Most Read: Gold Price Outlook: Fed May Shake Up Markets. Pullback or Rally in Store?

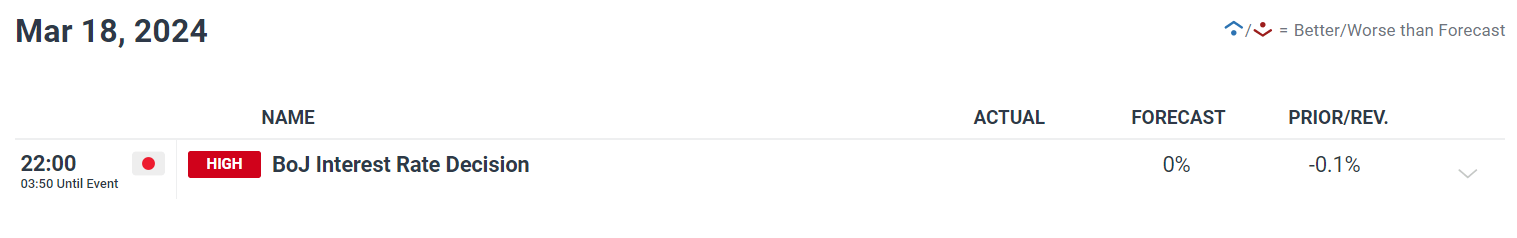

The Bank of Japan is set to wrap up its March monetary policy meeting on Tuesday (Japan time, still Monday in NY). After recent media leaks, the institution led by Governor Kazuo Ueda is widely expected to end negative borrowing costs, raising its benchmark rate to 0.0% from -0.1%. This would be the first hike since February 2007, in a turning point for the BOJ’s long-standing ultra-dovish stance.

The central bank is also seen terminating its yield curve control scheme, initiated in 2016 and under which it has been buying massive amounts of government bonds to target certain rates on the curve. In addition, the BoJ is also expected to end purchases of stock exchange-traded funds (ETFs) and other risk assets, which were initially introduced nearly 15 years ago.

The move to start unwinding stimulus comes after salary negotiations between the country’s big unions and top businesses resulted in bumper pay boosts for Japanese workers in excess of 5.2%, the highest in more than 30%. Policymakers had repeatedly indicated that strong wage growth is necessary for a virtuous spiral that generates sustainable price increases driven by domestic demand.

Curious about what lies ahead for the Japanese yen? Find comprehensive answers in our quarterly trading forecast. Claim your free copy now!

Recommended by Diego Colman

Get Your Free JPY Forecast

With this decision now largely discounted, traders should focus on guidance to gauge market reaction. If the central bank signals that it will only withdraw accommodative policies at glacial speed and that future rate hikes will be measured, the yen is likely to weaken as disappointed bulls cut long exposure. But even if this scenario were to play out, the Japanese currency should have better days ahead.

Conversely, if the BoJ unexpectedly adopts a hawkish stance in its outlook, traders should prepare for the possibility of a powerful bullish response in the yen. This could mean a sharp drop in pairs such as USD/JPY, GBP/JPY and EUR/JPY. However, the chances of this scenario materializing are slim, with key central bank officials leaning in favor of a very gradual normalization process.

Keen to understand how FX retail positioning can provide hints about the short-term direction of USD/JPY? Our sentiment guide holds valuable insights on this topic. Download it today!

| Change in | Longs | Shorts | OI |

| Daily | -5% | 10% | 7% |

| Weekly | -26% | 32% | 13% |

USD/JPY FORECAST – TECHNICAL ANALYSIS

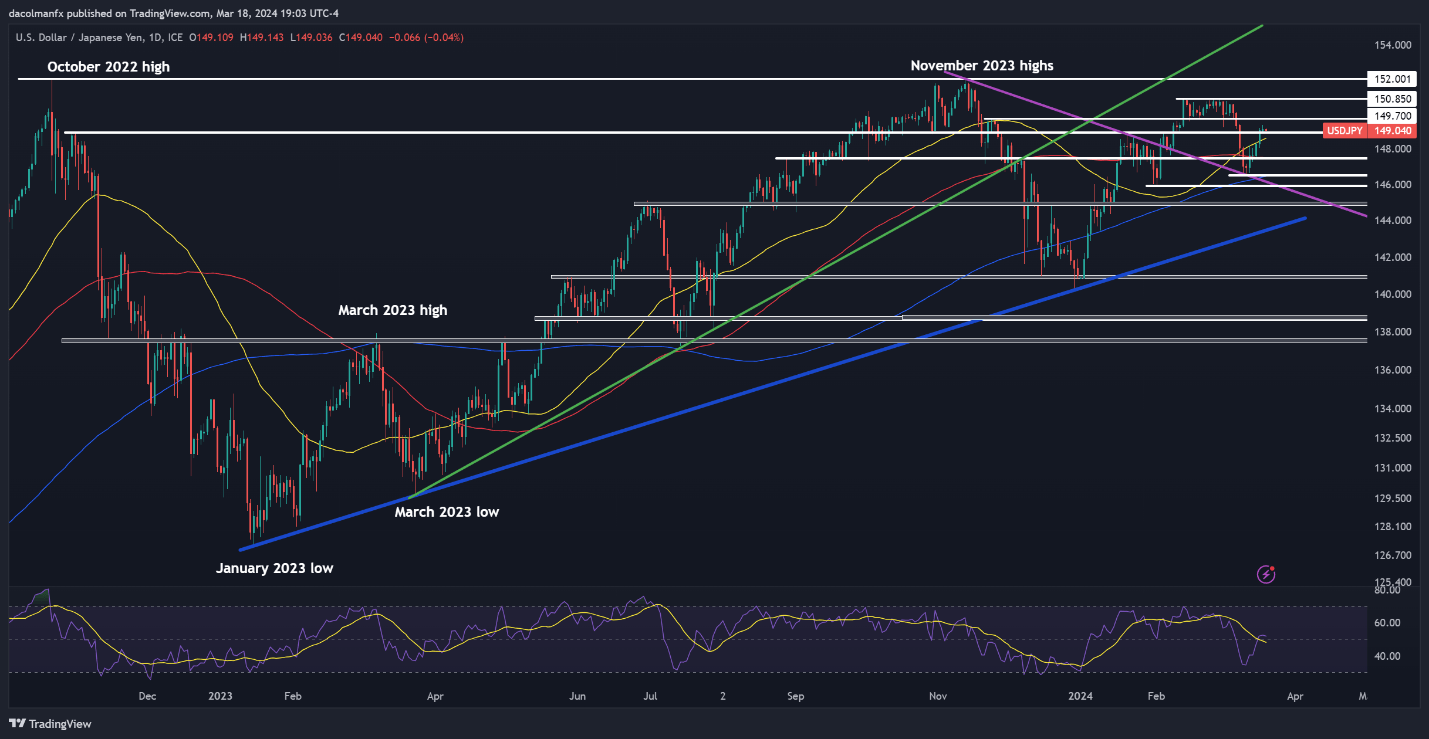

USD/JPY edged higher on Monday, consolidating above the 149.00 handle. If gains accelerate in the coming trading sessions, resistance appears at 149.70. On continued strength, market’s attention will be on 150.85, followed by 152.00.

On the other hand, if sellers mount a comeback and trigger a pullback below 149.00/148.90, the focus is likely to transition towards the 50-day simple moving average. Below this indicator, all eyes will be on 147.50 and 146.50 thereafter, which corresponds to the 200-day simple moving average.