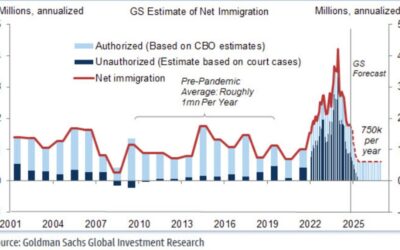

One of the global secular trends unfolding right now is an anti-immigration streak in politics. It's winning elections and that looks set to continue in Germany and Canada in 2025, among elsewhere.For the US, Goldman Sachs notes that net US immigration has already...

US stock exchanges to close on January 9 for Jimmy Carter’s funeral

The New York Stock Exchange and Nasdaq will close on January 9 to observe the national day of morning for former US President Jimmy Carter, who died yesterday.This follows the normal tradition of stock markets closing for the funerals of former Presidents. It came as...

US stocks show slome lift, Europe markets mostly lower to start the week

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

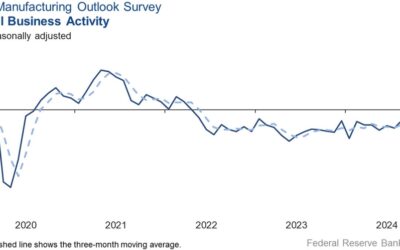

Dallas Fed December manufacturing business index +3.4 vs -2.7 prior

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

SIFMA recommends early bond market close on Jan 9 for Jimmy Carter’s funeral

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

Bitcoin breaks below a key level

It's an ugly day for risk assets and bitcoin is no exception. What I think is happening is that many in markets are anticipating profit taking in high-flying assets early in the new year as that pushes capital gains taxes out until 2026. There is a front-run of that...

US November pending home sales +2.2% vs +0.9% expected

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

Jimmy Carter’s funeral to be held January 9 — markets likely to be closed that day

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

Market struggles: Tech tumbles while energy offers a lifeline

Stock heatmap by FinViz.com Mon, 30 Dec 2024 14:46:04 GMTSector OverviewThe US stock market is experiencing significant turndowns, especially within the tech sector. A pervasive wave of red in the heatmap underscores a day of declines:📉 Technology: Leading the...

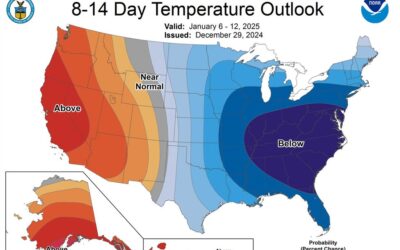

US natural gas prices rise 18% as models show a brutal January cold snap

The polar vortex is pushing south and east in what could be a record-breaking cold snap in parts of the United States.Several models are converging around cold weather in the eastern half of the US in the second week of January. The peak of the cold looks to be around...

GBPUSD retests the 100 hour MA at 1.25425 after swing area above stalled the rally

The GBPUSD moved higher into the US open, but has since reversed lower on risk-off flows (?). Stock in the US are getting hammered in pre-market trading. Admittedly, the declines are not being pushed by any news, except Friday was soft and today, the selling is...

Gold has risen in December for seven straight years — that streak is about to end

Barring a miracle turnaround in the final two trading days of the month, gold will finish lower in December. That's unusual because there has been a strong seasonal tailwind for gold in December forever and it's risen in the month in every year since 2016.Now, it's...

USDJPY tests the rising 100 hour MA in early US trading. Key barometer in the short term

The USDJPY is trading in a modest range today at 59 pips vs the 22 day average (about a month of trading) at 139 pips. The price high came in at 158.064. That was just short of the high price from last week at 158.080. Sellers leaned and pushed the price mostly lower....

EURUSD trading the technical levels

The EURUSD is trading the key technical levels to start the trading week.The initial move in the early European session saw the price moved down to test its 100 hour moving average (blue line on the hourly chart above). Buyers leaned against the level and pushed the...

Pending home sales highlight a light US economic calendar

Happy Monday in a stunted week that will be the final one of 2024 and the first one of 2025.It's the final full trading day of the year and it's been quiet so far in FX. That's not the case in equities where S&P 500 futures are down nearly 1%.It's all about...

What is moving the markets? Where are the markets moving?

The new week is underway and it will be dissected on Wednesday by New Years Day holiday on January 1. The US stock market will have a full day on New Years Eve (closing at 4 PM ET), but the US bond market will close early at 2 PM ET to start the festivities. Some...

Meet the Power Players of FOMC 2025: Their Next Moves Could Make or Break Your Portfolio

FOMC 2025: The Key Players and Hidden Signals Every Investor Needs to KnowAs the Federal Reserve prepares for a critical year of decision-making, the 2025 Federal Open Market Committee (FOMC) lineup has the potential to shape markets in significant ways. A mix of...

If there’s one word that we might be hearing a lot in 2025, this might be it

Well, you definitely won't hear central bankers admitting or acknowledging it. However, you'll most certainly hear plenty of whispers or even loud conversations in the background on this.The UK looks to be leading the stagflation charge but there are other major...

SNB total sight deposits w.e. 27 December CHF 445.7 bn vs CHF 456.5 bn prior

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

Bitcoin analysis shows bears still in control but these liquidation price levels coming…

In this bitcoin analysis on the Binance BTCUSDT 4 hourly chart on Binance, we delve into the current bearish trend in Bitcoin prices and explore the conditions necessary for a bullish reversal. This update focuses on the significant pitchfork patterns and key price...