High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

Reserve Launches Index Protocol; Bloomberg Indices, CoinDesk Indices, and MarketVector

Reserve Index Protocol introduces DTFs, allowing anyone to create, trade, and redeem crypto index products with instant 24/7 access and real-time transparency.Today, ABC Labs, the team behind Reserve, launches their Reserve Index Protocol, which offers a...

USDCAD makes a break higher and moves back above swing area/100 bar MA

. USDCAD: The pair is breaking higher, reclaiming both the 100-bar MA on the 4-hour chart at 1.4279 and a key swing area between 1.4268–1.4278. It has also moved back inside the Red Box range (1.4268–1.4466), which previously contained price swings through December...

US House speaker Johnson opens the door to delaying budget vote

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

AUDUSD dips below swing area support

The AUDUSD is dipping below the 0.6327–0.6336 swing area, which initially served as support in December before shifting to resistance. After breaking above on February 14, this zone has acted as support twice over the past week, including yesterday and today.The...

Dallas Fed service sector index +4.6 vs +7.4 prior

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

Opposing signals from Canada and Mexico around tariff deadline

Earlier today, Mexico's Sheinbaum expressed confidence about a trade deal with the US and she's now doubled down, saying there have been no trade conflicts with US. that could derail a possible deal ahead of tariff deadline next week.Meanwhile, the FT is out with a...

USDJPY moves below the 50% of the move up from September 2024. Sellers make a play

As USDJPY technicalsWeaker U.S. consumer confidence data aligns with last week’s lower Michigan sentiment index, pushing yields and the dollar lower. The two year yield is now down -8.2 basis points at 4.086%. The 10 year yield is down 10 basis points 4.2907%. Recall...

Stops hit as WTI crude oil drops through $70 to the lows of the year

WTI crude oil dailyIt's a tough day for risk assets and it's getting worse following a dismal consumer confidence reading and signs that Congress won't be able to easily pass Trump's tax cut without doing some major spending cuts.Stocks are dropping and yields are...

The House doesn’t has the votes for the budget resolution. Stocks down, yields down

There is a great deal of focus on economic data, geopolitics and AI in markets at the moment but I think the most-important signal is in Congress.House Republicans can only afford to lose two votes to pass anything given the slim majority and they're trying to move...

US Treasury Sec Bessent: US economy is brittle underneath

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

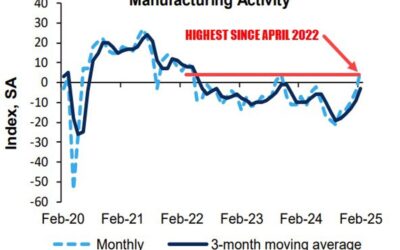

Richmond Fed composite index for February higher at 6 versus -4 last month

Prior month -4Richmond Fed composite index rise to 6 from -4 last month. Best level since April 2022Service index 11 vs 4 last montManufacturing shipments 12 vs -9 last monthPrices paid 2.23 versus 2.37 last monthPrices received 1.62 versus 1.21 last monthEmployment 9...

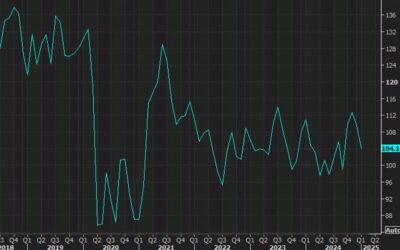

US February consumer confidence 98.3 vs 102.5 expected

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

Nasdaq trading below the 100-day MA

Nasdaq technicalsThe NASDAQ index is moving lower for the fourth consecutive day. The price has moved below its 100 day moving average at 19212.78 in the process. The current price is down -147 points or -0.77% at 19138.56. The move to the downside yesterday and again...

Tech struggles as healthcare and financial sectors show promise

Stock heatmap by FinViz.com Tue, 25 Feb 2025 14:46:07 GMTSector OverviewThe US stock market is showing a patchwork of performance today, with significant movements across various sectors. Technology is facing noticeable declines, with major players like Microsoft...

USDCHF making new lows for 2025, but working toward key support including 100 day MA

The USDCHF is making new lows for the year and trading to the lowest level since December 2023. The break has increased the bearish bias, but in moving lower, the price is approaching a key technical level that traders target. In the video, I speak to that target...

Sheinbaum says she aims to close a tariff deal with the US by next Tuesday

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

Bitcoin breaks lower and below a floor area between $90,742 to $92,092

The price of Bitcoin has broken lower, falling below a key floor in the $90,742–$92,092 swing area, a level dating back to November. A previous dip below this zone on January 13 was short-lived, with a low at $89,164 before a sharp rebound that led to the all-time...

German’s Merz: It is ruled out in the near future that we will reform the debt brake

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

US December CaseShiller 20-city house price index +4.5% y/y vs +4.4% expected

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...