GOLD PRICE, CHARTS AND ANALYSIS:

GOLD FORECAST: NEUTRAL

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

READ MORE: Gold Weekly Forecast: Gold (XAU/USD) Prices Delicately Poised Heading into Blockbuster Week

Gold has been on a rollercoaster this week with whipsaw price action sending mixed signals. A week that promised a lot did deliver on the volatility front but failed to provide any clarity on the possible direction of Gold prices moving forward. At the time of writing Gold trades at $1962/oz, just a smidge higher than last weeks close.

The US Federal Reserve decision on Wednesday has seen the US Dollar face significant selling pressure which helped Gold stage a Thursday rebound from 3-month lows. Market participants appear confused by the Federal Reserve’s pause as well as economic projections moving forward. The Fed did upgrade their outlook on the peak rate to 5.6% from 5.5% with Chair Powell effectively ruling out rate cuts in 2023 which makes the US Dollars fall all the more interesting.

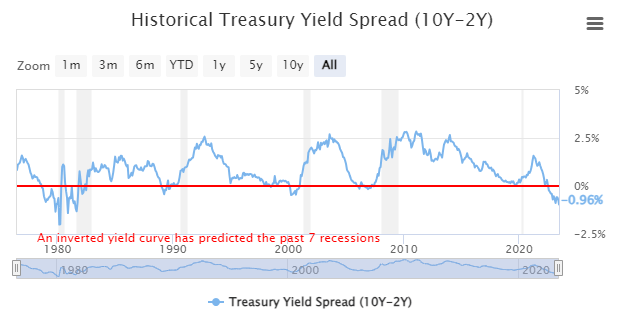

Looking back historically at Gold prices the last time the Fed paused in June 2006 we saw a period of consolidation and sideways price action for the ensuing 12-month period. Are in we for a similar run this time around? The similarities to the 2006 pause don’t end there as well with the global economy on the brink of a recession then as we all know. There are however many key differences which makes one question whether we are to see a similar outcome in 2006 as risk assets rallied while Gold consolidated ahead of the impending crisis of 2008. One of the key indicators and differences lies in the yield curve which was inverted by just 1bp in June 2006 compared to 90bps at the time of writing, the most in 40 years.

*The Grey Zones on the Chart Indicate US Recessions

Source: GuruFocus

So why haven’t we seen more concrete signs as of yet? The answer here likely lies in the increase in money supply since the start of the covid 19 pandemic and further exacerbated by the Federal Reserves recent printing of a further $400 billion in March to provide stability to the banking system. All of this keeping the Equity markets ticking along but pain may lie ahead for risk assets and could be something to keep an eye on in the weeks and months ahead.

Recommended by Zain Vawda

The Fundamentals of Range Trading

THE WEEK AHEAD AND FACTORS THAT COULD AFFECT GOLD

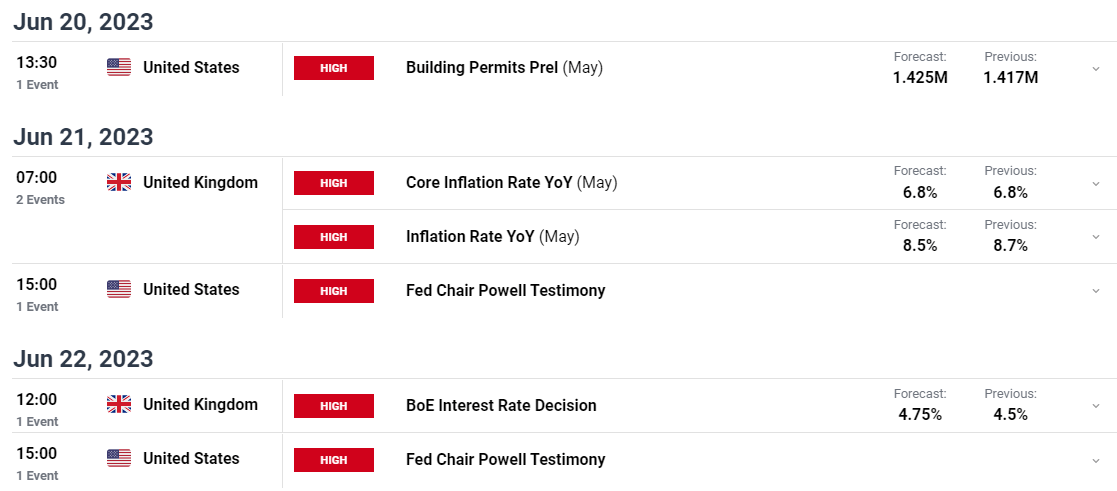

The US economic calendar is rather quiet in the week ahead with most of the data focused on the housing market. The biggest event risk from the developed markets in the week ahead comes from the UK with both inflation and the Bank of England rate decision likely to result in a spike of volatility.

We do have testimony from Federal Reserve Chair Jerome Powell while any further comments from Fed policymakers could also drive volatility and affect the US Dollar in the week ahead. Gold prices could receive a boost in demand and thus prices following a rate cut by the People’s Bank of China (PBoC) in a bid to stimulate growth. Market participants will hope to see an increase in demand from China with commodities and raw materials likely to benefit should such a surge materialize.

Here are the five high ‘rated’ risk events for the week ahead on the economic calendar which could affect Gold prices and lead to a spike in volatility:

For all market-moving economic releases and events, see the DailyFX Calendar

TECHNICAL OUTLOOK AND FINAL THOUGHTS

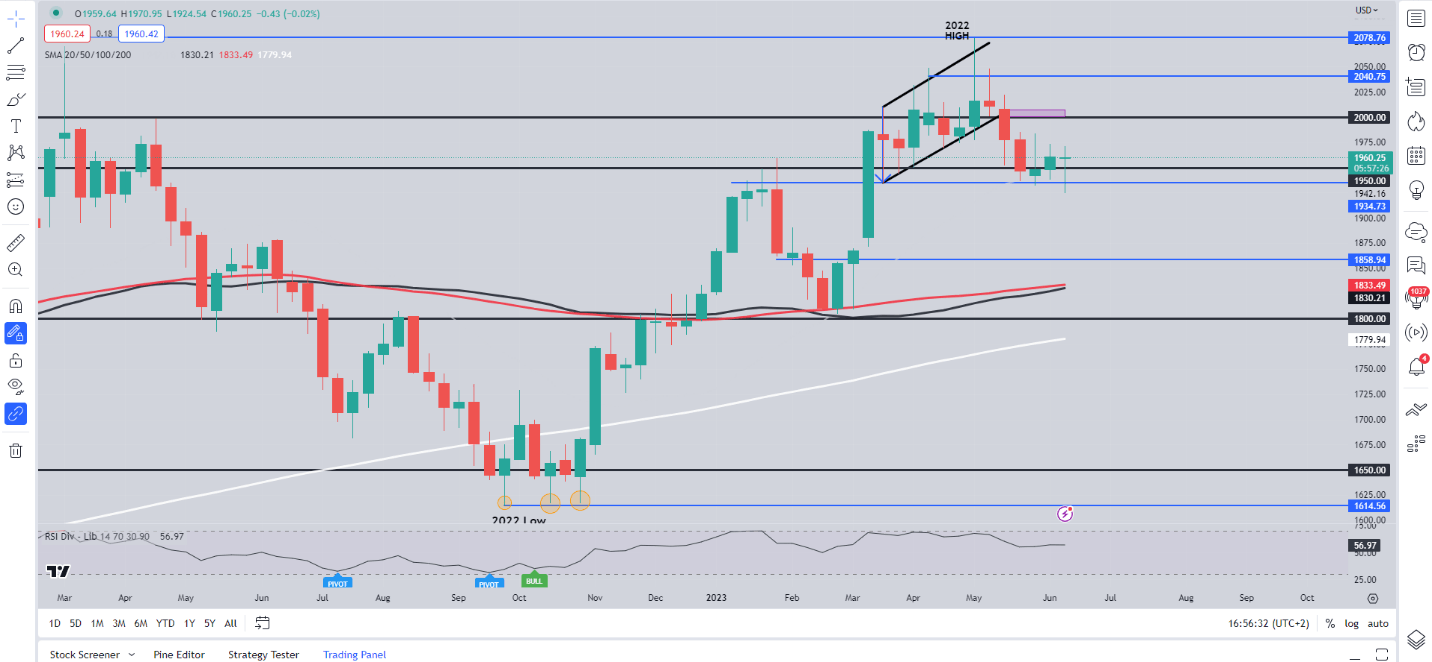

The weekly chart for XAUUSD looks on course to print a doji candlestick close which would be appropriate given the mixed and whipsaw price action we have seen for the majority of the week. Nothing much has changed on the weekly chart with the daily timeframe providing a bit more to work with. The huge downside wick on the weekly however does indicate the buying pressure still evident in the precious metal.

XAU/USD Weekly Chart – June 16, 2023

Source: TradingView

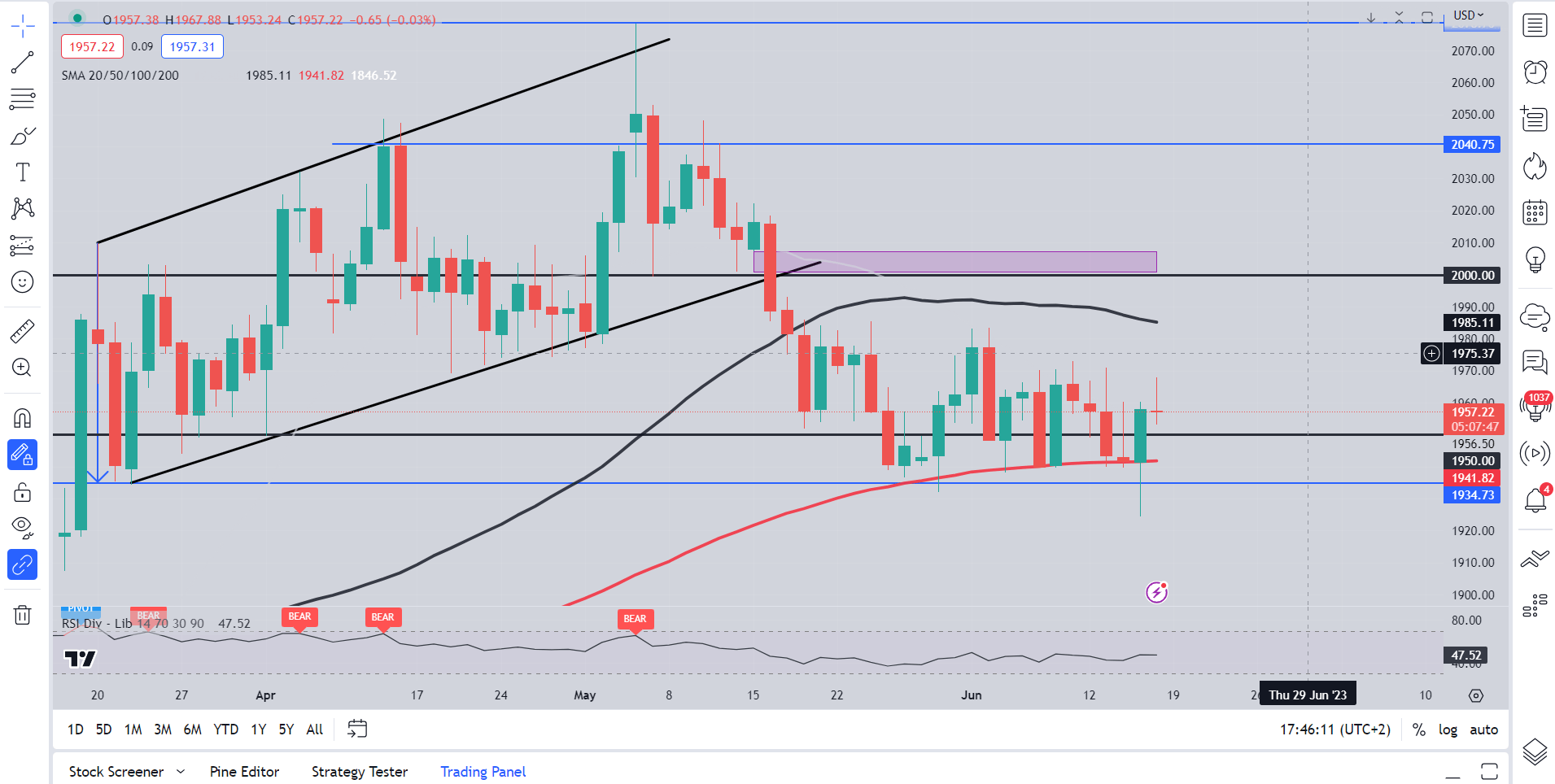

Dropping down to a daily timeframe and once again Gold has failed to close below the 100-day MA. The precious metal made 3 attempts this week pushing to a low of $1925 before a sharp rally saw price close comfortably above the 100-day MA resting around the $1941 handle. Thursdays bullish engulfing candle close hinted at further upside but as has been the norm of late, a follow through failed to materialize as Friday saw more indecisive and whipsaw price action.

Looking ahead to next week and the range between $1940-$1970 continues to hold with a daily candle close on either side of the range likely to facilitate a push in that direction. Until then rangebound and an intraday approach might be best suited to current market dynamics.

XAU/USD Daily Chart – June 16, 2023

Source: TradingView

Introduction to Technical Analysis

Technical Analysis Chart Patterns

Recommended by Zain Vawda

Written by: Zain Vawda, Market Writer for DailyFX.com

Contact and follow Zain on Twitter: @zvawda