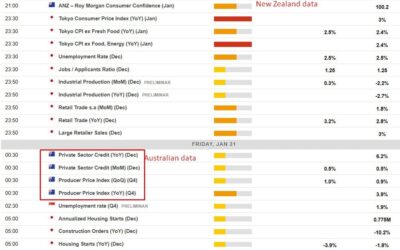

The first item lists, NZ consumer sentiment, has come in at 96.0 in January, a big drop from December. ***Most focus for the session is on Tokyo area CPI data. Tokyo area inflation data is the focus for the session - this might give us a heads up what the Bank of...

Trade ideas thread – Friday, 31 January, insightful charts, technical analysis, ideas

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

Trump says China is going to end up paying a tariff as well

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

Major US indices snap back from tariff news and closes higher

The major US stock indices snapped back from the late-day tariff news on Canada and Mexico and is closing higher on the day .The final numbers are showing:Dow industrial rose 160.61 points or 0.38% at 44882.31S&P index rose 31.86 points or 0.53% at 6071.17.NASDAQ...

Trump hasn’t yet put tariffs on Mexico and Canada but repeats that he will

The initial reports made it sound like he was signing the order at that moment. That's not the case as he was signing some different orders (hence the confusion).He repeated his threat that tariffs would be imposed on Saturday, Feb 1, citing fentanyl and large trade...

Pres. Trump to put 25% tariff on Canada and Mexico The USDCAD spike higher

Pres. Trump says that he will put a 25% tariff on Canada and Mexico citing fentanyl and border security. Trump said that oil would not be a part of the 25% tariff. However, Trump is now saying that they will decide on Thursday night whether to impose tariffs on oil....

US stocks moving higher as the clock ticks toward the close. Apple earnings after close.

The major stock indices are moving higher as the clock ticks toward the close. Dow Industrial average is up 231.10 points or 0.60% at 44985.90S&P is up 37 points or 0.62% at 6077.11Nasdaq is up 78 points or 0.40% at 19711. Russell 2000 is up 34.78 points or 1.52%...

Crude oil settled at $72.73

The price of WTI crude oil futures are selling at $72.73. That is up $0.11 or 0.15%.Looking at the hourly chart below, the price has been trending below its 100 hour moving average (blue line on the chart below) at $73.45 currently. Staying below that level kept the...

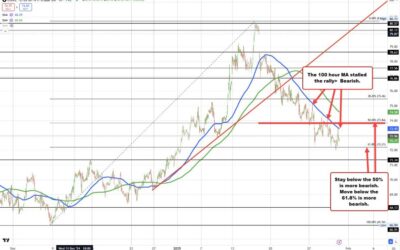

AUDUSD is up and down non-trending over the last few days, but control is with the sellers

The AUD/USD has been choppy and non-trending over the past few days, but the overall control remains with the sellers. The bearish bias stems from the pair breaking below the 200-hour moving average earlier this week and consistently staying below it on both Tuesday...

Despite GDP miss, underlying US growth still around 3% — CIBC

US GDP numbers today showed an expansion of 2.3% q/q annualized in Q4, below consensus expectations of 2.6% and last quarter’s 3.1% increase. That puts annual growth at 2.5%, which is solid and matches the Fed's expectations but it's not blockbuster.The real takeaway...

MUFG: Further JPY outperformance ahead as BOJ signals more rate hikes

Bank of JapanMUFG sees more upside for the JPY as the BoJ continues to deliver hawkish policy signals. Deputy Governor Himino’s speech reinforced expectations of two more rate hikes this year, pushing USD/JPY lower toward 154.00.Key Points:BoJ Hawkish Signals:Himino...

ECB may drop restrictive label on rate stance as soon as March – report

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

European indices cheer ECB rate cut

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

The GBPUSD buyers are back in control in the short term. Can the buyers keep bias control?

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

Trump Do not know what led to the crash

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

USDCHF sellers have pushed pair down to moving average support.Will the buyers come in?

The USD/CHF has moved lower, testing key support near the 200-hour moving average (0.90609) and 100-hour moving average (0.90504). The price has stalled in this area, as traders cautiously lean against these levels as a risk zone.Key Levels to Watch:Support: The...

Gold touches a fresh all-time record at $2791. What’s next

Gold weeklyGeopolitical uncertainty is fuelling a fresh record high in gold. It's up $34 today to $2791, breaking the November high by $1.At the start of December I touted the seasonal trend of strength in gold in Dec-Jan (as I always do). Once again this year it...

ECB sources: Policymakers expect a further cut in March followed by a deeper debate

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

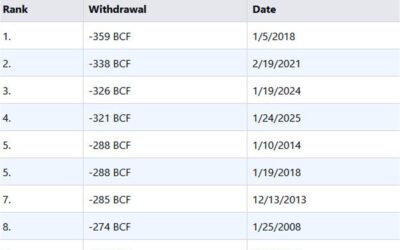

Last week’s 321 BCF US natural gas withdrawal was the fourth-largest ever

There is some angst about natural gas everywhere at the moment. Germany is floating the idea of the resumption of Russian natural gas flows as part of a peace settlement.In the US, a cold January has led to a series of very large natural gas inventory drawdowns....

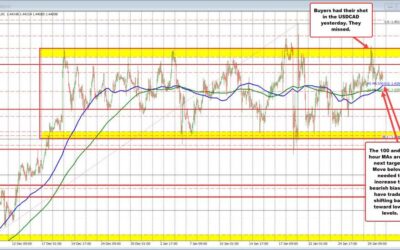

USDCAD buyers had their shot yesterday….they missed. Today, the price rotated toward MAs

The USD/CAD attempted to move higher yesterday following rate decisions by the Bank of Canada and the US Federal Reserve. The price briefly broke above the upper boundary of a key consolidation zone, referred to as the "red box" (see chart), which has defined most of...