POUND STERLING ANALYSIS & TALKING POINTS

- UK CPI comes off 30-year highs.

- Drop in core inflation reduced peak rate figure.

- Pound down over 0.5% on GBP/USD and EUR/GBP.

Recommended by Warren Venketas

Get Your Free GBP Forecast

GBPUSD & EUR/GBP FUNDAMENTAL BACKDROP

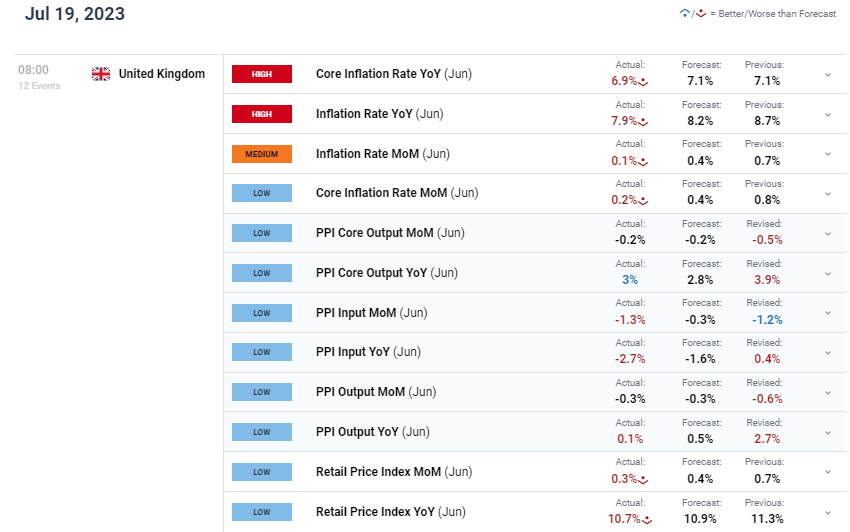

The British pound slipped after the UK CPI report (see economic calendar below) missed estimates on both headline and core inflation respectively falling from 30-year highs. The key focus was the core inflation print (6.9%) that could indicate a possible peak in the inflation cycle and the impact of the aggressive monetary policy adopted by the Bank of England (BoE). As welcome sign for many UK consumers are the reduction in PPI data which could indicate further decline in inflationary pressures to come.

Breaking down the inflation basket, several items remain sticky including alcohol and tobacco, clothing and footwear, Housing and household services of which owner occupiers’ housing costs and communication which all pushed higher on a YoY basis. The decline in transport and fuels was probably the most noteworthy with fuel prices falling by 22.7% in 2023 (up until June) with the transports segment retracting 1.7% relative to the 1.3% in May 2023.

Foundational Trading Knowledge

Macro Fundamentals

Recommended by Warren Venketas

UK ECONOMIC CALENDAR (GMT +02:00)

Source: DailyFX Economic Calendar

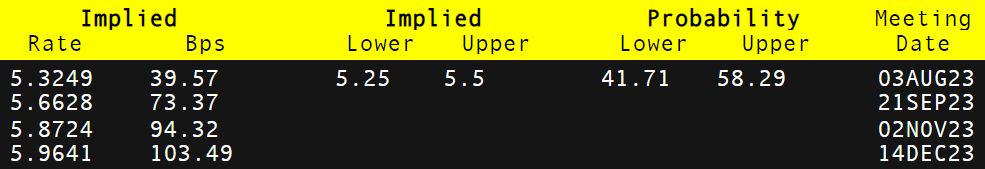

Looking at interest rate expectation from the BoE below, there remains a preference towards a 50bps rate hike in August of roughly 58% but the peak rate has since declined from around 6.15% to marginally above 6%. With no more significant UK economic data to come prior to the BoE rat announcement, the major GBP crosses are likely to be driven by both US and eurozone factors alike. Later today, EZ CPI is scheduled alongside US building permit data and the BoE’s Ramsden.

BANK OF ENGLAND INTEREST RATE PROBABILITIES

Source: Refinitiv

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

TECHNICAL ANALYSIS

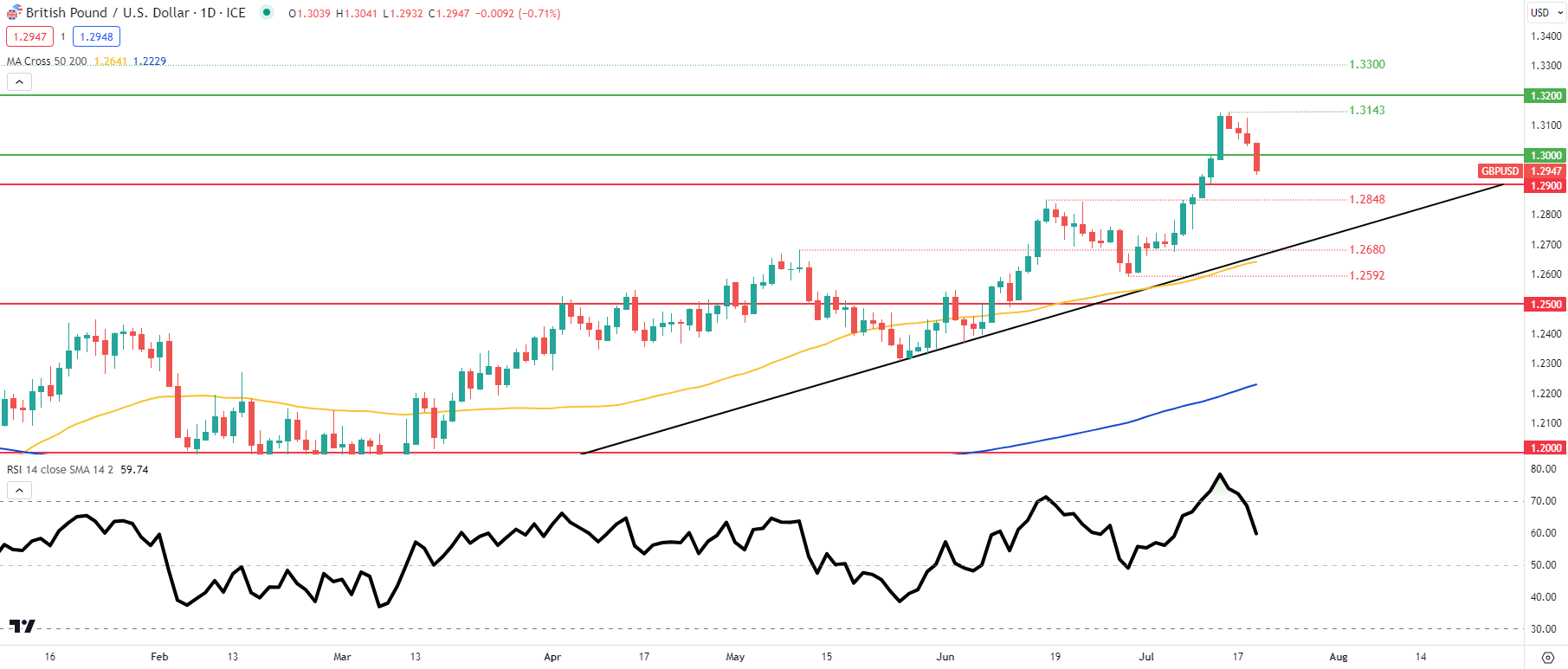

GBP/USD DAILY CHART

Chart prepared by Warren Venketas, IG

Price action on the daily cable chart above shows the immediate selloff in the pound against the greenback now below the 1.3000 psychological handle, extending its move out of the overbought zone on the Relative Strength Index (RSI).

Key resistance levels:

- 1.3143

- 1.3000

Key support levels:

- 1.2900

- 1.2848

- Trendline support

- 1.2680

BEARISH IG CLIENT SENTIMENT (GBP/USD)

IG Client Sentiment Data (IGCS) shows retail traders are currently net SHORT on GBP/USD with 67% of traders holding short positions (as of this writing). At DailyFX we typically take a contrarian view to crowd sentiment but due to recent changes in long and short positioning, we arrive at a short-term downside bias.

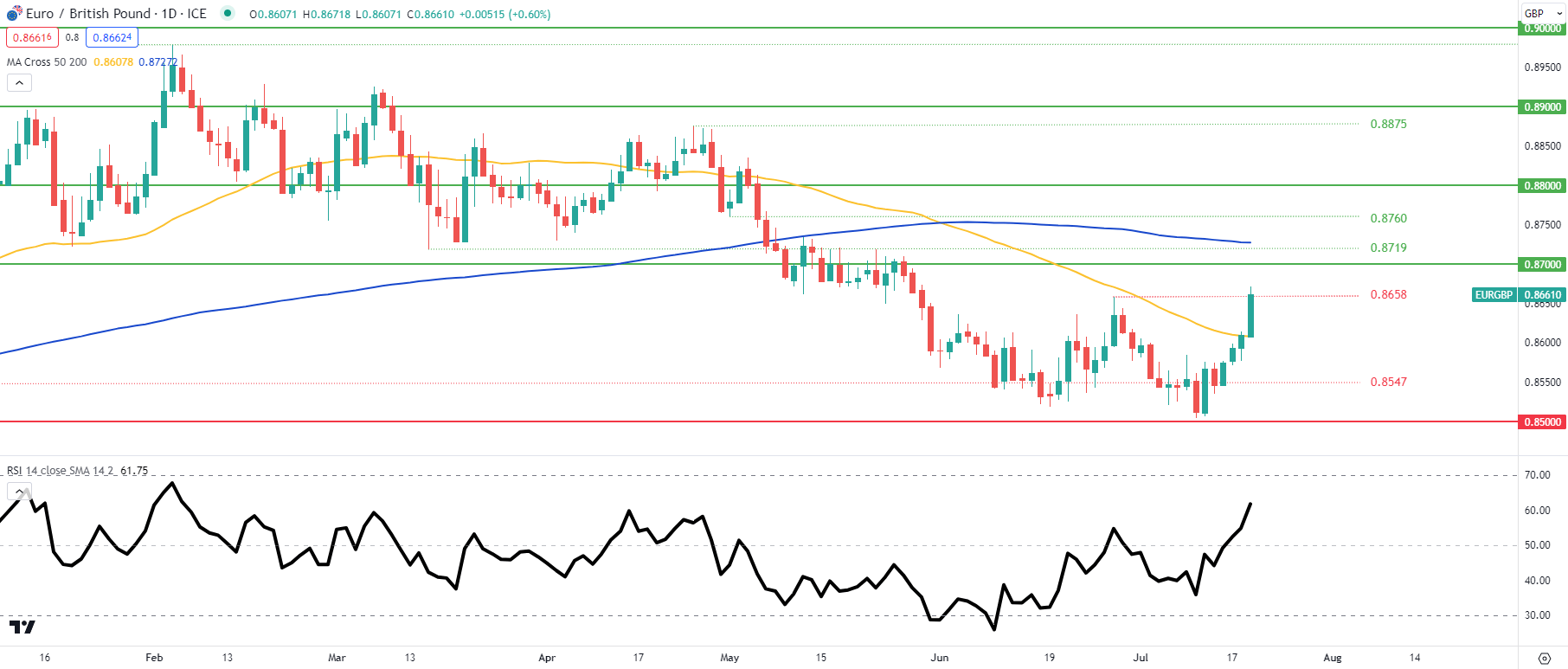

EUR/GBP DAILY CHART

Chart prepared by Warren Venketas, IG

EUR/GBP rallied post-release and now trades above the June swing high at 0.8658. Although the RSI approaching the overbought region, there is still room for further upside possibly around the 0.8700 – 0.8750 resistance zone.

Key resistance levels:

- 0.8719

- 0.8700

Key support levels:

- 0.8658

- 50-day MA (yellow)

BULLISH IG CLIENT SENTIMENT (EUR/GBP)

IG Client Sentiment Data (IGCS) shows retail traders are currently net LONG on GBP/USD with 62% of traders holding long positions (as of this writing). At DailyFX we typically take a contrarian view to crowd sentiment but due to recent changes in long and short positioning, we arrive at a short-term upside bias.

Contact and followWarrenon Twitter:@WVenketas