The Reserve Bank of Australia Statement on Monetary Policy (SoMP).

Headlines via Reuters:

- Some further tightening may be required

- Board considered

raising rates at August meeting, decided stronger case was to hold

steady - Policy has been

tightened significantly, full impact has yet to be felt - Board mindful of

lags in policy, painful financial squeeze on some households - Board keen to

preserve gains made in labour market - Tightening could

provide some further insurance against upside inflation risks

RBA trims GDP growth

and inflation forecasts for end 2023, most others little changed

- Forecasts GDP end

2023 0.9%, end 2024 1.6%, end 2025 2.3% - Forecasts CPI at end

2023 4.1%, end 2024 3.3%, end 2025 2.8% - Forecasts

unemployment end 2023 3.9%, end 2024 4.4%, end 2025 4.5%,

Full text is here:

—

What’s the SoMP?

The RBA’s Statement on Monetary Policy:

- It outlines the bank’s views on domestic and international economic conditions.

- also provides an analysis of the bank’s policy decisions and an outlook for inflation and output growth.

- published quarterly

- It typically includes:

- An overview of the global and domestic economic situation, which incorporates various factors such as growth, inflation, employment, and monetary and fiscal policies of key countries.

- Information about financial markets, which details changes in asset prices, exchange rates, and monetary policy settings worldwide.

- Domestic economic conditions, which provides a comprehensive analysis of key indicators including GDP, consumer spending, business investments, the labor market, and housing market.

- Forecasts for domestic economic activity and inflation, typically for a period of two years ahead. And an assessment of the balance of risks surrounding these forecasts.

—

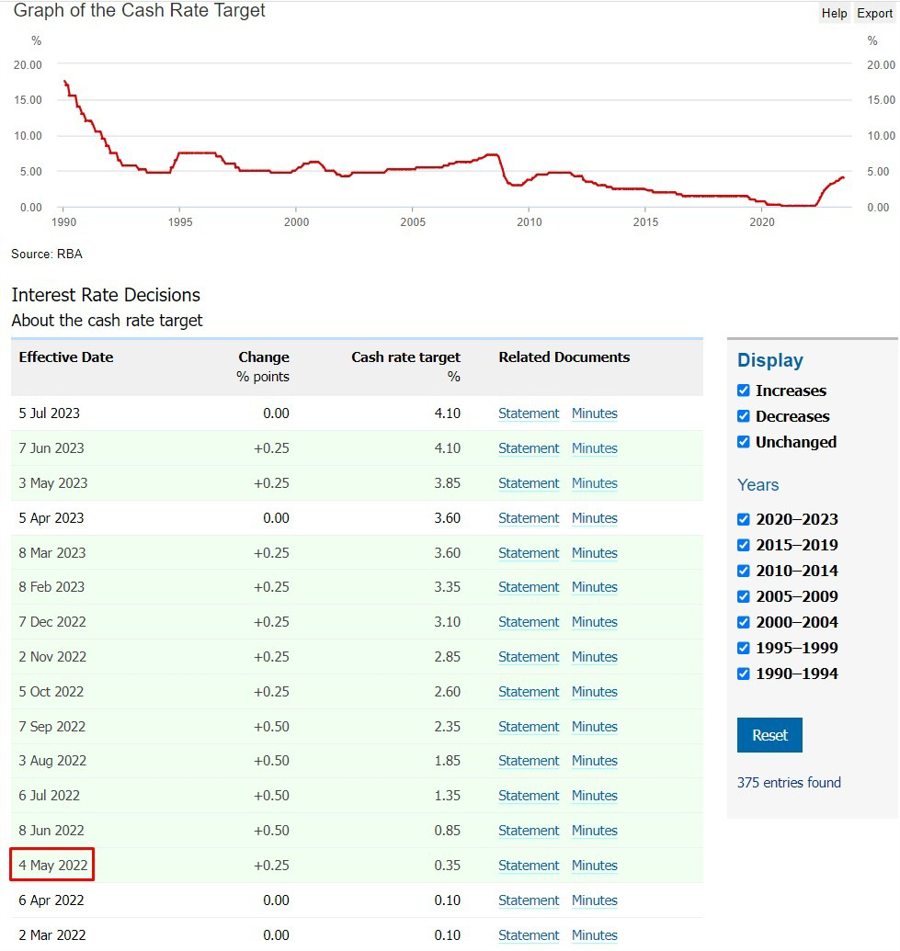

The hiking cycle began in May 2022 and there are thoughts it may be complete. Some are still tipping another hike though, likely in November.