Key messages from Octa for 2025:● In 2025, the implications of the U.S. presidential election will play out in full force.● A full-scale tariff war between the U.S. and the rest of the world is a major global risk.● An additional headwind is growing fiscal deficits in...

What is moving the market? What are the technicals for some of the major currency pairs?

A new week begins with the US and Canadian jobs report the highlight.For today, stocks are higher, US yields are lower and the USD is falling vs all the major currencies with the greenback moving the most vs the AUD (down -1.11%) and the NZD (-1.09%). It is also lower...

Germany December preliminary CPI +2.6% vs +2.4% y/y expected

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

ForexLive European FX news wrap: Dollar squeezed on hopes for softer tariffs

Headlines:Markets:AUD leads, USD lags on the dayEuropean equities higher; S&P 500 futures up 0.7%US 10-year yields down 0.5 bps to 4.589%Gold up 0.2% to $2,642.93WTI crude up 0.5% to $74.36Bitcoin up 1.3% to $99,503It's not a good day for dollar bulls as they are...

Nippon Steel files lawsuit over Biden’s decision to block US Steel acquisition

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

Is AMD Stock a Buy?

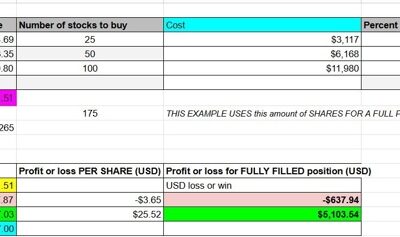

Is AMD Stock a Buy? A Strategic Buy-the-Dip Plan for Swing TradersIf you're asking, "Is AMD stock a buy?", the answer depends on your strategy and market outlook. With AMD's stock price currently sitting at $129.01, it recently dipped to $115.91 during premarket...

Trump aides reportedly exploring tariff plans to only cover critical imports

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

Trump policies may only have limited impact on inflation, says former Fed chair Bernanke

Bernanke said that the policies set out by Trump may not necessarily cause a major shift in inflation dynamics. He argued that:"I agree Trump policies, whatever their merits on public-finance grounds, probably will be modest in terms of their effect on the inflation...

Australian Dollar Futures Today – 0.62600 still waiting

Australian Dollar Futures (6A), March 2025 Contract: Key Levels, Analysis, and Price Prediction for the Australian Dollar Futures MarketCurrent Price: 0.6245Market Overview and Key Dynamics in Australian Dollar FuturesThe Australian dollar futures market, particularly...

Is Bitcoin a Buy or Sell?

Bitcoin Futures (BTC1!) Analysis: Key Levels and Market DynamicsCurrent Price: $99,665 (+0.44%)Resistance and Liquidity Area: $102,000 to $102,500Price Magnet: This area acts as a magnet due to its high liquidity. Many participants and algorithmic strategies are...

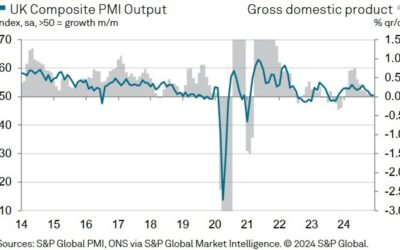

UK December final services PMI 51.1 vs 51.4 prelim

Final Services PMI 51.1 vs 51.4 expected and 50.8 prior.Final Composite PMI 50.4 vs 50.5 expected and 50.5 prior.Key Findings:Employment declines for the third month in a row. Marginal increase in business activity. Input cost inflation accelerates to an eight-month...

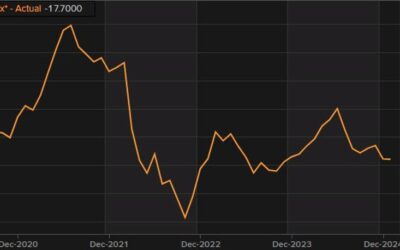

Eurozone January Sentix investor confidence -17.7 vs -18.0 expected

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

Dollar seen mostly lower to start the new week

EUR/USD is trading back up to 1.0365, up 0.5% on the day, and starting to nudge back above its 100-hour moving average of 1.0349. The pair is looking for a second straight day of gains, catching a bounce after a plunge last week to a low of 1.0222. Similarly, GBP/USD...

SNB total sight deposits w.e. 3 January CHF 439.6 bn vs CHF 445.7 bn prior

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

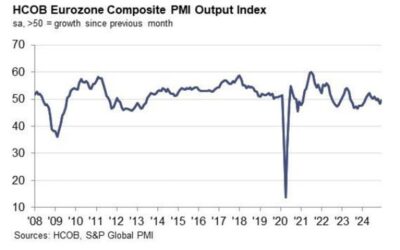

Eurozone December final services PMI 51.6 vs 51.4 prelim

Prior 49.5Composite PMI 49.6 vs 49.5 prelimPrior 48.3The readings are a marginal improvement to the initial estimates but overall, it still marks a slight contraction in euro area business activity in December. A worrying point is that price pressures in the services...

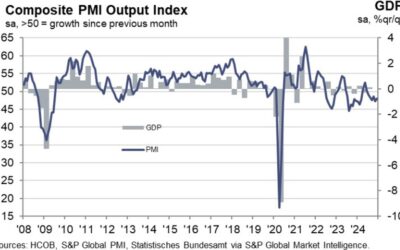

Germany December final services PMI 51.2 vs 51.0 prelim

Final Services PMI 51.2 vs. 51.0 expected and 49.3 prior.Final Composite PMI 48.0 vs. 47.8 expected and 47.2 prior.Key findings:HCOB Germany Services PMI Business Activity Index at 51.2 (Nov: 49.3). 2-month high. HCOB Germany Composite PMI Output Index at 48.0 (Nov:...

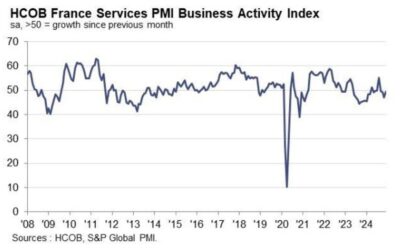

France December final services PMI 49.3 vs 48.2 prelim

Prior 46.9Composite PMI 47.5 vs 46.7 prelimPrior 45.9The revision marks a slight improvement to November but the French economy is still seen contracting for a fourth month running. Weak demand conditions remain the number one culprit, weighing on both output and new...

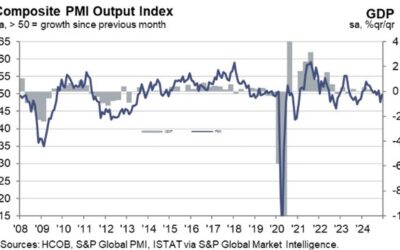

Italy December services PMI 50.7 vs 50.3 expected

Services PMI 50.7 vs. 50.3 expected and 49.2 prior.Composite PMI 49.7 vs. 47.7 prior.Key findings:Renewed, albeit only marginal rise in services activity. Softer decline in new business signalled. Cost and charge inflation pick up.Comment:Commenting on the final PMI...

Gold Technical Analysis – Awaiting the data for the next major move

Fundamental OverviewDespite the spike lower triggered by the last FOMC decision, gold didn’t extend the fall and remained confined in the range between the 2600 support and the 2721 resistance. The FOMC decision was perceived as more hawkish than expected but apart...

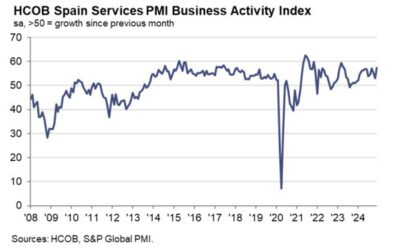

Spain December services PMI 57.3 vs 54.1 expected

Prior 53.1Composite PMI 56.8Prior 53.2This just reaffirms that the Spanish economy remains one of the few bright lights in the euro area, once again shining brightly. Business activity picked up in December, underpinned by a sharp rise in new business. HCOB notes...