Dow Jones, S&P 500, US Debt Ceiling Deal, Spending Cuts – Asia-Pacific Briefing:

- Dow Jones, S&P 500 reverse intraday gains as markets digest debt deal

- Unofficial estimates point to potential fiscal spending cuts of $1 trillion

- This could raise the risk and the severity of a recession amid high rates

Recommended by Daniel Dubrovsky

Get Your Free Equities Forecast

Dow Jones, S&P 500 Reverse Intraday Gains on Potential Government Spending Cuts

The Dow Jones, S&P 500, and to a certain extent the Nasdaq 100, retreated from highs to end Tuesday’s trading session relatively flat. Meanwhile, Treasury yields declined across the board, signaling a potentially dovish shift in US monetary policy expectations. Volatility on Wall Street remains constrained, with the VIX market preferred ‘fear gauge’ hovering around lows from early 2022.

It seems some of the market pessimism stemmed from the details of the debt ceiling deal policymakers in Washington are trying to hammer out this week. Over the weekend, reports crossed the wires US President Joe Biden and House Speaker Kevin McCarthy reached a final agreement to raise the country’s debt ceiling, opening the door to avoiding default.

A vote on this is expected to occur in the House on Wednesday which gives the Senate time to consider it before June 5th, which is the estimated date when the country could default on its debt obligations. A closer look at the agreement shows that the White House expects the plan to reduce government spending by at least USD 1 trillion (official estimates are not yet reported), according to AP News.

Consider what this could mean for US economic growth prospects. According to Bloomberg, federal spending has been making up a rising share of growth in recent quarters, helping to support GDP. Meanwhile, the latter has been slowing. Thus, spending cuts, which effectively functions as fiscal tightening, would go hand in hand with restrictive monetary policy.

As such, this could work to slow the economy. On the one hand, this could reduce inflation. But on the other, it could increase recession risk or even the severity of it. This might be why we saw the reaction in stock markets today as well as bonds. As such, it could be a choppy session for risk appetite heading into Wednesday’s Asia-Pacific trading session.

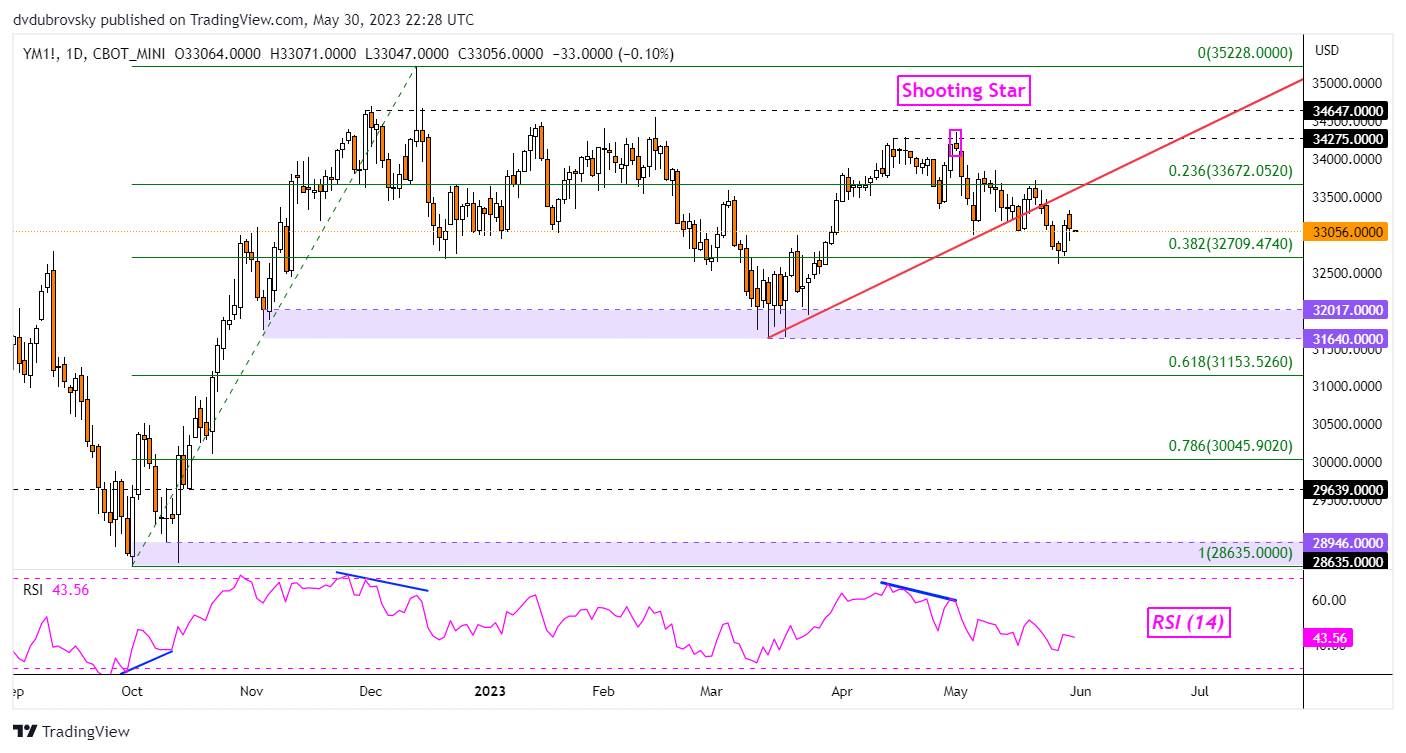

Dow Jones Technical Analysis

From a technical standpoint, the Dow Jones remains in a slightly bearish directional bias. Prices have confirmed a breakout under the former rising trendline from March. This also followed the emergence of a Shooting Star candlestick pattern. Immediate support is the 38.2% Fibonacci retracement level at 32709.

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

Dow Jones Daily Chart

— Written by Daniel Dubrovsky, Senior Strategist for DailyFX.com