High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

PBOC sets USD/ CNY reference rate for today at 7.1693 (vs. estimate at 7.2661)

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

BoJ likely to raise ratees higher than most expects says former official Hideo Hayakawa

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

New Zealand data – ANZ World Commodity Price Index +1.8% m/m in January (prior +0.1%)

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

Japan January services PMI 53.0 (prior 50.9)

Japan January services PMI 53.0prior 50.9flash was 52.7grew for the third consecutive month Composite PMI 51.1 in Januaryflash 51.1strongest growth since Septemberprior 50.5includes both manufacturing and servicesJapan's service sector grew, driven by strong Asian...

Fed’s Jefferson says there is no need to hurry further rate cuts

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

ANZ says NZ jobs data don’t stand in the way of RBNZ 50bp cut at meeting on 19 February

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

PBOC is expected to set the USD/CNY reference rate at 7.2661 – Reuters estimate

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

Trump says tomorrow more hostages will be released

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

Trump says US ‘will take over the Gaza Strip’

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

[3월부터 내통장 이렇게 싹다 바뀝니다! 모르면 나만손해! 꼭 확인하세요]#3.1경제독립tv

https://www.youtube.com/watch?v=DoBz3E2i7dw [3월부터 내통장 이렇게 싹다 바뀝니다! 모르면 나만손해! 꼭 확인하세요]#3.1경제독립tv [3년뒤 10억부자 3.1경제독립tv필독추천영상] [1]정기예금 꼭~이렇게 가입하세요~ 이자 40만원~100만원! 더 받아요! https://youtu.be/6U8BR4kcPAo [2]통장에 이 돈 당장 빼세요! 만65세, 기초연금탈락! 통장에 얼마 있으면 못받나?...

Japan headline wages +4.8% y/y in December, real wages rise also

Japan Overall Labour Cash Earnings for December 2024 have recorded a solid +4.8% y/yexpected was +3.6%, prior +3.0%YOvertime Pay +1.3%y/y, this is viewed as a barometer of business strengthprior +1.4%Wages adjusted for inflation are higher, +0.6% y/y, on bonus...

More on the New Zealand jobs data – unemployment hitting a 4 year high

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

More on Goldman Sachs – China retaliatory measures to have limited impact on energy prices

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

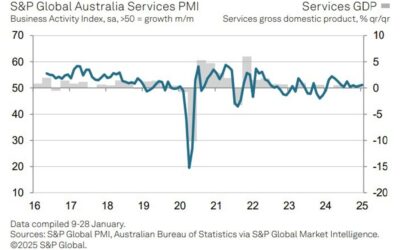

Australian (final) January Services PMI 51.2 (prior 50.8)

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

Goldman Sachs – China trade war retaliation measures to have a limited energy price impact

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

Japan’s Honda and Nissan may call off merger talks

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

New Zealand Q4 unemployment rate 5.1% (vs. 5.1% expected and 4.8% in Q3

New Zealand Q4 jobs data The jump in the unemployment rate is bad news, though not unexpected. It hit its highest in 4 years. As I said earlier, the impacts of the sustained Reserve Bank of New Zealand rate hike cycle is still impacting, despite the easing cycle...

Oil – private survey of inventory shows a headline crude oil build larger than expected

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

Forexlive Americas FX news wrap: US dollar slumps as the trade war dust settles

Markets:Gold up $29 to fresh record at $2842S&P 500 up 0.7%WTI crude down 62-cents to $72.52US 10-year yields down 2.8 bps to 4.51%CAD leads, USD lagsThe news flow on Tuesday was much slower than a day earlier but the market direction picked up from where we left...

![[3월부터 내통장 이렇게 싹다 바뀝니다! 모르면 나만손해! 꼭 확인하세요]#3.1경제독립tv](https://my.blogtop10.com/wp-content/uploads/2025/02/3ec9b94ebb680ed84b0-eb82b4ed86b5ec9ea5-ec9db4eba087eab28c-ec8bb9eb8ba4-ebb094eb809deb8b88eb8ba4-ebaaa8eba5b4eba9b4-eb8298eba78cec8690-400x250.jpg)