High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

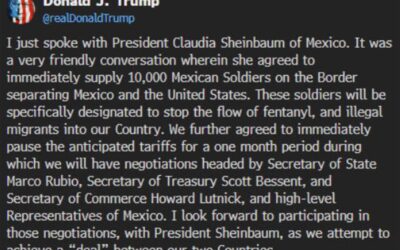

Trump confirms that Mexican tariffs will be paused, says negotiations will start

"I just spoke with President Claudia Sheinbaum of Mexico. It was a very friendly conversation wherein she agreed to immediately supply 10,000 Mexican Soldiers on the Border separating Mexico and the United States. These soldiers will be specifically designated to stop...

White House confirms that Mexican tariffs will be delayed for a month – report

CNBC spoke to the White House and confirmed the Mexican tariffs are delayed for a month.That doesn't include the Canadian tariffs. It suggests that this morning's call between Trump and Trudeau didn't go as well, which you could tell from Trump's post afterwards....

Sheinbaum says had a good conversation with Trump. Tariffs paused for a month

Mexican President Claudia SheinbaumSays they will deploy 10,000 national guard immediately to the border to avoid trafficking drugs to the USSays tariffs will be paused for a month'Good' call with Trump led to some agreementsComments from the White House also suggest...

NZDUSD a big mover today, but off the lows. What next?

The NZD/USD pair is experiencing a significant decline today, down -1.26%, making it one of the biggest movers in the market. The pair opened with a gap lower, breaking below the January low of 0.55398 before extending its drop to 0.55153, just a few pips away from...

Yen increasingly seen as the winner as yields fall, global growth questioned

EUR/JPY dailyThe yen continues to strength as global sovereign yields fall and the market grows increasingly concerned about tariffs.There are still 14 hours until tariffs go into effect on Canada and Mexico and no one is sure what will happen. The fear is that Trump...

White House says negotiations on tariffs are ongoing

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

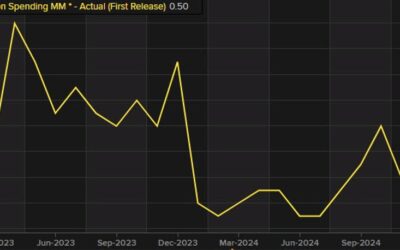

US construction spending for December 0.5% versus 0.2% estimate

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

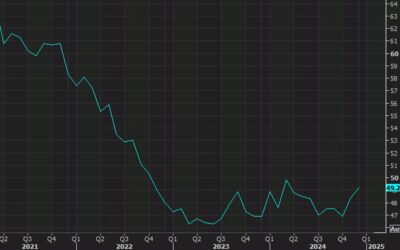

US January ISM manufacturing 50.9 vs 49.8 prior

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

tech struggles: semiconductors falter while healthcare offers stability

Stock heatmap by FinViz.com Mon, 03 Feb 2025 14:46:05 GMTSector OverviewToday's stock market heatmap reveals a pronounced downturn in the technology sector, especially within semiconductors. Nvidia (NVDA) leads the decline, dropping 5.26%, with AVGO and other chipset...

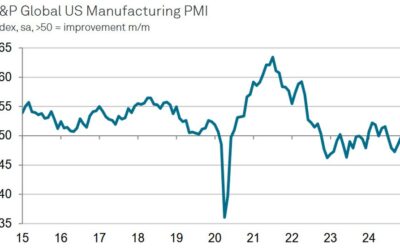

US January final S&P Global manufacturing PMI 51.2 vs 50.1 prior

Prelim was 50.1Prior was 49.4Optimism in the year-ahead outlook for production hit a 34-month highNew export orders nonetheless continued to fall in January,Chris Williamson, Chief Business Economist at S&P Global Market Intelligence “A new year and a new...

Canada January S&P Global manufacturing PMI 51.6 vs 52.2 prior

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

USDCAD runs to a 22-year high on tariff news and backs off. What next technically.

The USDCAD moved sharply higher on the back of the weekend tariff news. That news is fluid, so traders need to be cautious. A solution may be found, sending the USDCAD lower, or there could be an escalation of the trade/drug war. Technically, the price of the USDCAD...

Trump says he just spoke with Trudeau and they will speak again at 3 pm ET

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

Full transcript: What Kevin Hassett said today on CNBC on tariffs

The impression from the interview with White House Director of the National Economic Council today on CNBC was that there is a path to avoiding tariffs scheduled to go into effect on Tuesday. He talked about meetings that will happen today and sounded like someone...

Kickstart the FX trading day (and week) with a technical look at EURUSD, USDJPY and GBPUSD

The video above outlines the technical levels driving the three major currency pairs - the EURUSD, USDJPY and GBPUSD. The USD is higher by over 1% vs the EUR and 0.61% vs the GBP. Against the JPY, the USD is lower (the only currency the USD is lower vs as the market...

OPEC+ JMMC meeting to make no recommendation on oil output – report

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

Hassett: There have been some positive conversations on tariffs

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

WH economic council director says Trump will decide what he will or won’t call off

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

Snap Earnings Analysis by TrendIntel

📊 Data-Driven Decision Support for SNAP Stock Ahead of EarningsSnap Inc. (SNAP) reports Q4 2024 earnings tomorrow after market close. With expectations focused on revenue growth, advertiser demand, and user engagement, our data-backed perspective goes beyond...