US Dollar, Japanese Yen, USD/JPY, BOJ – Talking Points:

- BOJ kept ultra-loose policy settings unchanged, in line with expectations.

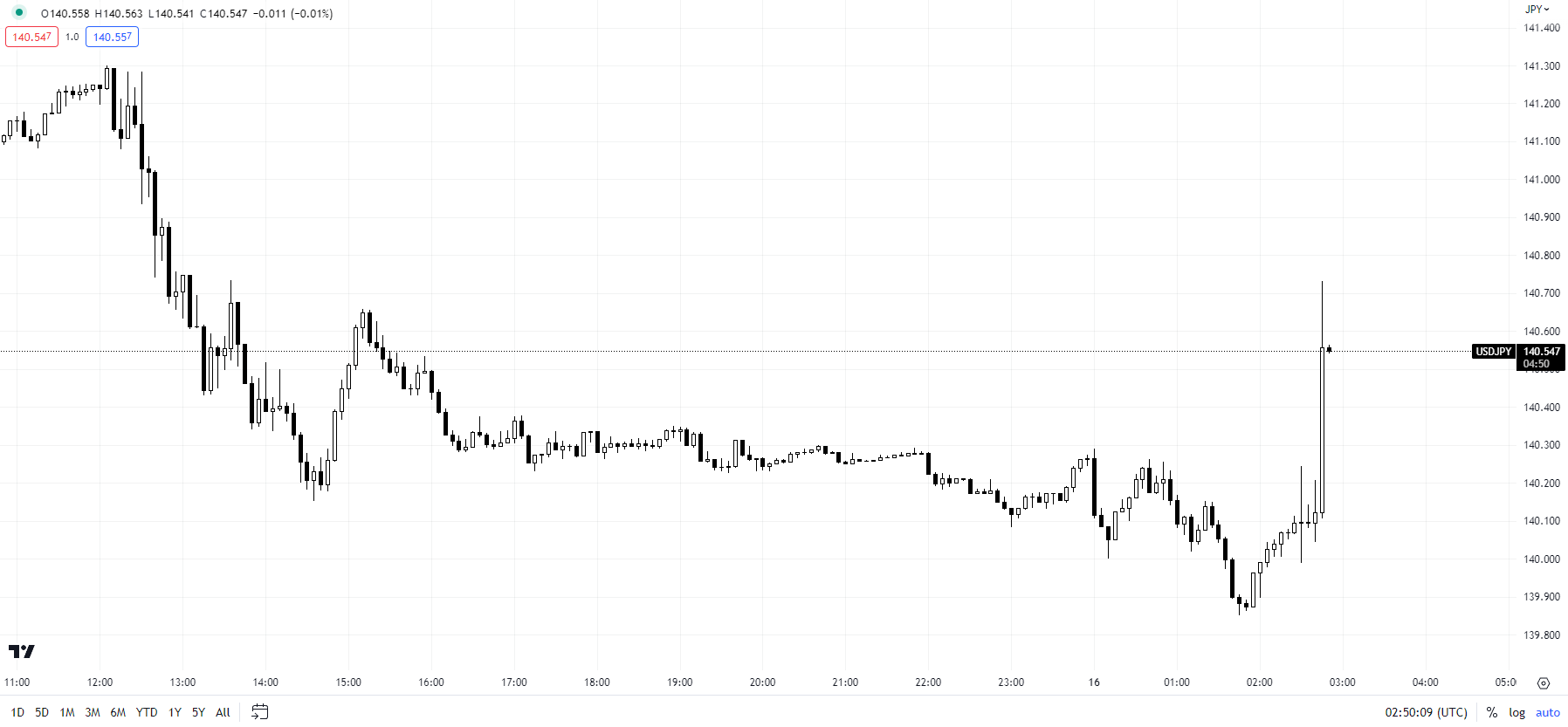

- USD/JPY rose slightly in reaction to status quo on policy.

- What is the outlook for USD/JPY and what are the signposts to watch?

Recommended by Manish Jaradi

How to Trade USD/JPY

The Japanese yen fell slightly against the US dollar after the Bank of Japan’s (BOJ) maintained ultra-loose policy settings, especially the closely watched yield curve control (YCC) policy, in a bid to support the nascent economic recovery and sustainably achieve its inflation goal.

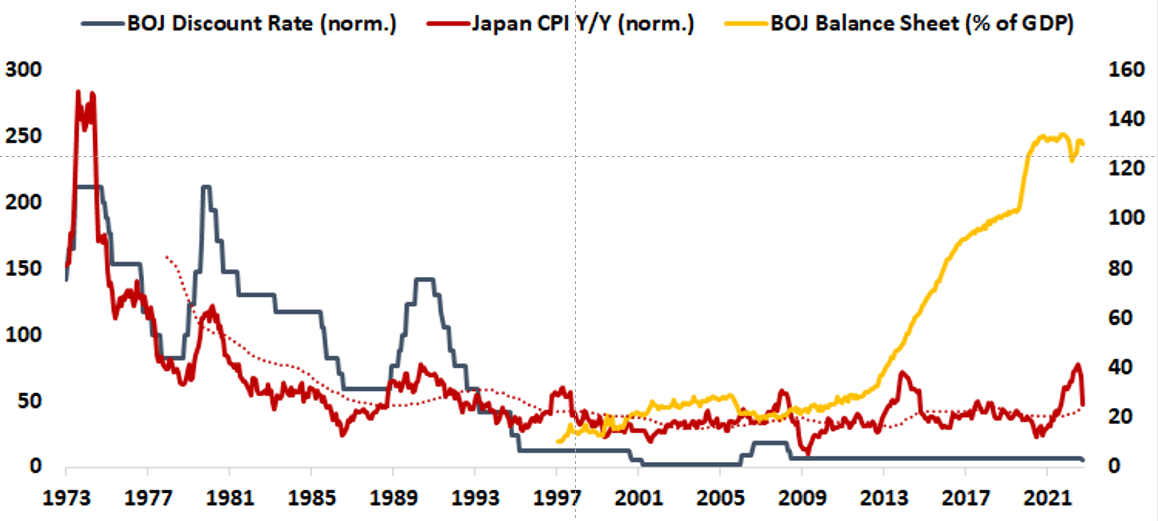

The BOJ was widely expected to maintain its ultra-easy monetary policy at Friday’s meeting, with any tweaks to the YCC being the key focus. BOJ Governor Kazuo Ueda has said the central bank would ‘patiently’ maintain the current policy as there is still some way to achieve its 2% inflation target stably and sustainably.

USD/JPY 5-Minute Chart

Chart Created Using TradingView

Ueda has said the central bank expects inflation to slow below 2% toward the middle of the current fiscal year and rebound thereafter. On Friday, Ueda added the country’s corporate price-setting behaviour was showing changes that could push up inflation more than expected.

Japan’s core inflation hit 3.4% in April, well over BOJ’s 2% target, and it would be a matter of time before the YCC policy is adjusted. The BOJ removed its long-standing forward guidance at its April meeting while nimbly responding to developments in economic activity and prices. This makes the July 28 meeting a ‘live’ one.

Japan Inflation and BOJ Balance Sheet

Source data: Bloomberg; chart created in Microsoft Excel

For the yen, higher for longer US interest rates, easing fears of a hard landing in the US, and still-hawkish global central banks reinforce the broader bearish setup for the low-yielding Japanese yen against some of its peers. For more details see “Japanese Yen Drops After FOMC: Price Setups in USD/JPY, AUD/JPY, GBP/JPY,” published June 15.

The yen’s weakness continues to be more pronounced against currencies where central banks are in rate hiking mode, including the RBA, BOC, BOE, and ECB, but less so central banks have paused (Fed) or where central banks have indicated that rates are at a peak (NZD). For more discussion see “Making Sense of Japanese Yen’s Recent Slide: Is it the Start of a Renewed Leg Lower?”, published June 1, and “Japanese Yen Week Ahead as Fed Skip Bets Grow: USD/JPY, EUR/JPY, AUD/JPY”, published June 5.

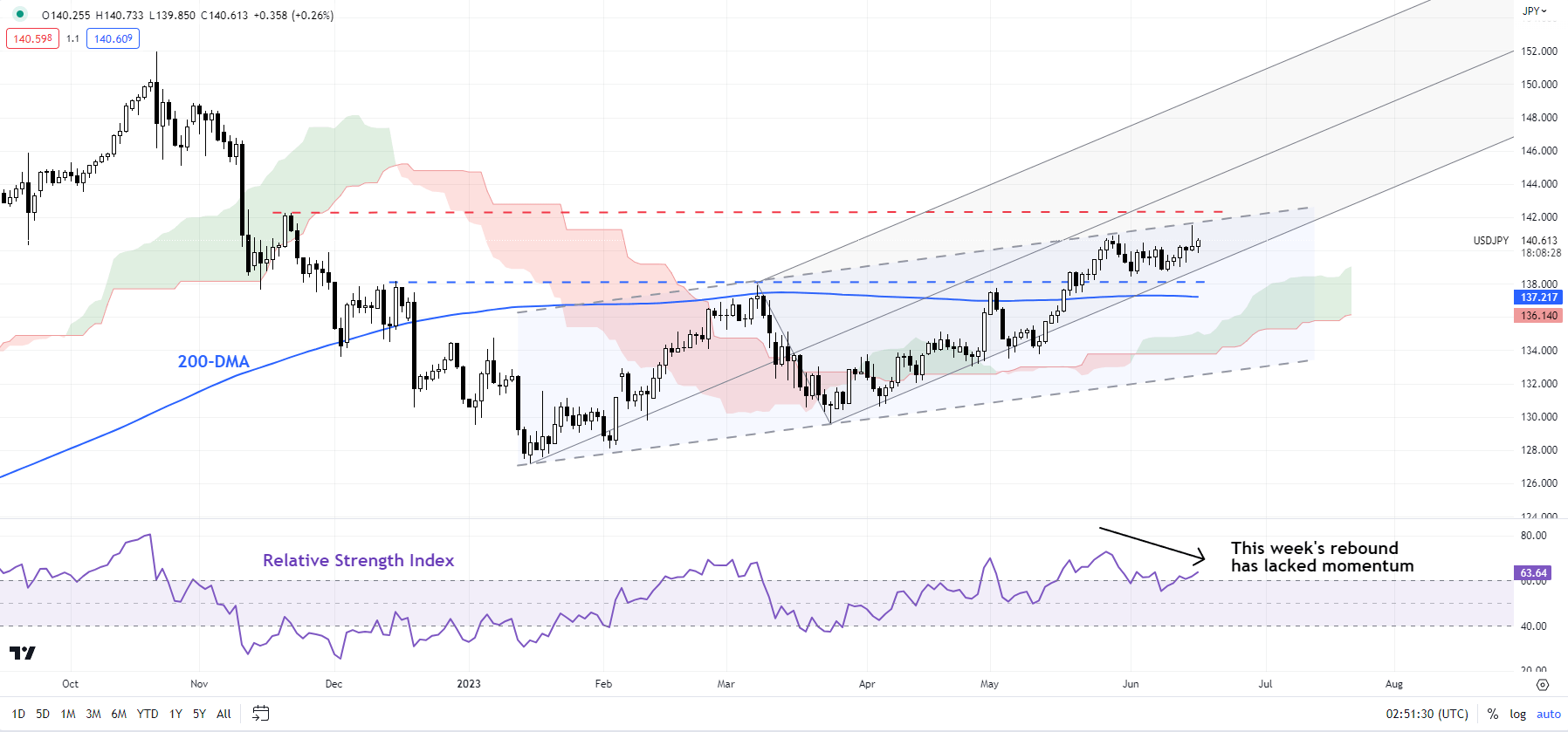

USD/JPY Daily Chart

Chart Created Using TradingView

On technical charts, USD/JPY has been flirting with a stiff converged resistance: the upper edge of a rising channel from early 2023, coinciding with the end-2022 high of 142.25, not too far from the median line of a pitchfork channel from January (at about 143.75).

The bearish inverted hammer candlestick pattern on the daily candlestick chart on Thursday has raised the bar for an imminent break above the key resistance. However, as highlighted in theprevious update, the pair would need to break below the early-June low of 138.50 for the upward pressure to fade.

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

— Written by Manish Jaradi, Strategist for DailyFX.com

— Contact and follow Jaradi on Twitter: @JaradiManish