AUD/USD ANALYSIS & TALKING POINTS

- Concerns around Chinese economy increase leaving AUD under pressure.

- Fed speakers under the spotlight later today.

- Bears eye 0.6500.

Recommended by Warren Venketas

Get Your Free AUD Forecast

AUSTRALIAN DOLLAR FUNDAMENTAL BACKDROP

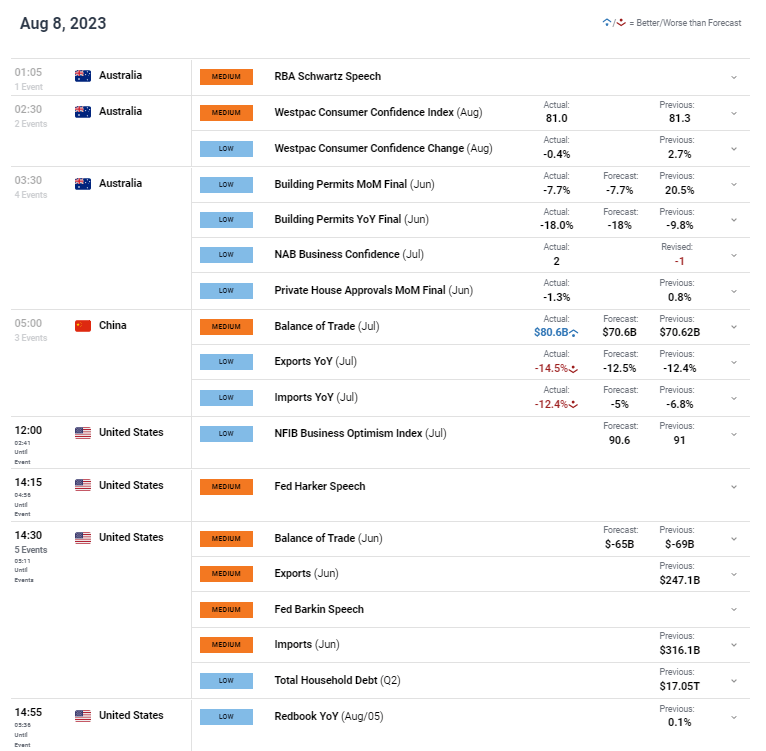

The Australian dollar has slid further this Tuesday morning as Chinese import and export numbers (refer to economic calendar below) fell sharply (missing estimates), underlying the gloomy economic conditions within the region. Australia’s close trade links with China via commodities have weighed on the Aussie dollar with broad-based commodity prices turning red. Being a ‘pro-growth’ currency, the AUD is currently weakening more so than any other G10 currency against the US dollar.

Augmenting the AUD selloff was the Westpac consumer confidence index print for August that moderated somewhat reflecting a deteriorating outlook from a consumer perspective. Later today, the focus will shift towards US data in the form of balance of trade alongside Fed speakers Harker and Barkin. While this may not move the pair significantly, the focal point for the weak will be squarely on the US CPI release this Thursday which may leave little room for large moves leading up to the print.

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

AUD/USD ECONOMIC CALENDAR (GMT +02:00)

Source: DailyFX economic calendar

TECHNICAL ANALYSIS

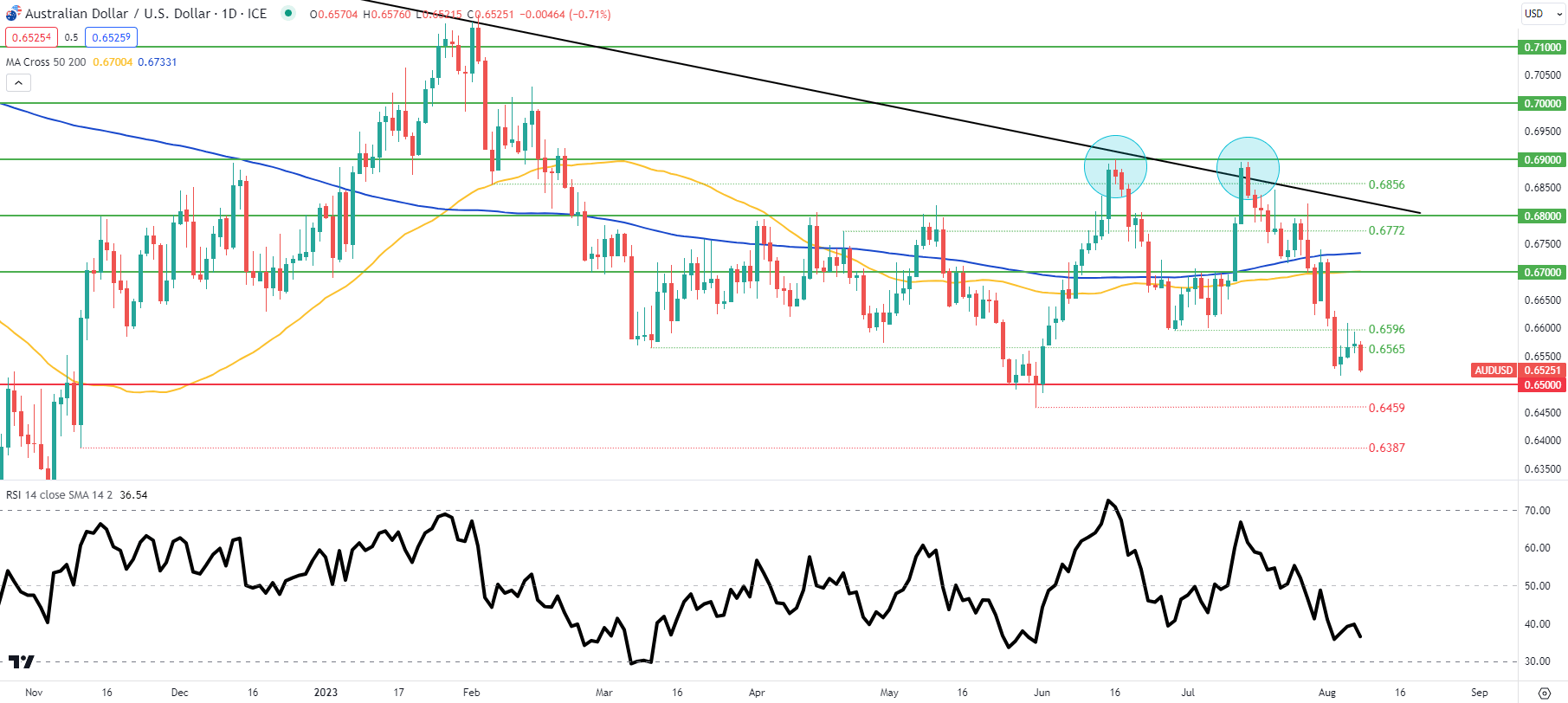

AUD/USD DAILY CHART

Chart prepared by Warren Venketas, TradingView

Daily AUD/USD price action above looks towards the 0.6500 psychological support zone for the first time since early June. Considering there is still room before reaching oversold territory on the Relative Strength Index (RSI), the pair may well hit this key level.

Key resistance levels:

- 0.6700/50-day moving average

- 0.6596

- 0.6565

Key support levels:

- 0.6500

- 0.6459

IG CLIENT SENTIMENT DATA: CAUTIOUS (AUD/USD)

IGCS shows retail traders are currently net LONG on AUD/USD, with 80% of traders currently holding long positions. At DailyFX we typically take a contrarian view to crowd sentiment but due to recent changes in long and short positions we arrive at a short-term mixed disposition.

Contact and followWarrenon Twitter:@WVenketas