Canadian Dollar, USD/CAD, Crude Oil, Risk Aversion – Briefing:

Recommended by Daniel Dubrovsky

Get Your Free Oil Forecast

Canadian Dollar Sinks Alongside Crude Oil Prices as Sentiment Sours

The Canadian Dollar was one of the worst-performing major currencies over the past 24 hours. Weakness in the Loonie followed a similarly dismal day for crude oil prices, with WTI sinking about 5.6% on Tuesday. That was the worst performance for the commodity over 24 hours since July 12th. Oil has fully reversed gains on surprise cuts from OPEC+ from weeks ago and then some.

Generally speaking, it was a risk-averse 24 hours across global financial markets. Pessimism picked up pace during the Wall Street trading session. By the end of the day, the Nasdaq 100, S&P 500 and Dow Jones fell -0.92%, -1.17% and -1.11%, respectively. Meanwhile, the VIX market ‘fear gauge’ soared over 10 percent (although most gains were reversed before the end of Wall Street trade).

Fears of slowing global growth likely drove market price action. For one thing, a couple of regional bank stocks plunged in the aftermath of First Republic Bank being rescued by JPMorgan. Meanwhile, a key labor market gauge continued heading in the wrong direction. There are now about 1.64 jobs in the US per unemployed person, the lowest since the end of 2021. Still, it remains historically elevated.

Oil is a key Canadian export. As such, the direction of the commodity often plays a key role in local monetary policy. As such, the Canadian Dollar was pressured lower by multiple fundamental forces: slowing growth prospects (especially potential trading demand with the US) and prospects of future revenue from crude oil.

Looking ahead, Wednesday’s Asia-Pacific trading session could continue in the footsteps of Wall Street. A further deterioration in market sentiment may continue pressuring crude oil, and potentially the Loonie, sending USD/CAD higher. Markets are also nervously awaiting the Federal Reserve interest rate decision, due in less than 24 hours.

Canadian Dollar Technical Analysis

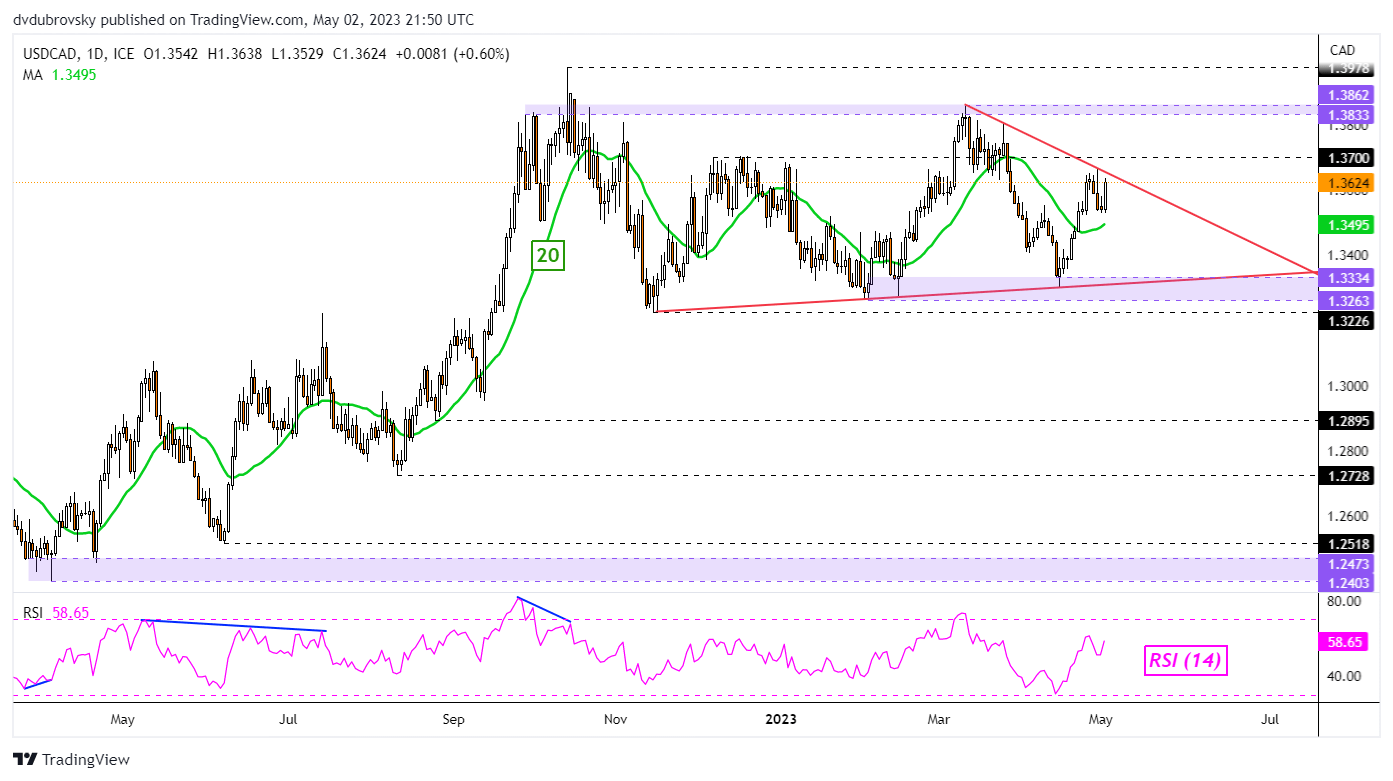

On the daily chart, USD/CAD turned back higher towards the near-term falling trendline from March. This could maintain the downward focus. But prices also remain above the 20-day Simple Moving Average (SMA). The latter is starting to slope upward, meaning that a key breakout could be seen in this pair relatively soon. Extending higher exposes the 1.3833 – 1.3862 resistance zone. If not, turning lower places the focus on the 1.3263 – 1.3334 range.

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

USD/CAD Daily Chart

— Written by Daniel Dubrovsky, Senior Strategist for DailyFX.com