GAMMA SQUEEZE TALKING POINTS

Some find the gamma squeeze a mysterious concept. This article aims to illuminate the intricacies of the gamma squeeze by covering the following key ideas:

- What is a Gamma Squeeze?

- Delta and Gamma Greek Call Table.

- What causes a Gamma Squeeze and how you can avoid it?

- Gamma squeeze vs Short squeeze.

- Gamma squeeze example.

What is a Gamma Squeeze?

A gamma squeeze is a function of market makers hedging their exposure to negative (short) gamma and negative (short) delta after selling call options on a specific stock.

This may all seem confusing so let’s break it down:

Delta – this represents the expected change in the price of an option in response to a $1 change in the underlying stock price. A positive delta indicates a long position on the market because the price of the option would rise in line with a rise in stock price (delta), while a negative delta relates to being short the market.

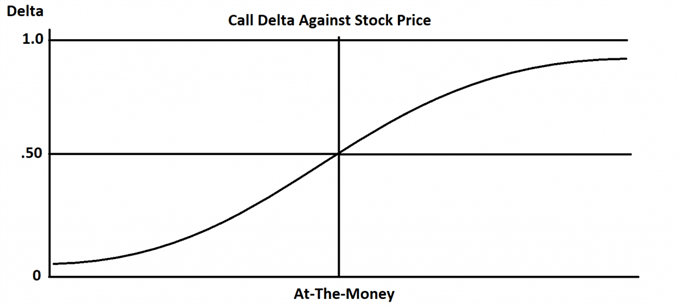

Gamma – Gamma is the first derivative of delta and simply denotes the rate of change of delta. Gamma values are highest for ATM (at-the-money) options and lowest for those far OTM (out-the-money) or ITM (in-the-money).

Long gamma – signals that an option position’s delta will rise when the share price rises and vice versa.

Short gamma – signals that an option position’s delta will fall when the share price rises and vice versa.

The chart above shows how call delta values change with stock prices. The slope is steepest around ATM options which is the rate of change and therefore gamma itself. The flatter curve for deep OTM options show graphically why gamma is lowest for deep OTM and ITM options.

Delta and Gamma Greek Call Table

| Direction | Delta | Gamma |

|---|---|---|

| Long Call | + | + |

| Short Call | – | – |

What causes a Gamma Squeeze and how you can avoid it?

There is no one contributing factor to a gamma squeeze however, there are several important donors to the phenomenon:

- Short-dated call options on a stock.

- Delta hedging.

- Shares with low liquidity.

To avoid the negative effects of a gamma squeeze investors should keep in mind two simple rules:

- Do not short stocks while the gamma squeeze is underway – trying to pick tops.

- Keep away from selling call options.

Recommended by Warren Venketas

Get Your Free Equities Forecast

Gamma squeeze vs Short squeeze

A short squeeze involves shorting or borrowing stock and buying back at a later date but when buyers flood the market and push the share price higher, short sellers add to the upward pressure by joining the buying frenzy in an attempt to mitigate losses and close out their positions.

A gamma squeeze on the other hand involves options, and when market makers sell deep OTM options, they are required to purchase more and more shares to hedge their exposure to rising share prices as gamma of the option rises, hence why it is called a ‘gamma squeeze’. This may be more clear with the example below.

Gamma squeeze example

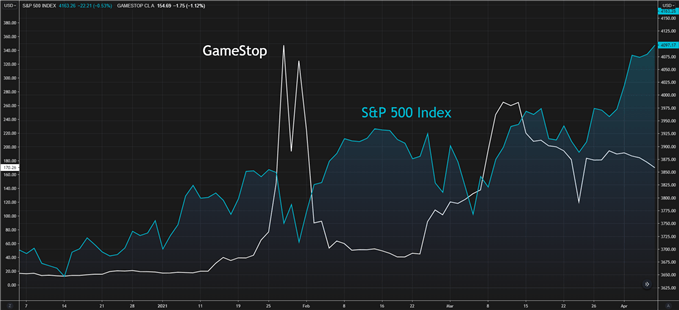

Most recently the GameStop (GME) spectacle made headline news after a meteoric rise in its share price within a relatively short space of time (see chart below). When investors purchase call options on GME, there needs to be a counterparty. In most cases the market maker (counterparty) takes this position on the other side of the trade. Market makers are generally indifferent to underlying stock price movements and profit from the trade itself (spread). Therefore, taking on additional long calls carries risk for the market maker should underlying share prices rise. To hedge against such adverse movements, market makers go to the market and purchase the respective share.

This is ultimately what caused the sharp increase in the GME share price. In theory this happening was a combination of a short squeeze and gamma squeeze with the gamma squeeze providing additional fuel to the fire.

GameStop Corp. vs S&P 500 Index

Chart prepared by Warren Venketas, Refinitiv

Contact and follow Warren on Twitter: @WVenketas