TradeCompass for Canadian Dollar Futures (6C - March 2025 Contract) | January 24, 2025Canadian Dollar Futures Analysis and Price PredictionsAt the time of this analysis, Canadian Dollar Futures (ticker: 6C) are trading at 0.69825, just below key thresholds that could...

ForexLive European FX news wrap: Risk aversion holds as DeepSeek triggers tech selloff

Headlines:Markets:JPY leads, NZD lags on the dayEuropean equities lower; S&P 500 futures down 2.2%US 10-year yields down 9 bps to 4.522%Gold down 0.4% to $2,760.93WTI crude down 0.4% to $74.23Bitcoin down 3.5% to $98,988It's a rare risk-off day in markets on a...

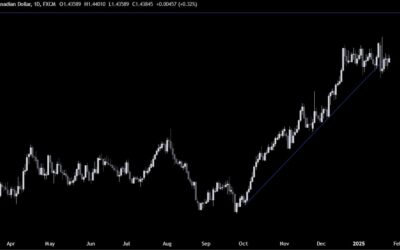

USDCAD Technical Analysis – The focus remains on the tariffs

Fundamental OverviewThe USD opened higher today and continued to dominate throughout the Asian session as we got once again some tariffs headlines that weighed on the risk sentiment. In fact, late yesterday Trump announced that he will impose 25% tariffs and sanctions...

The rout continues with S&P 500 futures down over 2% now

Tech shares are the main drag with Nvidia itself down some 11% in pre-market trading. A lot of attention is put on DeepSeek and Adam had the early scoop last week already here: China's DeepSeek may have just upended the economics of AIThat's leading to a broader...

NVIDIA Stock Price Prediction (and a Contrarian Swing Long Coming Soon)

TradeCompass for NVIDIA Stock: Contrarian Long Opportunity Amid Pre-Market DeclineAt the time of this analysis, NVIDIA (NVDA) is trading at $128.40, down nearly 10% in pre-market from Friday’s close. This presents an intriguing contrarian long opportunity for swing...

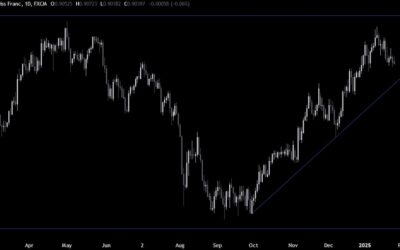

USDCHF Technical Analysis – Tariffs headlines keep the volatility high

Fundamental OverviewThe USD opened higher today and continued to dominate throughout the Asian session as we got once again some tariffs headlines that weighed on the risk sentiment. In fact, late yesterday Trump announced that he will impose 25% tariffs and sanctions...

USD/JPY threatens firmer break under 155.00 on safety flows

USD/JPY hourly chartAt the end of last week, the 155.00 level proved to be the key for buyers in keeping the pair afloat. But amid the risk-off mood in markets today, we're seeing sellers finally making a case for a downside break. The pair has struggled in the past...

China promises to take back illegal migrants after Trump threats

Bloomberg reports that China pledged to accept the return of undocumented Chinese citizens in the US, after President Donald Trump threatened to hit Colombia with tariffs for refusing to take back deported migrants.“China will receive people who are confirmed as...

SNB total sight deposits w.e. 24 January CHF 441.3 bn vs CHF 445.3 bn prior

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

Germany January Ifo business climate index 85.1 vs 84.7 expected

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

Morgan Stanley cuts UK 2025 GDP growth forecast to 0.9% from 1.3% previously

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

USDJPY Technical Analysis – We got stuck in a range

Fundamental OverviewThe USD opened higher today and continued to dominate throughout the Asian session as we got once again some tariffs headlines that weighed on the risk sentiment. In fact, late yesterday Trump announced that he will impose 25% tariffs and sanctions...

ECB’s Lagarde: Central bank independence in question in several parts of the world

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

European indices see red at the open amid broader market selloff

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

Bitcoin dips back under $100,000 on risk selloff

Chipmakers have been the new poster boy for stocks this past year and they are being smashed to start the new week. That is leading to a broader risk rout with cryptocurrencies also feeling the pinch. People are pointing the finger to DeepSeek, a Chinese AI startup,...

Crypto and Stock Market Sell-Off

Crypto and Stock Market Update: Crypto Sell-Off and Nasdaq WeaknessThe cryptocurrency market and Nasdaq futures are experiencing sharp declines, reflecting heightened risk-off sentiment in global markets. Cryptocurrencies like Bitcoin (BTCUSD) and Ethereum (ETHUSD)...

Market Outlook for the Week of 27th – 31st January

On Monday, the U.S. will release the new home sales data. On Tuesday, Japan will publish the BoJ core CPI y/y, while in the U.S., durable goods orders m/m, the CB consumer confidence index, and the Richmond manufacturing index will be released. On Wednesday, Japan...

Central banks to dominate the agenda in trading this week

The agenda points to a big week in markets with key central bank policy decisions lined up. But all in all, it may play out rather straightforward. The Fed is set to keep interest rates unchanged while the ECB and BOC are set to cut by 25 bps each respectively. And...

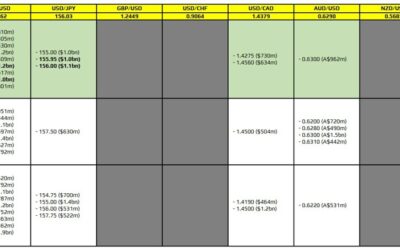

FX option expiries for 27 January 10am New York cut

There are a couple to take note of, as highlighted in bold.The first ones are for EUR/USD at the 1.0440 and 1.0460 levels. These don't hold much of any technical significance, with notable resistance still seen closer to 1.0500 alongside offers at the figure level....

ForexLive Asia-Pacific FX news wrap: A bad news / good news day

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...