This summary of the Bank of America note is via eFX.

For

bank trade ideas, check

out eFX Plus.

For a limited time, get a 7-day free trial, basic for $79 per month

and premium at $109 per month. Get

it here.

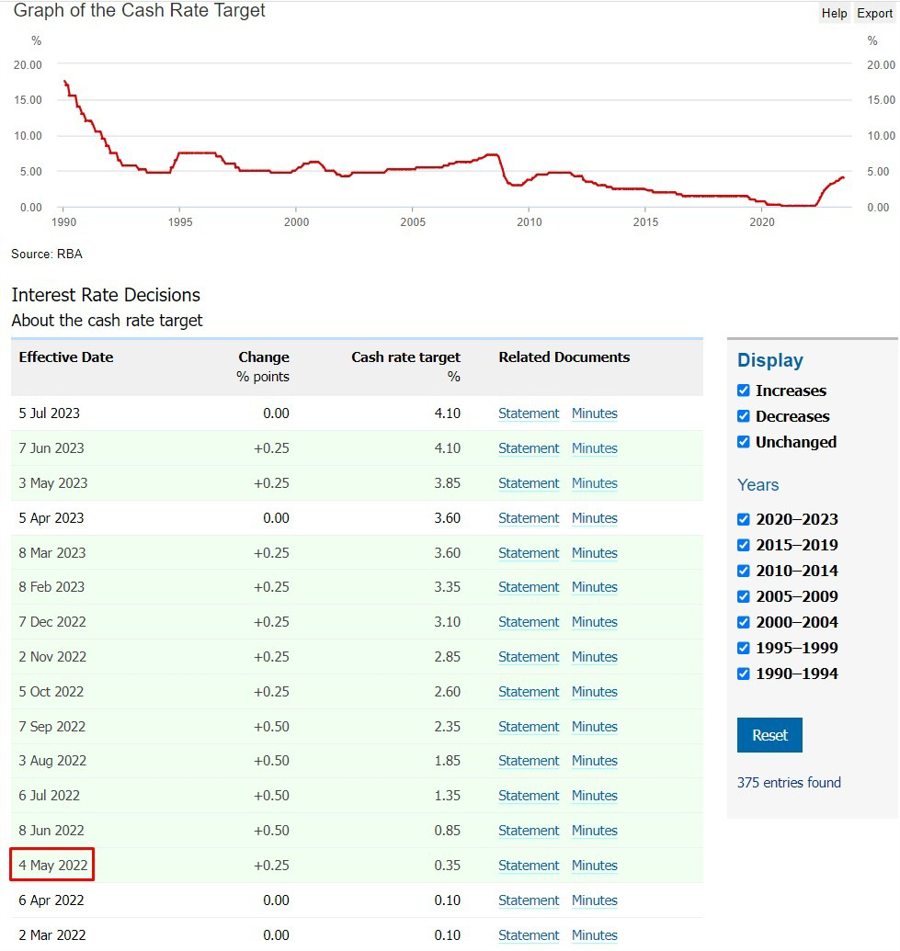

1. Rate Hike Expectation: BofA anticipates the RBA to raise the cash rate by 25 basis points, moving it from 4.1% to 4.35%. They believe this decision would be optimal for offering sustained support to Australia’s robust labor market and for ensuring that inflation gradually approaches the upper boundary of the target range.

2. Rate Stabilization: If BofA’s projection of a rate hike in August comes to fruition, they predict that the RBA will maintain these rates for the remainder of the year. This pause will allow the central bank to gauge the economic repercussions of the elevated rates.

3. AUD Support: The potential rate hikes have been beneficial for the Australian Dollar (AUD), albeit moderately. Despite this, BofA points out that domestic policy rates in Australia are still comparatively less constraining than in other regions.

4. Recession Avoidance: BofA posits that Australia is in a favorable position to steer clear of a recession, especially when compared to other G10 countries. This economic stability would likely emerge as a mid-term benefit, particularly as global central banks are projected to transition into an easing cycle by 2024.

—

The RBA rate hike cycle began in May 2022: