Key Concept: For day and swing traders looking to capitalize on Amazon stock earnings volatility, fading an earnings move based on institutional participation and historical liquidity zones presents a high-probability opportunity. This trade plan for Amazon (AMZN)...

easyMarkets Wins ‘Broker of the Year 2024’ and TradingView’s ‘Best of the Best’

easyMarkets a trusted name in trading excellence, is proud to announce that it has been awarded ‘Broker of the Year 2024’ and TradingView’s Best of the Best, marking the company’s second consecutive win, following its Best CFD/Forex Broker 2023 recognition last...

EURUSD Technical Analysis – The greenback stays on the backfoot

Fundamental OverviewThe USD continues to be under pressure as the positive tariffs talks on Monday eased the trade war fears and weighed on the greenback. In fact, trade war fears have been the only thing keeping the bid under the USD as interest rate expectations and...

ECB’s de Guindos: Inflation to start converging to 2% target in the spring

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

European equities keep little changed at the open today

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

China gold reserves seen increasing again to start the new year

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

France December trade balance -€6.6 billion vs -€7.1 billion expected

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

UK January Halifax house prices +0.7% vs +0.2% m/m expected

Prior -0.2%With the increase in January, the average property price in the UK moves up to a new record high of £299,138. Halifax notes that "affordability is still a challenge for many would-be buyers, but the market's resilience is noteworthy". On an annual basis...

Germany December trade balance €20.7 billion vs €17.0 billion expected

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

Germany December industrial production -2.4% vs -0.6% m/m expected

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

A quieter mood ahead of European trading today

Major currencies are little changed so far with the dollar keeping steadier on the day. The greenback caught a breather in trading yesterday, after having dealt with a setback following the opening gap higher on Monday. Tariff fears are receding and that's led to the...

[테슬라 하락충격! 어디까지 떨어지나? 지금 중요한 이유 대반등 시점은 이때 시작된다]#3.1경제독립tv

https://www.youtube.com/watch?v=H3CyI62Lrxo [테슬라 하락충격! 어디까지 떨어지나? 지금 중요한 이유 대반등 시점은 이때 시작된다]#3.1경제독립tv [3년뒤 10억부자 3.1경제독립tv필독추천영상] [1]정기예금 꼭~이렇게 가입하세요~ 이자 40만원~100만원! 더 받아요! https://youtu.be/6U8BR4kcPAo [2]통장에 이 돈 당장 빼세요! 만65세, 기초연금탈락! 통장에 얼마 있으면 못받나?...

US jobs report the main event on the agenda today

Given the backdrop, it will be a placeholder session in European morning trade today. The bond market has already looked to have made up its mind on the week here. And it's now time to look to the US jobs report for vindication.The dollar is still in a vulnerable spot...

The Reserve Bank of India (RBI) cut its key repo rate by 25bp, to 6.25%

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

ForexLive Asia-Pacific FX news wrap: USD/JPY drops under 151.00 (bounces back)

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

There is Chinese inflation data due this weekend – CPI and PPI for January 2025

Data due on Sunday at 0130 GMT, which is 2030 US Eastern time on Saturday is expected to show Chinese inflation (CPI) barely stumbling along above deflationary territory:Deflation—when prices decline over time—can be harmful to an economy for several reasons:Delayed...

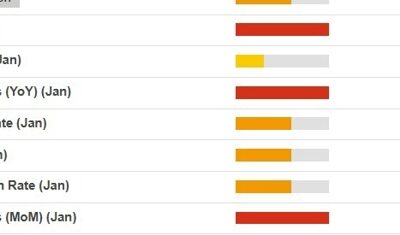

US January 2025 non-farm payrolls data – the critical key ranges for estimates to watch

The January 2025 employment report is due from the US on Friday, February 7, 2025, at 0830 US Eastern time, 1330 GMT. Taking a look at the range of expectations compared to the median consensus (the 'expected' in the screenshot above) for the key data points:Data...

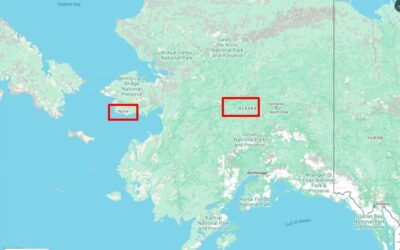

An aircraft with 10 people on board has disappeared from radar in the USA

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

Japanese Prime Minister Ishiba will meet with Trump – press conference Friday

Much of this 'summit' will be spent on regional security issues of importance to Japan and the US:North KoreaTaiwanfor example.On economic issues, there will be discussion on:collaboration on technologies, such as artificial intelligence and semiconductorsJapan's...

Nissan Seeks New Partnerships After Honda Merger Talks Fail

Nissan is exploring new partnership opportunities following the collapse of merger discussions with Honda, with Taiwan’s Foxconn emerging as a potential candidate. The automaker walked away from talks after Honda proposed making Nissan a subsidiary—a move CEO Makoto...

![[테슬라 하락충격! 어디까지 떨어지나? 지금 중요한 이유 대반등 시점은 이때 시작된다]#3.1경제독립tv](https://my.blogtop10.com/wp-content/uploads/2025/02/ed858cec8aaceb9dbc-ed9598eb9dbdecb6a9eab2a9-ec96b4eb9494eab98ceca780-eb96a8ec96b4eca780eb8298-eca780eab888-eca491ec9a94ed959c-ec9db4-400x250.jpg)