USD/JPY ANALYSIS

- Will Fed Chair Powell continue is hawkish rhetoric?

- US economic data awaits as global slowdown concerns grow.

- 145.00 on the cards for USD/JPY bulls?

Recommended by Warren Venketas

Get Your Free JPY Forecast

JAPANESE YEN FUNDAMENTAL BACKDROP

The Japanese Yen has had a tough time last week and heads into the week on an overall weaker note due to Fed Chair Jerome Powell’s hawkish Testimony as well as Friday’s decline in Japanese CPI. Falling inflation will make it difficult for the Bank of Japan (BOJ) to shift from its ultra-loose monetary policy but changes to Yield Curve Control (YCC) is still a possibility.

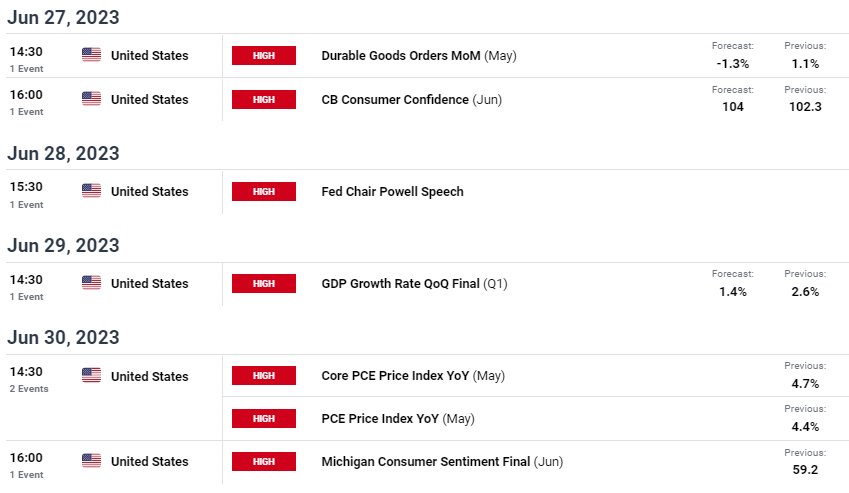

The week ahead is mostly taken up by US centric data (see economic calendar below) including the core PCE print which is the Fed’s preferred measure of inflation. Mr. Powell is scheduled to speak again and is likely to continue on his policy tightening path as opposed to a rate hold as money market probabilities move ever closer to a 25bps hike in July. Other key releases include durable goods orders, GDP and Michigan consumer sentiment that will allow for a more clearer picture of the broader US economy. Should data point to a slowing economy, recessionary fears may creep back in and could play into the hands of the safe haven Yen.

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

ECONOMIC CALENDAR (GMT +02:00)

Source: DailyFX economic calendar

TECHNICAL ANALYSIS

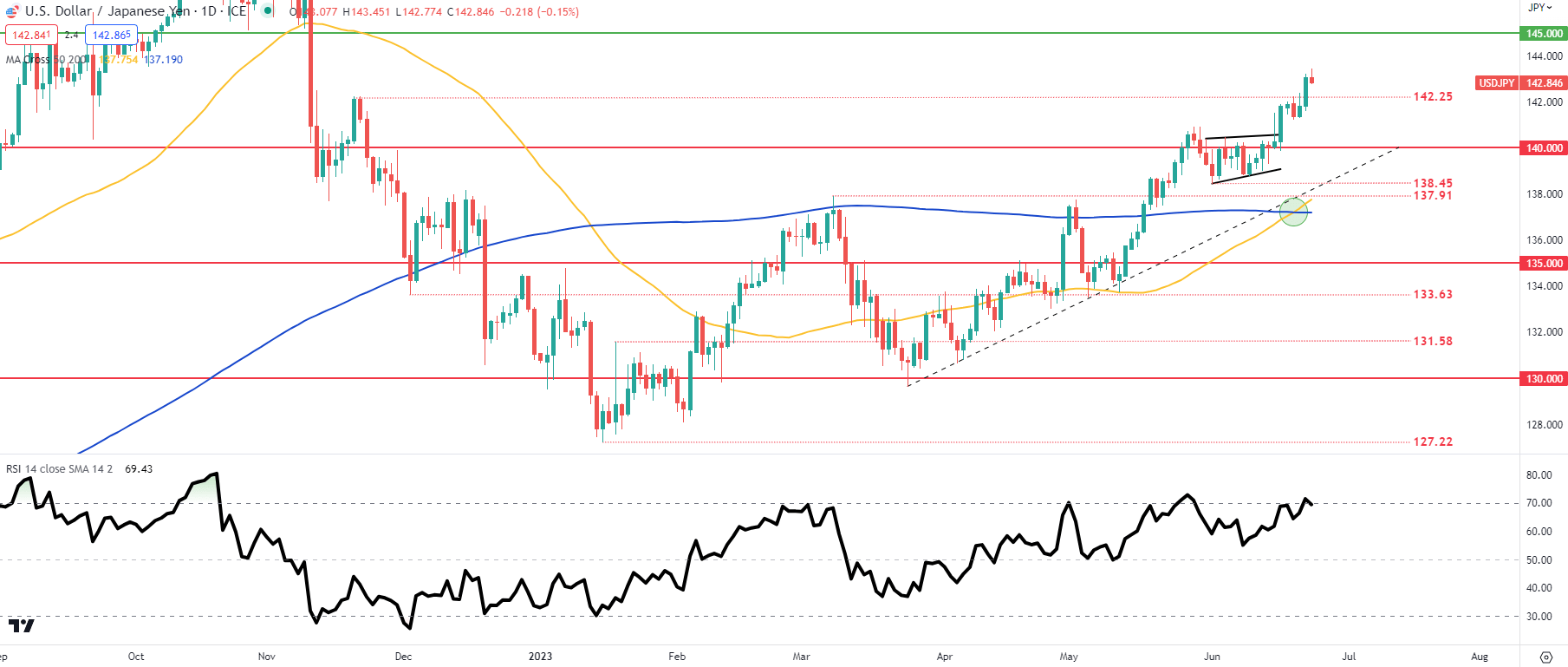

USD/JPY DAILY CHART

Chart prepared by Warren Venketas, IG

USD/JPY shows price action has been following the golden cross (green) signal pushing to fresh 2023 highs. While the pair is in overbought territory as shown by the Relative Strength Index (RSI), there could still be more to go towards the 145.00 psychological level before a pullback lower.

Key resistance levels:

Key support levels:

- 140.00

- Trendline support

IG CLIENT SENTIMENT: BULLISH

IGCS shows retail traders are currently net SHORT on USD/JPY, with 72% of traders currently holding short positions (as of this writing). At DailyFX we take a contrarian view on sentiment resulting in a short-term upside disposition.

Contact and followWarrenon Twitter:@WVenketas