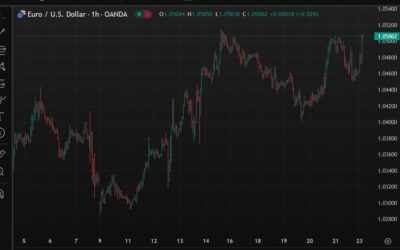

EUR/USD had been struggling to secure a firm break above 1.0500 since last month but may be looking at that now. The chart is certainly getting very interesting as we digest the results of the German election over the weekend.EUR/USD daily chartThere's no major upset...

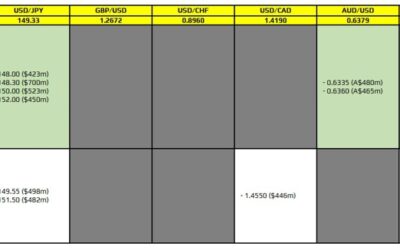

FX option expiries for 24 February 10am New York cut

There are a couple to take note of on the day, as highlighted in bold.They are for EUR/USD at the 1.0500 and 1.0525 levels. The euro is underpinned after the German election results over the weekend. The result sees Friedrich Merz's CDU/CSU alliance take charge, with...

ECB’s Wunsch warns of risk of “sleepwalking” into too many rate cuts

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

Capital Economics says USD/JPY expected to reach 145 by year-end 2025

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

Bank of Canada Deputy Governor Gravelle speaking Monday

1315 GMT / 0815 US Eastern time:Panel discussion by Toni Gravelle, Bank of Canada Deputy Governor at the Bank of England Annual Research Conference:Topic is Managing the Central Bank’s Balance Sheet in a Period of Quantitative TighteningI'm not sure we'll be getting...

Trump will be speaking at 2pm US Eastern time on Monday 24 February 2025

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

ForexLive Asia-Pacific FX news wrap: EUR/USD gain on German election, broader USD weakness

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

Bank of England speakers Monday: Deputy Governors Lombardelli & Ramsden plus Dhingra

The times below are in GMT/US Eastern time format:0900/0400 Bank of England Deputy Governor Clare Lombardelli gives opening remarks at BoE research conferenceLombardelli was the OECD's Chief Economist and G20 Finance Deputy since May 2023 was appointed Deputy Governor...

China developers are buying land at up to a 20% premium – dipping a toe back in the market

China’s state-backed developers are ramping up land acquisitions at a premium, following government easing of home price restrictions to revive the struggling property market.So far in 2025, 37% of land deals have been sold at 20% or more above asking price, compared...

New Zealand data – January credit card spending +1.3% y/y (prior -1.3%)

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

Goldman Sachs stays bullish on China’s A-Shares and H-Shares

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

UBS forecasts AI stock volatility but still overall strong returns

UBS predicts mid-teen returns for global AI stocks in 2025, driven by strong investment commitments and rising monetization trends, despite potential market volatility from tariffs and export controls.The forecast follows China’s DeepSeek AI launch, which raised...

Updating the USD ‘battle of the trendlines’

I posted last month on what appeared, to me, to be the end of the US dollar uptrend:One of the traps that some folks fall into is that if an uptrend breaks then we must be in a downtrend. Don't ask me how I know this trap ;-)In that post a month ago I cautioned...

COSCO shares slump 8% on Trump’s fee proposal

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

PBOC sets USD/ CNY reference rate for today at 7.1717 (vs. estimate at 7.2495)

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

EUR/USD back above 1.05 – euro catching a bid from German election results

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

USD/JPY back under 149.00

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

[2025년, 실업급여 이렇게 바뀐다!! 최대 1782만원! 최대 50% 깎일수도#실업급여#고용노동부#재취업수당#3.1경제독립tv

https://www.youtube.com/watch?v=7KrqvyxRZTs [2025년, 실업급여 이렇게 바뀐다!! 최대 1782만원! 최대 50% 깎일수도#실업급여#고용노동부#재취업수당#3.1경제독립tv [3년뒤 10억부자 3.1경제독립tv필독 추천영상] [1]정기예금 꼭~이렇게 가입하세요~ 이자 40만원~100만원! 더 받아요! https://youtu.be/6U8BR4kcPAo [2]통장에 이 돈 당장 빼세요! 만65세, 기초연금탈락! 통장에 얼마 있으면 못받나?...

China to deepen rural reforms further, move to accelerate rural revitalization

China releaesed its "No. 1 central document" for 2025 on Sunday.This is the first policy statement released by China's central authorities each year, and is viewed as an indicator of policy priorities.It outlines strategies to deepen rural reforms and drive...

PBOC is expected to set the USD/CNY reference rate at 7.2495 – Reuters estimate

People's Bank of China USD/CNY reference rate is due around 0115 GMT.The People's Bank of China (PBOC), China's central bank, is responsible for setting the daily midpoint of the yuan (also known as renminbi or RMB). The PBOC follows a managed floating exchange rate...