The dollar is sitting over 1% higher against most major currencies to start the day as Trump duly delivered on his tariffs threat against Canada and Mexico. The additional 10% tariffs on China feels like a separate discussion at this stage as it sits in a different...

Wall Street Journal reports China promises not to devalue the yuan

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

There is an OPEC+ (JMMC) meeting scheduled for today, to review current market conditions

OPEC is set to hold its Joint OPEC/non-OPEC Ministerial Monitoring Committee (JMMC) meeting today to review current market conditions. No recommendations for broader policy changes are anticipated. Under the existing agreement, voluntary production cuts will continue...

ForexLive Asia-Pacific FX news wrap: Trump tariff war triggers USD surge, ‘risk’ slump

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

Federal Reserve speakers on Monday include Bostic and Musalem

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

[속보]테슬라+비트코인 트럼프발 충격! 어디까지 떨어지나? 여기까지 견디면 충격 대반전 온다!]#3.1경제독립tv

https://www.youtube.com/watch?v=lnX4TqOZZ1s [속보]테슬라+비트코인 트럼프발 충격! 어디까지 떨어지나? 여기까지 견디면 충격 대반전 온다!]#3.1경제독립tv [3년뒤 10억부자 3.1경제독립tv필독추천영상] [1]정기예금 꼭~이렇게 가입하세요~ 이자 40만원~100만원! 더 받아요! https://youtu.be/6U8BR4kcPAo [2]통장에 이 돈 당장 빼세요! 만65세, 기초연금탈락! 통장에 얼마 있으면 못받나?...

JP Morgan on Trump tariffs – reinforce their bullish view on gold

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

Persistent Trump tariffs mean a minus 5% hit to Canada’s economy, Mexico -8%, US -1%

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

AUD/USD dipped under 0.61

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

Ethereum implodes

ETH 10 minsIt's turning into some kind of 'Black Sunday' in the ethereum market.Bitcoin is having a rough one as it's down to $93K but ethereum is absolutely puking, falling 25% in minutes and down by a third from Friday level.So far the September lows are holding.ETH...

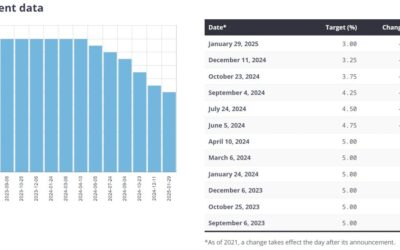

Bank of Canada will implement six consecutive quarter-point interest rate cuts

Bank of Montreal (BMO) has revised its outlook for Canadian interest rates in response to the economic impact of Trump's 25% tariff. BMO now anticipates the Bank of Canada will implement six consecutive quarter-point interest rate cuts, bringing the policy rate down...

Caixin China Manufacturing PMI (January 2025) 50.1 vs. expected 50.5

Caixin China Manufacturing PMI for January 2025:A weak 50.1, but keeps its nose in expansionexpected 50.5prior 50.5This manufacturing PMI comes in better than the official manufacturing PMI:***Posted earlier, but here it is again ICYMI:***The two PMIs are quite...

Goldman Sachs says the medium term risks to oil prices is skewed to the downside

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

AUD/USD falls to to its lowest since early 2020

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

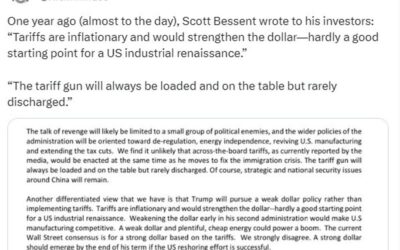

US TreasSec Bessent said tariffs inflationary, not good “for a US industrial renaissance”

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

Australia retail sales December 2024 -0.1%% m/m (expected -0.7%)

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

Australian building permits for December 2024: +0.7% m/m (expected +1.0%)

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

Japan Manufacturing PMI January (final) 48.7 (prior 49.6)

Jibun / S&P Global Manufacturing PMI for Japan in January 2025, the final reading48.7The report on the numbers argues that the PMI results for Japan's manufacturing sector indicate that subdued activity persisted at the start of 2025. Both production and new...

Trump says he’ll speak with Canada’s Trudeau on Monday

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

Australian private survey of inflation, January 2025: +0.1% m/m (prior +0.6%)

Melbourne Institute of Applied Economic & Social Research at the University of Melbourne.Privately surveyed inflation measure, lower in January than in December:+0.1% m/mprior +0.6%+ 2.3% y/yprior +2.6%From the RBA website, the official cash and inflation...

![[속보]테슬라+비트코인 트럼프발 충격! 어디까지 떨어지나? 여기까지 견디면 충격 대반전 온다!]#3.1경제독립tv](https://my.blogtop10.com/wp-content/uploads/2025/02/ec868debb3b4ed858cec8aaceb9dbcebb984ed8ab8ecbd94ec9db8-ed8ab8eb9fbced9484ebb09c-ecb6a9eab2a9-ec96b4eb9494eab98ceca780-eb96a8ec96b4-400x250.jpg)