Stock heatmap by FinViz.com Mon, 10 Feb 2025 14:46:10 GMTTechnology surges while Tesla stumbles: Navigating today's mixed marketSector Overview: Tech Triumphs, Auto StrugglesToday's stock market heatmap reveals a robust performance in the technology sector, marked by...

US stocks shrug off the weekend tariff news. Look to open higher today.

The major US stock indices are struggling off the weekend US tariff news. Pres. Trump is looking to impose a 25% tariff on all aluminum and steel imports. He is looking to enact reciprocal tariffs on all countries by Tuesday or Wednesday. The markets are getting used...

EURUSD is off low but still bearish. USDJPY is below 100/200D MAs. GBPUSD bearish tilt

EURUSD: The EURUSD gapped marginally lower (in relation to the previous week) as tariff fear continue to increase inflation fears, However, prices rebounded higher only to find resistance sellers within a swing area between 1.0330 and 1.0343. The 38.2% retracement of...

White House advisor Hassett on CNBC: Trump will stop waivers on steel

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

The US session is underway. Yields little changed. Stocks are higher.

The day after....no not the Super Bowl,..the US jobs report which had mostly strong. The Unemployment rate fell to 4%. The number of jobs added was less than expectations but the revisions were higher. However, benchmark revisions were lower for 2024. The earnings...

ForexLive European FX news wrap: Dollar steady as risk shrugs off Trump’s tariff threats

Headlines:Markets:USD leads, JPY lags on the dayEuropean equities higher; S&P 500 futures up 0.4%US 10-year yields up 1 bps to 4.496%Gold up 1.5% to $2,904.46WTI crude up 1.3% to $71.92Bitcoin up 1.1% to $97,592The start to the new week is featuring more of the...

EU’s von der Leyen to meet with US VP Vance on Tuesday

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

USD/JPY up on the day but buyers face a stern technical test

USD/JPY daily chartThe dollar might have surrendered gains elsewhere on the session but USD/JPY is proving to be an exception to that at least for now. The pair is up 0.5% to 152.15 currently and is keeping underpinned in European trading. There's not much of a...

China says will place greater emphasis on boosting consumption

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

EUR/USD futures signal bearish pressure: OrderFlow Intel analysis

Euro traders are closely watching EUR/USD futures (6E), now trading at 1.035 as order flow data reveals a shift in market momentum. While the Euro initially saw bullish attempts, renewed selling pressure has started to take control, raising questions about whether the...

How to Trade Bitcoin Today by TradeCompass

Bitcoin Futures Trade Compass – February 10, 2025Current Price: $98,295Bias: Bullish Above $99,120, Bearish Below $97,850Today's Bitcoin Futures Trade Plan OverviewBitcoin Futures is up 2.4% from Friday’s close, currently trading at $98,295. The Trade Compass today...

Copper Technical Analysis – We are approaching a key resistance zone

Fundamental OverviewLast week, copper had a great performance following the easing in trade war fears. In fact, we tariffs on Canada, Mexico and China weighed on the market initially but as we got the pause in tariffs for Canada and Mexico following positive talks,...

Eurozone February Sentix investor confidence -12.7 vs -16.3 expected

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

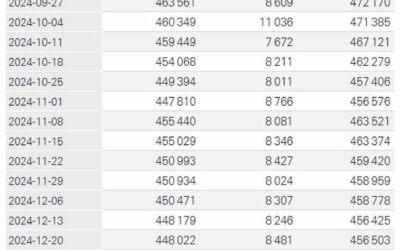

SNB total sight deposits w.e. 7 February CHF 438.1 bn vs CHF 441.9 bn prior

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

Crude Oil Technical Analysis – We are back inside the old range

Fundamental OverviewCrude oil eventually fell below the key 72.00 support zone and kept the bearish trend intact. The bulls will now need to see the price rising back above that level to regain some conviction. The latest moves came from the tariffs fears at the...

Nasdaq Monthly Analysis by Orderflow Intel

The Nasdaq 100 futures (NQ) have been on an impressive five-month bullish run, posting consecutive gains and reaching new highs. However, a closer look at order flow dynamics suggests that momentum may be slowing down, raising the question: Is a pullback on the...

Market Outlook for the Week of 10th – 14th February

Monday starts slow, with no significant economic data scheduled for the FX market. On Tuesday, Australia will release the Westpac Consumer Sentiment and NAB Business Confidence data. Fed Chair Powell is set to testify on the Semi-Annual Monetary Policy Report before...

ECB’s de Guindos: It is very important to avoid a trade war

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

Gold Technical Analysis – Tariffs are back on the menu

Fundamental OverviewGold jumped to yet another all-time high today following renewed tariffs fears. In fact, over the weekend, Trump talked about imposing a 25% tariff on steel and aluminium on all countries on Monday and that he will announce reciprocal tariffs on...

European indices open a little higher to start the week

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...