Yesterday the NASDAQ index and the Russell 2000 low the way to the downside with declines of -1.25%. Today those declines were reversed. A snapshot of the closing levels shows:Dow industrial average rose by 134.13 points or 0.30% at 44556.04 S&P index rose 43.30...

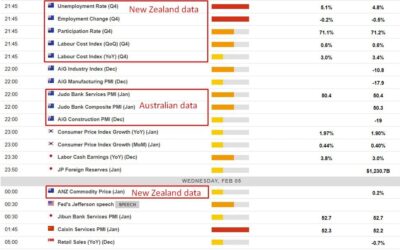

Economic calendar in Asia 05 February 2025 – NZ jobs data, China services PMI

New Zealand is still feeling the impact of the long rate hike cycle from the Reserve Bank of New Zealand, even though the Bank began cutting last year. The unemployment rate is expected to rise. From China we'll get the second of the service PMIs for January. We've...

Trade ideas thread – Wednesday, 5 February, insightful charts, technical analysis, ideas

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

Zelensky: We are ready for diplomatic track to end the war

This sounds like the beginning of the end, as Zelensky says they're ready for the diplomatic track to end the war and ready to talk to Putin if necessary. He said Europe must be present at negotiations.I don't believe he's said this kind of thing before. Previously...

What a run for gold to start the year

Gold is posting another strong day in what's been a nearly non-stop rally to start the year. It's up $27 to a new record at $2841.All the trade uncertainty has been a big tailwind for gold, which started the year at $2621. That's an 8% rally barely a month into the...

Alphabet (Google) reports after the close

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

David Sacks: The feasibility of a bitcoin reserve is being studied

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

GBPUSD extends to the topside target area and above the 50% midpoint. Buyers in control

Early in the U.S. session, the price hovered around the 100- and 200-hour MAs, reflecting a choppy market awaiting direction. That push finally came from buyers, driven by easing tariff concerns, lower yields, and weaker U.S. data (JOLTS showed a decline in job...

Trump says his memo on Iran is “very tough”, hopefully won’t have to use it

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

US crypto czar David Sacks made no comment on crypto reserve

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

Morgan Stanley now sees just one Fed cut this year

Morgan Stanley economists no longer expect a Fed cut in March, according to the WSJ. They now expect only one rate cut this year, in June. "Imposing tariffs more quickly than we assumed would likely mean disinflation halts at a higher pace of inflation, blocking any...

Fed’s Daly: The economy is in a very good place

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

Is the tide finally turning on EU over-regulation?

Investing in Europe has been a disaster for the past 15 years as it misses every wave of growth and technology development. I sense a vibe shift in the entire world around regulation, slow-moving construction, nimby-ism and tokenism. One of the few successes in the EU...

Goldman Sachs: GBP strategy ahead of the February BOE meeting

GBPUSD dailyThe BoE's upcoming decision presents a complex backdrop for GBP, given the mixed economic data. While a 25bp cut is well-priced, the focus will be on the Bank's tone and projections. Goldman Sachs expects gradual GBP weakness rather than an immediate sharp...

Gold price hits new record high; technical indicators guide traders

The price of gold is once again making a new all-time high. The current price is trading at $2843.96. The high price extended to $2845.48. Technically, the rise today has been able to extend above a topside trendline. That level currently comes in at $2839.79. The...

Bitcoin Price Prediction by TradeCompass

Bitcoin Futures Key Levels & Trade StrategyAt the time of this analysis, Bitcoin Futures is trading at 99,750. The market structure presents a tight value area, reflecting a consolidated trading session.POC (Point of Control): 99,995, aligning closely with the...

USDCAD nears critical support level in trading range

USDCAD technicalsThe USDCAD has fallen toward key swing area support and the lower boundary of the "Red Box" that has defined most of the trading range since December 17. Adminttedly, there was a brief volatility break around the inauguration in January, but those...

WSJ: Pres Trump and China Pres. Xi are not speaking today

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

EURUSD has stretched to new highs and in the process moved above key technical targets

The EURUSD is extending to new highs in the U.S. session as European traders wrap up for the day. The pair has pushed above key resistance levels, including the swing area between 1.03329 and 1.0343, the 100-hour moving average at 1.03539, and the 50% retracement of...

European equity close: Spain, Italy and France lead with strong gains

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...