Oil prices could rise on the latest comments from Putin, who said the latest attack on the Caspian Pipeline Consortium is "impossible to restore quickly" because western equipment was damaged.The pipeline moves Kazakhstan oil to world markets and has been reduced by...

Putin sounds pleased with progress on Ukraine talks

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

US January housing starts 1.366M versus 1.39M expected

Prior was 1.499m (revised to 1.515m)Starts -9.8% vs +15.8% priorBuilding permits 1.483m vs 1.46m expectedPermits +0.1% vs -0.7% priorThere has been some volatility in this data set in the multi-family side but single-family authorizations in January were at a rate of...

It’s housing starts day in the US and the signs aren’t great

Stock markets in the US, UK and Europe are all hitting record highs and the mood is buoyant. The US is cutting regulation and optimism is high. You would be mistaken if you think that rising tide lifts all boats.The anchor of the market since the election has been...

The USD is mixed. What technical clues are in play for the EURUSD, USDJPY and GBPUSD

The US dollar is mixed as the North American traders enter for the day. In the video above, I outline for traders the technical levels that are in play for the three major currency pairs – the EURUSD, USDJPY and GBPUSD. The USD is higher versus the EUR and the GBP,...

ForexLive European FX news wrap: Dollar holds steady, UK inflation ticks up

Headlines:Markets:NZD leads, GBP lags on the dayEuropean equities lower; S&P 500 futures down 0.1%US 10-year yields up 2.2 bps to 4.565%Gold flat at $2,935.83WTI crude up 0.9% to $72.48Bitcoin up 1.3% to $96,300It was a mixed session as markets are taking a bit of...

[2025 새로운 자동 부업] 하루 8분만 ‘이렇게’ 해보세요! 매달 자동으로 돈이 들어옵니다! (지금 당장 100% 승인되는) 집에서 무료+자동 부수입 만들기!

https://www.youtube.com/watch?v=df7kpVnkKmQ 2025년 새해가 된지 벌써 2월이 되었습니다. 재택 부업을 비롯해, 그동안 다양한 돈버는 직장인 부업과 투잡을 소개해드렸는데요, 오늘은 집에서 1번이라도 실행하면, 매달 자동 수익을 벌 수 있는 부수입 파이프라인을 만드는 새로운 방법을 하나 더 소개하려고 합니다 보통 검토 기다리다가 시간 다가는데, 이번 것은 하자마자 100% 승인되는 방법이고요, 집에서도 실행 가능하고, 학력 경력 무관 한데다,...

China says willing to work with US to resolve trade concerns through dialogue

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

US MBA mortgage applications w.e. 14 February -6.6% vs +2.3% prior

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

ECB’s Schnabel: We are getting closer to a point where we pause or halt cuts

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

S&P 500 Technical Analysis – The market is flirting with a new all-time high

Fundamental OverviewThe S&P 500 is back around the all-time highs after a strong rally triggered by the benign US PPI and the Trump’s reciprocal tariffs announcement. In fact, despite a higher than expected US PPI report, the details that feed into the Core PCE...

US-EU trade talks one to watch later in the day

Šefčovič will be meeting up with Trump's top economic adviser, Kevin Hassett, trade representative, Jamieson Greer, and commerce secretary, Howard Lutnick. They are expected to meet in Washington some time in the afternoon.There's going to be a lot to discuss, ranging...

A Bold New Way to Earn: CoiniGo’s Referral Program Offers Up to $10,000

CoiniGo, with its Holistic Growth Mindset, is enhancing the way businesses accept crypto payments. They don’t just recognize the potential of industry influencers and leaders—they empower them. That’s why they have launched a high-reward Referral Program, allowing...

Eurozone December current account balance €50.5 billion vs €34.6 billion prior

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

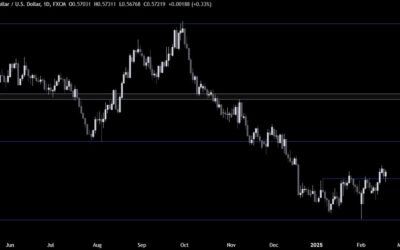

NZDUSD Technical Analysis – RBNZ’s Orr revises the neutral rate higher

Fundamental OverviewThe US Dollar this week has been erasing some of the losses experienced last week after the benign US PPI and the Trump’s reciprocal tariffs announcement. There hasn’t been any notable catalyst this week to support the greenback although some...

USDJPY Technical Analysis – Higher Treasury yields limit the JPY gains

Fundamental OverviewThe US Dollar this week has been erasing some of the losses experienced last week after the benign US PPI and the Trump’s reciprocal tariffs announcement. There hasn’t been any notable catalyst this week to support the greenback although some...

European indices open lightly changed to start the day

Eurostoxx flatGermany DAX +0.1%France CAC 40 -0.1%UK FTSE -0.1%Spain IBEX -0.1%Italy FTSE MIB +0.4%US futures are also little changed, keeping marginally higher by 0.1% on the day. It's been a slower last few sessions, as traders are settling down for a bit of a...

ECB’s Panetta: Signs of weakness in Eurozone economy are more persistent than anticipated

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

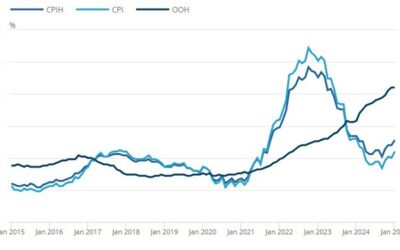

UK January CPI +3.0% vs +2.8% y/y expected

Prior +2.5%Core CPI +3.7% vs +3.7% y/y expectedPrior +3.2%The December report was plagued by a steep drop in prices for airfares, as noted at the time here. A strong rebound there is one of the causes for the hotter report in January. Besides that, the introduction of...

BOJ’s Takata: We have no preset idea on timing, level of future rate hikes

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

![[2025 새로운 자동 부업] 하루 8분만 ‘이렇게’ 해보세요! 매달 자동으로 돈이 들어옵니다! (지금 당장 100% 승인되는) 집에서 무료+자동 부수입 만들기!](https://my.blogtop10.com/wp-content/uploads/2025/02/2025-ec8388eba19cec9ab4-ec9e90eb8f99-ebb680ec9785-ed9598eba3a8-8ebb684eba78c-ec9db4eba087eab28c-ed95b4ebb3b4ec84b8ec9a94-400x250.jpg)