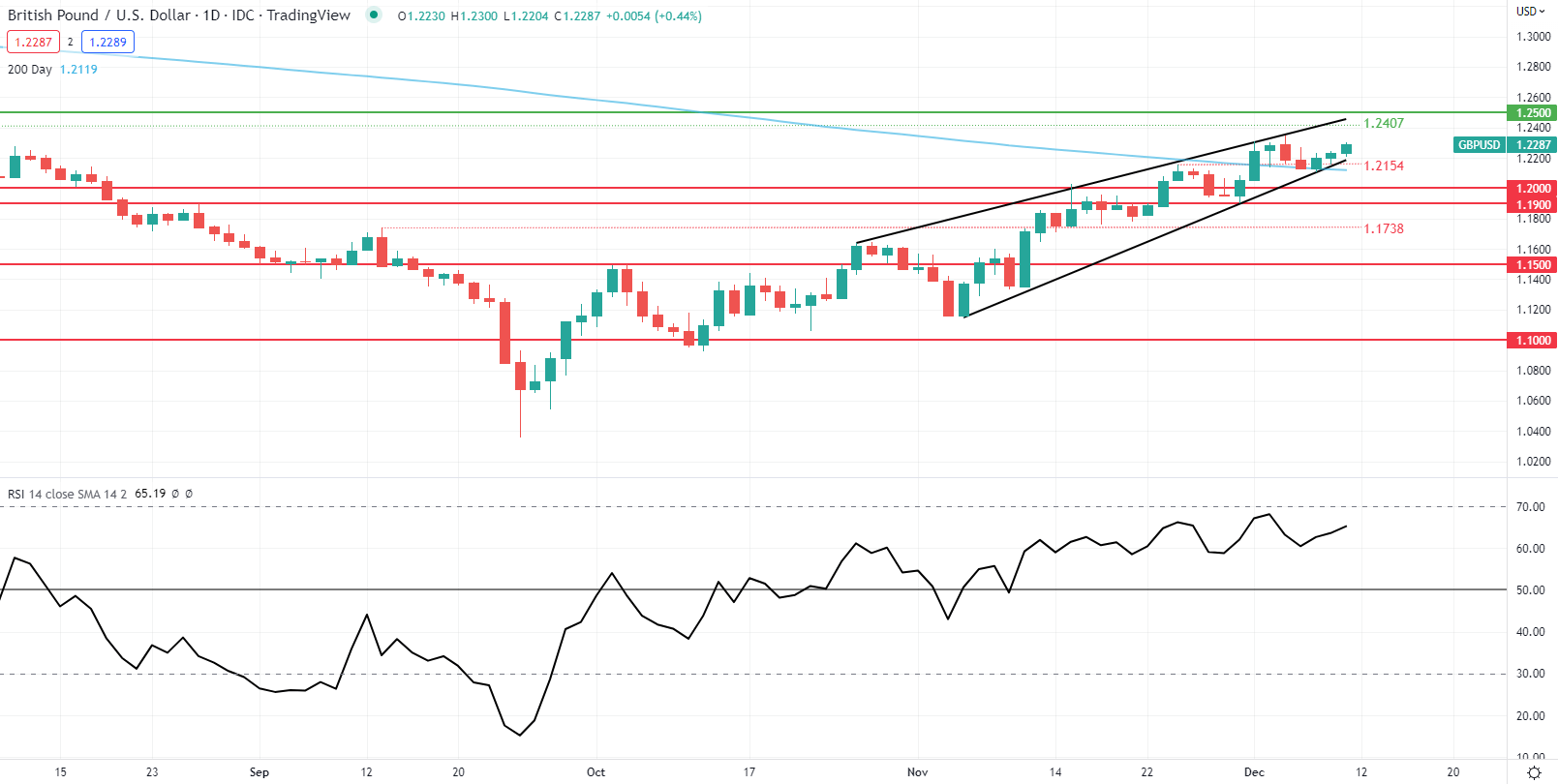

GBP/USD DAILY CHART

Chart prepared by Warren Venketas, IG

Introduction to Technical Analysis

Candlestick Patterns

Recommended by Warren Venketas

Daily GBP/USD price action continues to track the rising wedge formation (black) after the recent push above the 200-day SMA (blue). This being said, there has been a lack of conviction by bulls to exploit this move which could be a sign that bullish momentum is waning. The Relative Strength Index (RSI) has is nearing overbought levels which leaves some room for further pound strength but considering the fundamental headwinds facing the UK, there could be scope for a leg lower on the cable pair. A confirmation close below the 200-day SMA which should coincide with wedge support could expose the 1.2000 and 1.1900 support handles respectively.

Key resistance levels:

- 1.2500

- 1.2407

Key support levels:

- 1.2154

- 200-day SMA/Wedge support

- 1.2000

- 1.1900

MIXED IG CLIENT SENTIMENT

IG Client Sentiment Data (IGCS) shows retail traders are currently SHORT on GBP/USD, with 61% of traders currently holding short positions (as of this writing). At DailyFX we typically take a contrarian view to crowd sentiment but due to recent changes in long and short positioning, we arrive at a short-term cautious bias.

Contact and followWarrenon Twitter:@WVenketas