High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

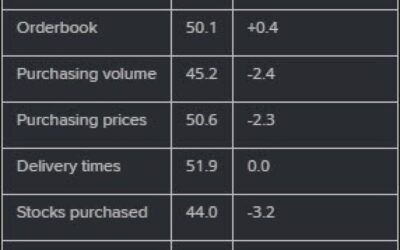

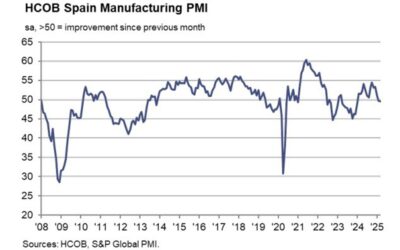

Spain March manufacturing PMI 49.5 vs 49.9 expected

Prior 49.7A decline in new orders weighed on Spain's manufacturing sector last month, resulting in a marginal contraction. Output showed an increase though and employment levels also improved. So, there are some positive takeaways. HCOB notes that:“The HCOB PMI...

USDJPY Technical Analysis – The JPY eases as the risk sentiment improves

Fundamental OverviewThe USD got under some pressure last Friday following the ugly University of Michigan survey where consumer sentiment got revised lower and long-term inflation expectations higher. The market responded by increasing more aggressively the...

European indices bounce back at the open to start the day

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

UK trade secretary says hopeful for Trump tariffs to be reserved in the next weeks/months

Come what may, it wouldn't be the most surprising thing to see some exemptions or delays being made in the weeks ahead. That will likely come from several rounds of negotiations after the announcement from Trump tomorrow, first and foremost. But we'll see.Staying on...

UK March Nationwide house prices 0.0% vs +0.2% m/m expected

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

Trump tariffs remain in focus as the countdown continues

After being gripped by fear, dip buyers managed to wrestle back some optimism in trading yesterday. Tech shares lagged but it was definitely a win even if the Nasdaq closed down by just 0.1%. Meanwhile, the S&P 500 caught a bounce once again following a brief test...

Learn Investing: Why Beginner Real Estate Investors Should Usually Start in Their Backyard

How knowing your local market gives you an edge — and why proximity often beats complexity in real estate investing."In real estate investing, what you know and can see often matters more than what looks good on paper."Your 1st real estate investment? Consider the...

RBA governor Bullock: We’ve not lost confidence on inflation goal

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

RBA governor Bullock: We’ve not made up our mind on May decision

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

RBA governor Bullock: We judge that policy is restrictive to get inflation back to target

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

Learn to Invest: Stay Humble

Why early success can be dangerous, and how to stay humble, focused, and profitable in your investing journey."In investing, confidence without caution is a recipe for costly mistakes."Stay confident, yet humble, otherwise you might fall.Why Overconfidence Is So...

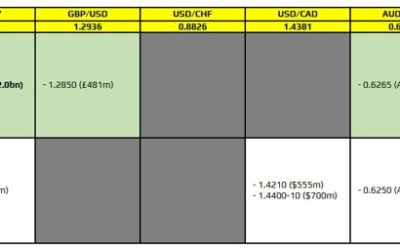

FX option expiries for 1 April 10am New York cut

There is just one to take note of on the day, as highlighted in bold.That being for USD/JPY in the region of 150.00-05. The pair caught a bounce late yesterday on a rebound in the risk mood but that was arrested near the figure level with the 100-hour moving average...

How to Invest: Build Discipline

Why consistency beats brilliance in investing, and how small, repeatable actions build serious wealth."Discipline isn’t about motivation. It’s about building habits that make good investing decisions automatic."Build Investing DisciplineWhy Investing Discipline...

Learn to Invest: Knowing How to Lose!

How professional investors manage risk and why trying to avoid every loss is a losing strategy."In investing, losses are inevitable. The key is making sure they’re small, controlled, and never wipe you out."Everyone Loses When Investing for a Long Enough. Learn...

Learn to Invest: Build a Stock Portfolio

Creating a portfolio you can trust — one that grows, weathers storms, and doesn’t keep you up at night."The goal isn’t to own everything — it’s to own enough of the right things."A stock portfolio that balances risk and rewardWhy Portfolio Construction MattersA...

Learn to Invest: Holding the Stock for the Long Run

How to recognize businesses you can trust to compound wealth — and why most stocks aren’t built that way."Time is the friend of the wonderful business, the enemy of the mediocre." — Warren BuffettHolding for the Long RunWhy Long-Term Stocks Are Rare — But PowerfulNot...

[속보]머스크 5월 복귀확정! 주가 반토막 내탓! 트럼프발 기회 커진다. 관세전쟁 반전 임박]#3.1경제독립tv

https://www.youtube.com/watch?v=EYEenITjAhw [속보]머스크 5월 복귀확정! 주가 반토막 내탓! 트럼프발 기회 커진다. 관세전쟁 반전 임박]#3.1경제독립tv *본 채널은 투자에 대한 조언을 드리지만, 투자는 전적으로 본인의 판단하에 진행하고, 투자에 대한 책임도 전적으로 본인에게 있다는 점을 명심하셔야 합니다 [3년뒤 10억부자 3.1경제독립tv필독 추천영상] [1]정기예금 꼭~이렇게 가입하세요~ 이자 40만원~100만원! 더 받아요!...

[집을 왜 지어요? 농촌 체류형 쉽터 대박! 4평+6평 무한변신! 피로가 싹 풀립니다! 청우산업 우승예대표 인터뷰-3부]#3.1경제독립tv

https://www.youtube.com/watch?v=xgFpYwzzi6Y [집을 왜 지어요? 농촌 체류형 쉽터 대박! 4평+6평 무한변신! 피로가 싹 풀립니다! 청우산업 우승예대표 인터뷰-3부]#3.1경제독립tv [3년뒤 10억부자 3.1경제독립tv필독 추천영상] [1]정기예금 꼭~이렇게 가입하세요~ 이자 40만원~100만원! 더 받아요! https://youtu.be/6U8BR4kcPAo [2]통장에 이 돈 당장 빼세요! 만65세, 기초연금탈락! 통장에 얼마 있으면...

RBA leaves its cash rate unchanged at 4.10%, as expected

Prior 4.10%Underlying inflation is moderatingCautious about the outlookNeed to be confident that inflation progress will continueUncertainty about the outlook abroad also remains significantGeopolitical uncertainties are also pronouncedReturning inflation sustainably...

![[속보]머스크 5월 복귀확정! 주가 반토막 내탓! 트럼프발 기회 커진다. 관세전쟁 반전 임박]#3.1경제독립tv](https://my.blogtop10.com/wp-content/uploads/2025/04/ec868debb3b4eba8b8ec8aa4ed81ac-5ec9b94-ebb3b5eab780ed9995eca095-eca3bceab080-ebb098ed86a0eba789-eb82b4ed8393-ed8ab8eb9fbced9484ebb09c-400x250.jpg)

![[집을 왜 지어요? 농촌 체류형 쉽터 대박! 4평+6평 무한변신! 피로가 싹 풀립니다! 청우산업 우승예대표 인터뷰-3부]#3.1경제독립tv](https://my.blogtop10.com/wp-content/uploads/2025/04/eca791ec9d84-ec999c-eca780ec96b4ec9a94-eb868decb48c-ecb2b4eba598ed9895-ec89bded84b0-eb8c80ebb095-4ed8f896ed8f89-ebacb4ed959cebb380-400x250.jpg)