High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

PBOC sets USD/ CNY reference rate for today at 7.1885 (vs. estimate at 7.3442)

The news earlier should be yuan supportive:People's Bank of China USD/CNY reference rate is due around 0115 GMT.The People's Bank of China (PBOC), China's central bank, is responsible for setting the daily midpoint of the yuan (also known as renminbi or RMB). The PBOC...

PBoC and SAFE move to allow Chinese firms greater access to foreign capital

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

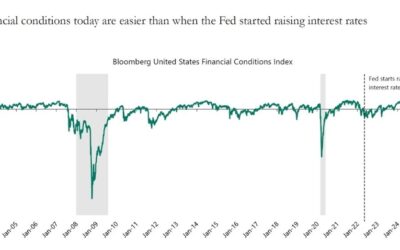

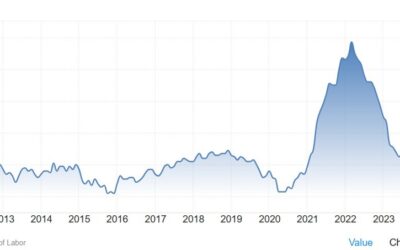

US economy “reaccelerating”, there’s a near coin toss chance of a Fed rate hike this year

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

Australian December inflation gauge 0.6% m/m (prior 0.2%) & 2.6% y/y (prior 2.9%)

Australian Melbourne Institute Inflation Gauge for December 2024:0.6% m/m, the largest jump higher in a yearprior 0.2%trimmed mean +0.4% m/m, highest since March 20242.6% y/y prior 2.9%AUD is little changed. Around 0.6155.***The Australian Melbourne Institute...

PBOC is expected to set the USD/CNY reference rate at 7.3442 – Reuters estimate

People's Bank of China USD/CNY reference rate is due around 0115 GMT.The People's Bank of China (PBOC), China's central bank, is responsible for setting the daily midpoint of the yuan (also known as renminbi or RMB). The PBOC follows a managed floating exchange rate...

UBS expects further Federal Reserve rate cuts, but at a slower pace

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

ICYMI – Bank of America see no Fed interest rate cuts in 2025, risk skewed towards a hike

I posted earlier on Morgan Stanley being unmoved by the jobs report:They look like they are on a desert island though, analysts elsewhere are dialling back rate cut expectations. Goldman Sachs for example:Adam had the big call from Bank of America posted on...

Optimism for higher gold prices in 2025, but what are the risks?

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

US and UK tighten sanctions on Russian oil industry

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

Canada PM Trudeau says has counter-tariffs ready If Trump launches a trade war

Canadian Prime Minister Justin Trudeau dpoke in an interview with CNBC on Sunday:“As we did last time, we are ready to respond with tariffs as necessary” Trudeau is referring here to 2018, when Canada slapped dollar-for-dollar tariffs on U.S. steel and aluminum in...

Goldman Sachs now expect two Federal Reserve interest rate cuts in 2025, down from three

I posted earlier on Morgan Stanley unmoved by the jobs report:In the preamble to that post I spoke about the data. Repeating it here 'cause it contains what should be useful info:December payroll data from the US was much stronger than expected:The +256,000 headline...

ICYMI – Morgan Stanley expect the Fed to cut rates in March

December payroll data from the US was much stronger than expected:The +256,000 headline significantly beat expectations of 160,000. The highest expected was +200,000, while the 140K-185K range showed the most clustering. If you didn't know this going into the data you...

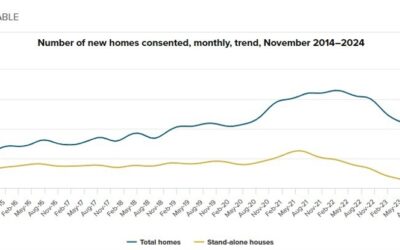

New Zealand November building approvals +5.3% m/m, huge jump from -5.2% the prior month

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

Economic calendar in Asia Monday, January 13- Chinese trade data, ECB’s Lane speaking

more to come China's exports are expected to have expanded at a faster pace in December than in November, with firms hurrying to move inventory to major markets ahead of Trump's return to the White House this month and the accompanying fresh trade risks.Imports are...

Trade ideas thread – Monday, 13 January, insightful charts, technical analysis, ideas

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

Monday morning open levels – indicative forex prices –

As is usual for a Monday morning, market liquidity is very thin until it improves as more Asian centres come online ... prices are liable to swing around, so take care out there.ps. It's a Japanese holiday today, which will keep it thinner for longer. Singapore and...

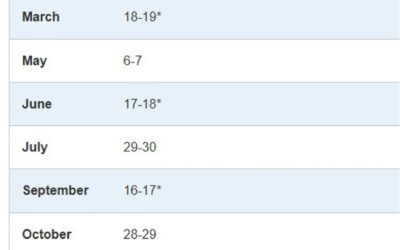

Weekly Market Outlook (13-17 January)

UPCOMING EVENTS:Monday: NY Fed Inflation Expectations.Tuesday: US NFIB Small Business Optimism Index, US PPI.Wednesday: UK CPI, US CPI.Thursday: Japan PPI, Australia Employment report, UK GDP, US Retail Sales, US Jobless Claims, US Import Prices, US NAHB Housing...

Newsquawk Week Ahead: US CPI & Retail Sales, China Activity Data, UK CPI, Aussie jobs

Mon: N/ATue: EIA STEO; CBR Policy Announcement; Indian WPI (Dec), US PPI (Dec)Wed: IEA OMR, UK CPI (Dec), EZ Industrial Production (Nov), US CPI (Dec), NY Fed Manufacturing (Jan)Thu: ECB Minutes (Dec), BoK Policy Announcement; Australian Employment (Dec), UK GDP...

[테슬라 4,000간다-캐시우드 5년전 전망 아직도 유효? 머스크 경호강화 이유는? 비트코인 조정+기회인가]#3.1경제독립tv

https://www.youtube.com/watch?v=C209CV6RLgQ [테슬라 4,000간다-캐시우드 5년전 전망 아직도 유효? 머스크 경호강화 이유는? 비트코인 조정+기회인가]#3.1경제독립tv [3년뒤 10억부자 3.1경제독립tv필독추천영상] [1]정기예금 꼭~이렇게 가입하세요~ 이자 40만원~100만원! 더 받아요! https://youtu.be/6U8BR4kcPAo [2]통장에 이 돈 당장 빼세요! 만65세, 기초연금탈락! 통장에 얼마 있으면 못받나?...

![[테슬라 4,000간다-캐시우드 5년전 전망 아직도 유효? 머스크 경호강화 이유는? 비트코인 조정+기회인가]#3.1경제독립tv](https://my.blogtop10.com/wp-content/uploads/2025/01/ed858cec8aaceb9dbc-4000eab084eb8ba4-ecba90ec8b9cec9ab0eb939c-5eb8584eca084-eca084eba79d-ec9584eca781eb8f84-ec9ca0ed9aa8-eba8b8ec8aa4-400x250.jpg)