Dow Jones, S&P 500, Retail Trader Positioning, Technical Analysis – IGCS Equities Update

- Dow Jones and S&P 500 have been stuck in range-bound trade

- Retail traders are increasing upside exposure, a bearish sign?

- How is the technical landscape shaping up amid this signal?

Recommended by Daniel Dubrovsky

Get Your Free Equities Forecast

In recent weeks, the Dow Jones and S&P 500 have been stuck in range-bound price action. As volatility continues to cool, retail traders have continued to adapt their exposure. This can be seen by looking at IG Client Sentiment (IGCS), which can at times function as a contrarian indicator. Recently, IGCS has been producing bearish signals. Let us take a closer look.

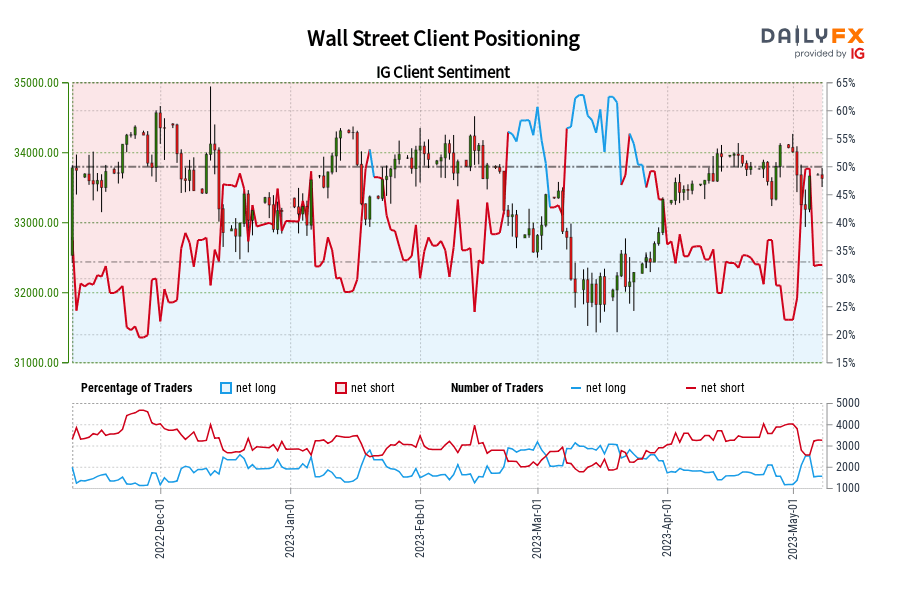

Dow Jones Sentiment Outlook – Bearish

According to IGCS, about 37% of retail traders are net-long the Dow Jones. Since most exposure is still biased to the downside, this hints prices may continue rising. But, upside exposure has increased by 31.24% and 42.63% compared to yesterday and last week, respectively. With that in mind, these recent changes warn that the price trend may soon reverse lower.

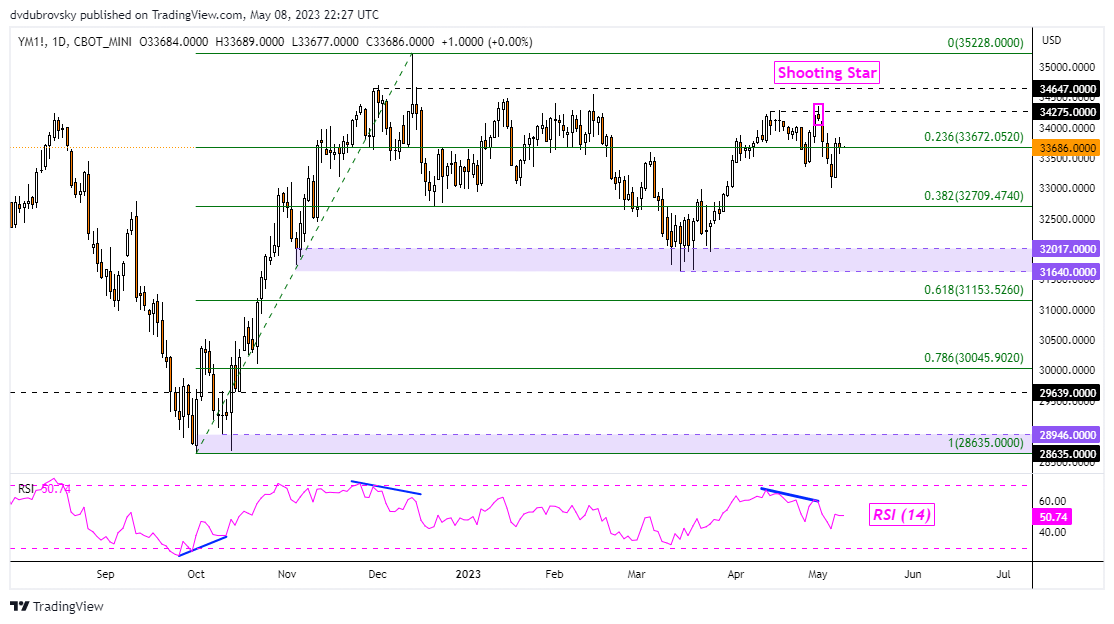

Dow Jones Technical Analysis

On the daily chart, the Dow Jones has been aiming somewhat lower in the aftermath of a Shooting Star candlestick pattern as well as fading upside momentum. The latter was shown by negative RSI divergence as the candlestick pattern emerged. This is a sign of perhaps further weakness to come. Immediate support is the 23.6% Fibonacci retracement level at 33672. Clearing that exposes the 38.2% point at 32709 before the 31640 – 32017 zone kicks in.

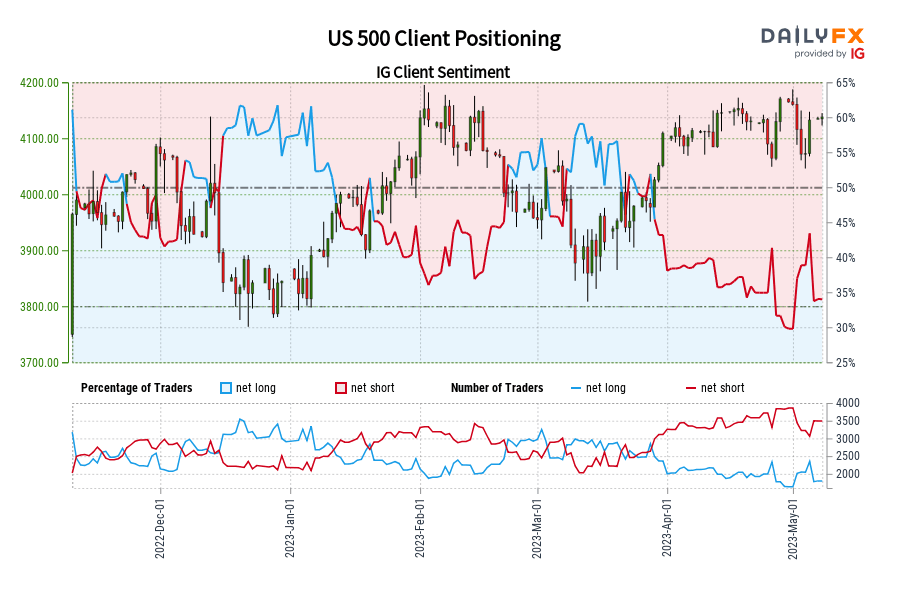

S&P 500 Sentiment Outlook – Bearish

According to IGCS, about 36% of retail traders are net-long the S&P 500. Since most positioning is biased to the downside, this hints prices may rise. Meanwhile, upside exposure has increased by 15.11% and 12.72% compared to yesterday and last week, respectively. With that in mind, recent changes in positioning hint that the price trend may soon reverse lower.

Recommended by Daniel Dubrovsky

Improve your trading with IG Client Sentiment Data

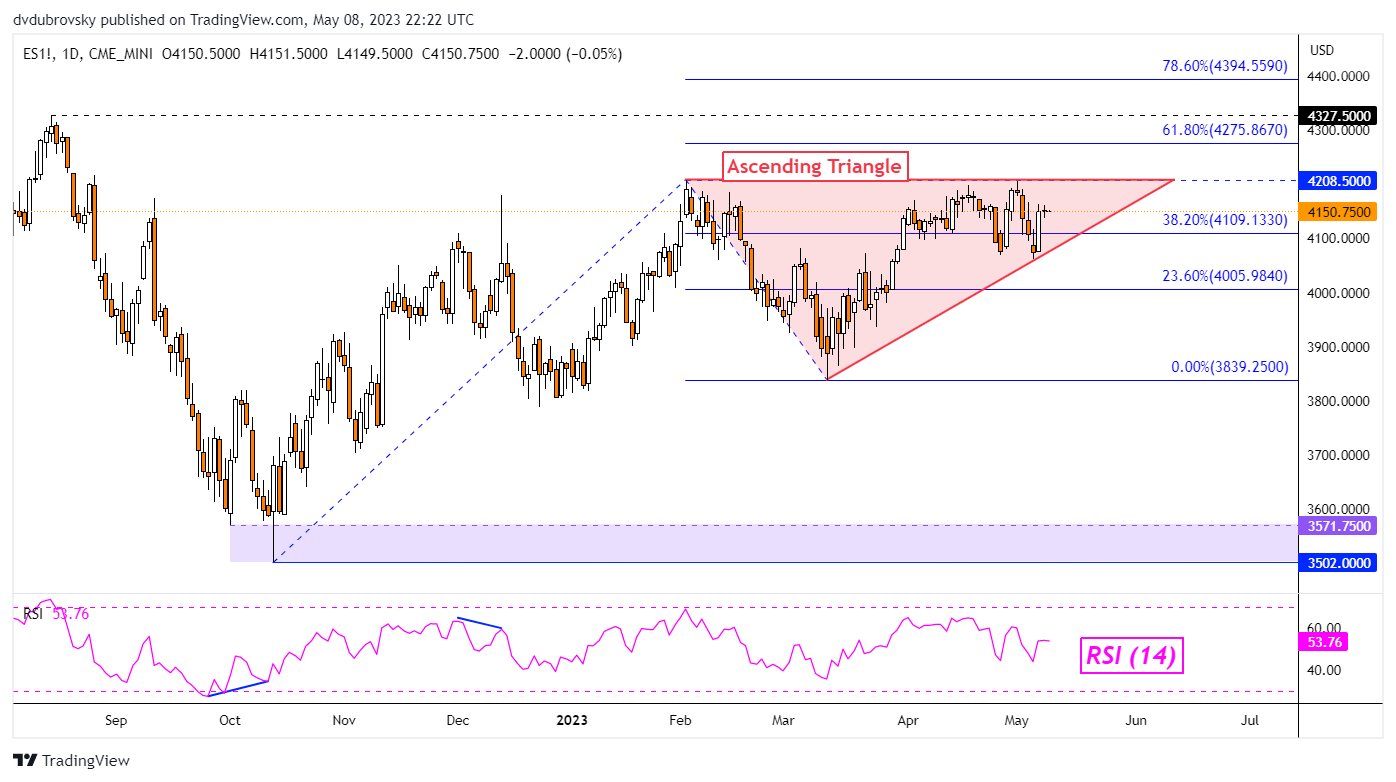

S&P 500 Technical Analysis

The S&P 500 appears to be forming an Ascending Triangle chart formation. Recently, prices bounced off the floor, which is a rising trendline from March. Meanwhile, the ceiling is around 4208, established back in January. The direction of the breakout could be key for the coming trend. A push lower exposes the March low at 3839. Meanwhile, a turn higher places the focus on the 61.8% level at 4275.

— Written by Daniel Dubrovsky, Senior Strategist for DailyFX.com