Headlines:Markets:USD and CAD lead, JPY lags on the dayEuropean equities lower; S&P 500 futures up 0.6%US 10-year yields up 5.5 bps to 4.303%Gold down 1.0% to $2,887.82WTI crude up 1.1% to $69.35Bitcoin up 2.3% to $86,465We're still in that month-end trading phase...

USDCHF Technical Analysis – The risk-off flows boosted the CHF

Fundamental OverviewThe USD continues to be supported against most major currencies, especially the commodity currencies, as the markets remain in a risk-off mood following some bad US data releases. In fact, since last Friday, we got weak US Flash Services PMI, UMich...

Shorting Salesforce Stock After Earnings

How to Short Salesforce (CRM) After Negative Earnings – A Tactical ApproachMost of you have heard the saying: the trend is your friend. The idea is simple—you want to go with the flow, ride the wave, and not fight against market momentum. A crucial aspect of this is...

Eurozone February final consumer confidence -13.6 vs -13.6 prelim

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

PU Prime Wins Best Multi-Asset Broker – MEA 2025 at iFX EXPO Dubai

PU Prime has been recognized Best Multi-Asset Broker – MEA 2025 at a ceremony held at the Dubai World Trade Centre. The award was presented at the close of the first day of iFX EXPO Dubai 2025, one of the leading events in the financial services industry. Organized by...

Eurozone January M3 money supply +3.6% vs +3.8% y/y expected

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

2025년 바뀌는 도로교통법

https://www.youtube.com/watch?v=qztMplNr5CI 올해부터 바뀌는 2025도로교통법의 변화에 대해서 알려드리겠습니다. #도로교통법 #뉴스 #도로교통공단 MoneyMaker FX EA Trading Robot

USDCAD Technical Analysis – Risk-off and tariffs threats weigh on the Loonie

Fundamental OverviewThe USD continues to be supported against most major currencies, especially the commodity currencies, as the markets remain in a risk-off mood following some bad US data releases. In fact, since last Friday, we got weak US Flash Services PMI, UMich...

USDJPY Technical Analysis – The JPY thrives amid the risk-off flows

Fundamental OverviewThe USD continues to be supported against most major currencies, especially the commodity currencies, as the markets remain in a risk-off mood following some bad US data releases. In fact, since last Friday, we got weak US Flash Services PMI, UMich...

European stocks fall back at the open today

Eurostoxx -0.9%Germany DAX -1.0%France CAC 40 -0.6%UK FTSE -0.3%Spain IBEX -1.0%Italy FTSE MIB -1.3%This takes away a chunk of the gains from yesterday and creates a bit of a nervy situation going into the end to February trading tomorrow. Trump threatening tariffs is...

DAX Trading Map Today

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

Spain February preliminary CPI +3.0% vs +3.0% y/y expected

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

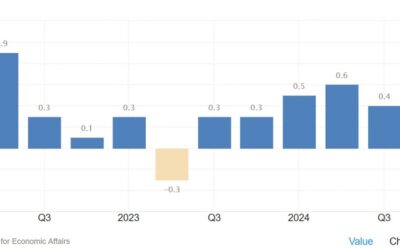

Switzerland Q4 GDP +0.2% vs +0.2% q/q expected

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

Silver Futures Today – tradeCompass

Silver Futures Analysis – tradeCompass for TodayCurrent Silver Futures Price: $32,350The tradeCompass is a structured framework for Silver Futures analysis, helping traders identify key price levels where market participation is expected to increase. This approach...

The bond market moves to test another key level

If anything, it's a sign that this is a market that's no longer that afraid - if at all - of tariff threats. A case of the boy who cried wolf perhaps. In this case being the man who cried tariffs. And with softer US economic data recently, traders are coming around to...

Gold down on the day, poised to snap weekly win streak

It's now a testing time for gold as mentioned yesterday here: The technical lines in the sand have shifted in goldAnd with the latest fall today, gold is now down 1.4% on the week and poised to snap its win streak of eight consecutive weeks of gains. Yup, it has been...

tradeCompass for RTY (Russell 2000)

tradeCompass for RTY (Russell 2000) – February 27, 2025Trade Plan: Short Setup on Russell 2000 with Staggered ScalingAt the time of this analysis, RTY is at 2192.5, and today’s tradeCompass today is designed to fade the move, meaning we are entering a short position...

[테슬라 반등시점 임박했나? 역대급 폭락후 상승률! 최상의 선택은 이것! 10배 수익률 갈림길 ]#3.1경제독립tv

https://www.youtube.com/watch?v=k7dvZna59fk [테슬라 반등시점 임박했나? 역대급 폭락후 상승률! 최상의 선택은 이것! 10배 수익률 갈림길 ]#3.1경제독립tv *본 채널은 투자에 대한 조언을 드리지만, 투자는 전적으로 본인의 판단하에 진행하고, 투자에 대한 책임도 전적으로 본인에게 있다는 점을 명심하셔야 합니다 [3년뒤 10억부자 3.1경제독립tv필독 추천영상] [1]정기예금 꼭~이렇게 가입하세요~ 이자 40만원~100만원! 더 받아요!...

Japan’s new births fell again in 2024 for a ninth straight year

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

China’s annual parliament, the “Two Sessions,” starts next week.

China's once a year parliament - the “Two Sessions” - begins on March 4:On Tuesday the Chinese People’s Political Consultative Conference (peak advisory body) meetsThis is then followed by National People’s Congress meeting, the legislatureIt'll all go for about a...

![[테슬라 반등시점 임박했나? 역대급 폭락후 상승률! 최상의 선택은 이것! 10배 수익률 갈림길 ]#3.1경제독립tv](https://my.blogtop10.com/wp-content/uploads/2025/02/ed858cec8aaceb9dbc-ebb098eb93b1ec8b9ceca090-ec9e84ebb095ed9688eb8298-ec97adeb8c80eab889-ed8fadeb9dbded9b84-ec8381ec8ab9eba5a0-ecb59c-400x250.jpg)