The Australian Dollar finished the second quarter not far from where it started after breaking both sides of an established range. Although some domestic factors haver played a role in AUD/USD direction, the US Dollar remains a dominant factor for the currency.

For the full Australian Dollar third quarter report, click on the banner below.

Recommended by Daniel McCarthy

Get Your Free AUD Forecast

The RBA and the Fed have their say

The 0.6565 – 0.6900 range played out from February through to late May before the dip lower on the back of a stronger USD. Early June saw the RBA surprise markets with a 25 basis point hike and AUD/USD rallied in the aftermath. Interest rate futures are pricing two more lifts in the cash rate target by the end of the year from the RBA.

US Federal Reserve Chair Jerome Powell has reaffirmed the bank’s hawkish stance after a pause in its hiking cycle at the last Federal Open Market Committee (FOMC) meeting in mid-June. The decision not to raise rates saw the US Dollar initially undermined but then subsequently strengthen on Powell’s comments. The Fed’s next meeting in late July might provide some impetus for the next significant move in the Aussie Dollar.

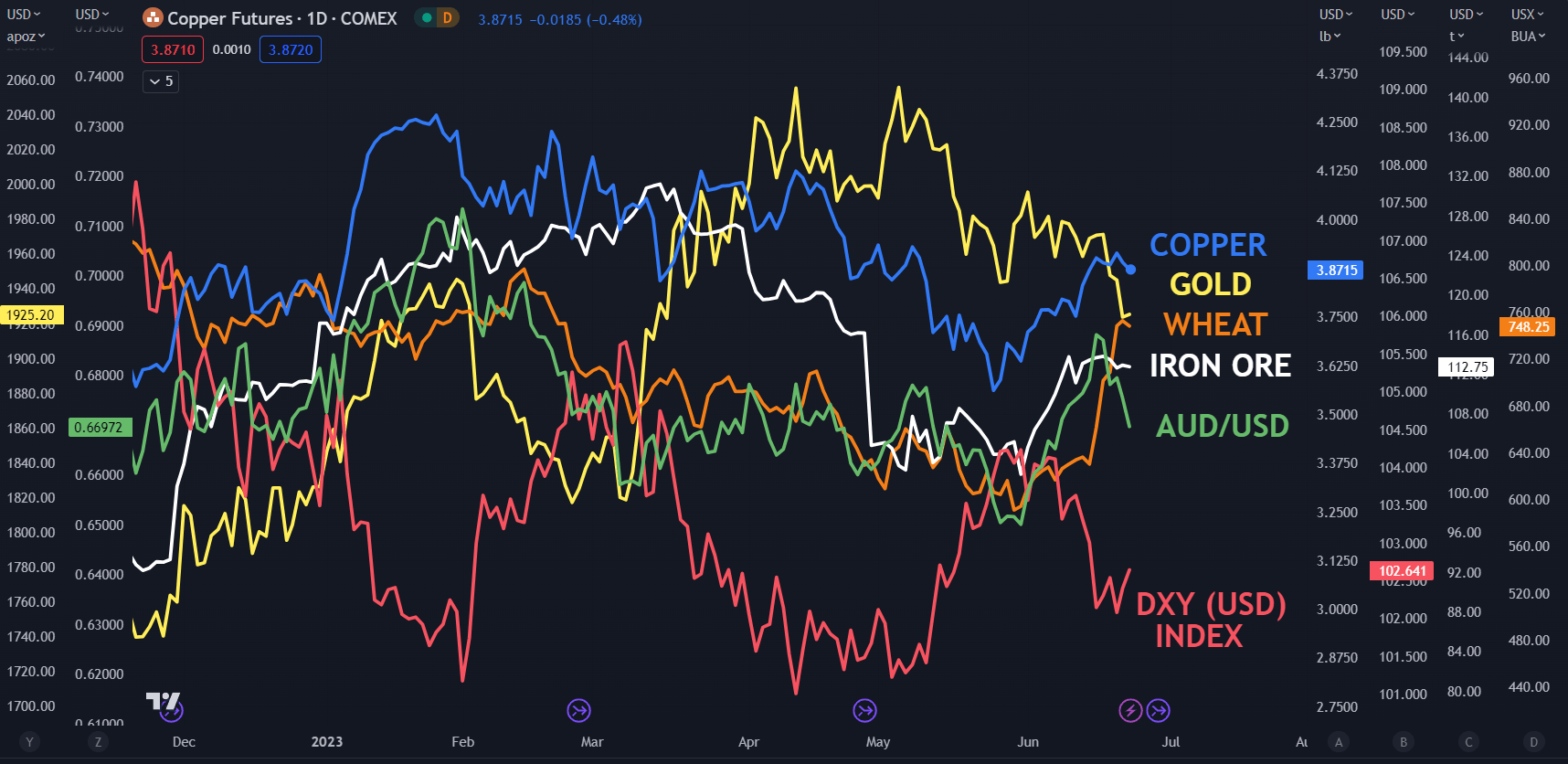

Commodity Prices Add to Trade Surplus

The fundamental backdrop for the Australian economy remains strong but it may not contribute to a higher exchange rate. The trade surplus continues to significantly contribute to bottom line with many of Australia’s key commodity exports in global demand.

Chart prepared by Dan McCarthy, created with TradingView

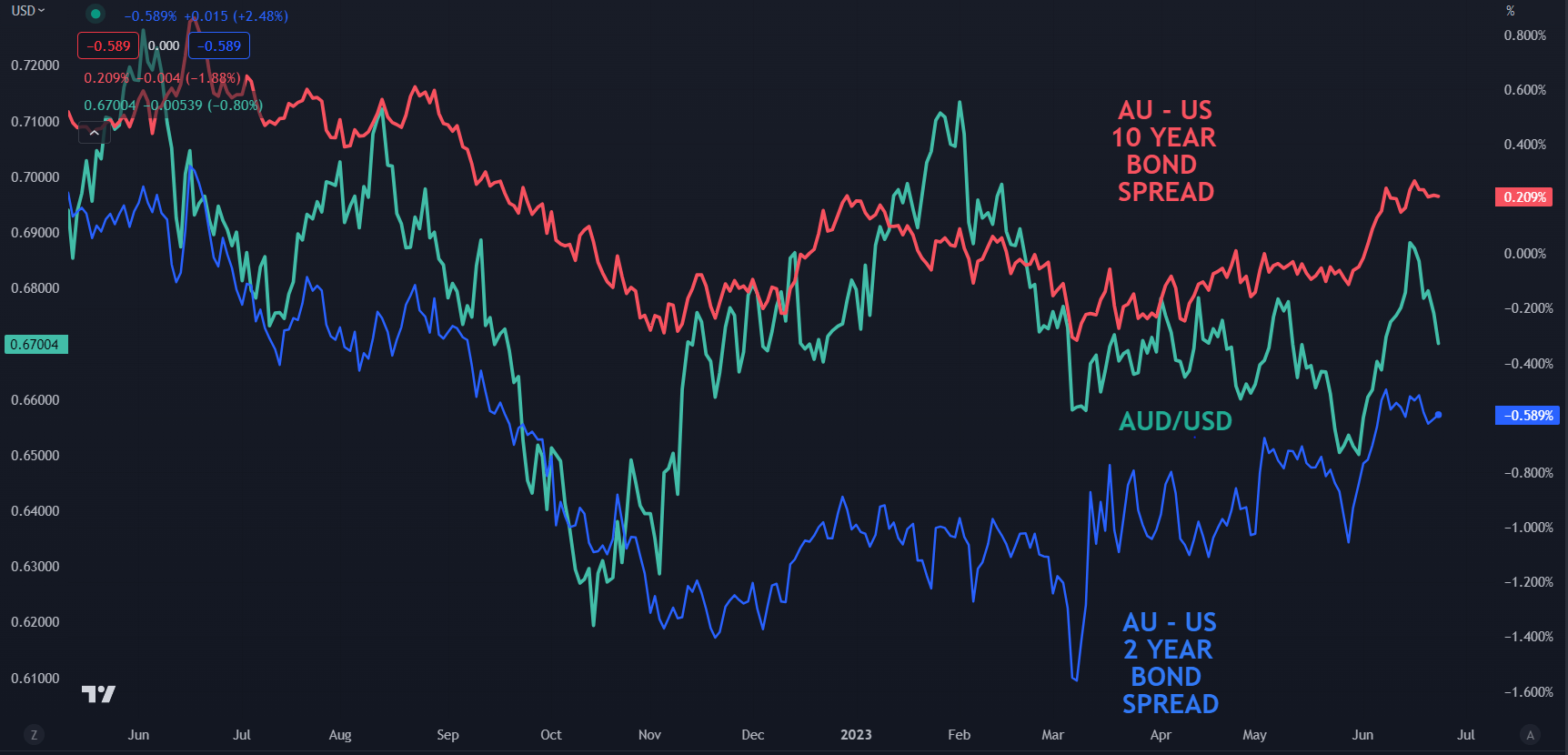

Bond Spread Correlation

The correlation of the bond spreads to AUD/USD is sometimes high, but not always so. However, it is certainly worth tracking to look for clues in the currency’s directions.

June also saw the Australian 3s 10s government bond yield invert for the first time since 2008. When this occurs, the implication from the bond market is that an economic slowdown is possible at some stage further down the track.

Chart prepared by Dan McCarthy, created with TradingView

Australian CPI Might Hold the Key

Going into the third quarter, a key piece of economic data will be Australia’s quarterly CPI figures that will be released on July 26th. Another hot number there may see the RBA tilt back toward a more aggressive tightening stance. A soft reading might see the opposite unfold. Nonetheless, AUD/USD could see some volatility if CPI is dramatically different from expectations.

The actions of the RBA and Fed appear likely to be a driving factor for the currency going forward. A problem for markets, and the banks themselves, is the uncertainty around the rate path in the months ahead. Both banks have made it clear that the upcoming decisions will be depending on the data as it is released, which makes it difficult to anticipate AUD/USD moves.

Disclaimer

DailyFX Market Opinions

Any opinions, news, research, analyses, prices, or other information contained in this report is provided as general market commentary and does not constitute investment advice. DailyFX will not accept liability for any loss or damage, including without limitation to, any loss of profit, which may arise directly or indirectly from use of or reliance on such information.

Accuracy of Information

The content in this report is subject to change at any time without notice and is provided for the sole purpose of assisting traders to make independent investment decisions. DailyFX has taken reasonable measures to ensure the accuracy of the information in the report, however, does not guarantee its accuracy, and will not accept liability for any loss or damage which may arise directly or indirectly from the content or your inability to access the website, for any delay in or failure of the transmission or the receipt of any instruction or notifications sent through this website.

Distribution

This report is not intended for distribution, or use by, any person in any country where such distribution or use would be contrary to local law or regulation. None of the services or investments referred to in this report are available to persons residing in any country where the provision of such services or investments would be contrary to local law or regulation. It is the responsibility of visitors to this website to ascertain the terms of and comply with any local law or regulation to which they are subject.

High Risk Investment

Trading foreign exchange on margin carries a high level of risk and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to trade foreign exchange, you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain losses in excess of your initial investment. You should be aware of all the risks associated with foreign exchange trading and seek advice from an independent financial advisor if you have any doubts.