The USD is moving up and down as Trump addresses the Davos World Economic Forum. Trump spoke of bringing the price of oil down. He spoke about interest rates coming down. That seemed to help to weaken the dollar. IN the US debt market, the yield curve steepened with...

EIA weekly US crude oil inventories -1017K vs -1645K

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

EIA weekly US crude oil inventories -1017K vs -1645K

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

Oil and the US dollar fall on Trump’s Davos comments

GBP/USD 10 minsThe US dollar declined modestly across the board during Trump's appearance in Davos after initially rallying.Trump talked about tariffs across the board as a way to raise money for tax cuts. On the initial talk of tariffs, the US dollar briefly jumped...

Oil and the US dollar fall on Trump’s Davos comments

GBP/USD 10 minsThe US dollar declined modestly across the board during Trump's appearance in Davos after initially rallying.Trump talked about tariffs across the board as a way to raise money for tax cuts. On the initial talk of tariffs, the US dollar briefly jumped...

Highlights: Trump’s speech from Davos as he comments on crypto and tariffs

Repeats talking points about a 'golden age' and 'revolution of common sense'Biden totally lost controlTotal gov't spending is $1.5 trillion higher than projected when I left office"It was the highest inflation in the history of our country"I terminated the "green new...

Watch live: Trump addresses World Economic Forum in Davos

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

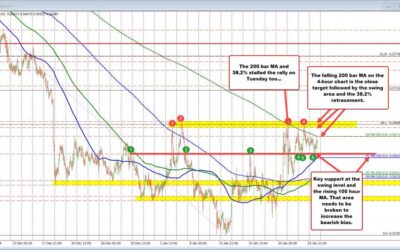

The NZDUSD stalled the rise yesterday at the 38.2% retracement and today at a falling MA.

The NZD/USD stalled its rise yesterday at the 38.2% retracement level (0.5688) of the decline from the November 29 high. This level also aligns with a key swing area between 0.56837 and 0.56917. Sellers capitalized on this resistance, pushing the price lower into the...

EC Markets Reflects on Award-Winning Success at iFX EXPO Dubai 2025

EC Markets is delighted to reflect on its resounding success at iFX EXPO Dubai 2025, an event that brought together the global trading and fintech community for three days of innovation, collaboration, and knowledge-sharing. As an elite sponsor of this prestigious...

Retail sales show that lower interest rates are working to boost consumer spending – CIBC

Canadian retail sales painting a mixed picture in today's report with November disappointing but the advance December numbers showing a strong climb.After a flat reading in November, the advanced December reading was up 1.6%."That still suggests a healthy pace of...

Bitcoin spikes higher on “Big things are coming” comment from influential Senator.

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

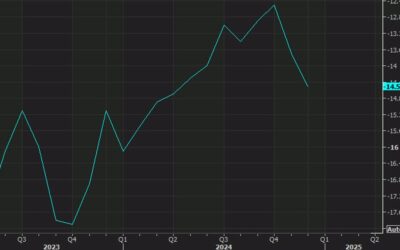

Eurozone January flash consumer confidence -14.2 vs -14.2 expected

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

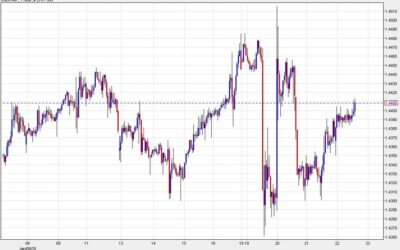

The USDCHF tested the 100 hour MA for the 2nd time this week and found willing sellers

The USDCHF moved higher in the European/early US session and in the process tested the falling 100 hour MA (blue line currently at 0.90869). That was the 2nd test of the MA this week. On Tuesday, the price also moved to that moving average, and found willing sellers....

Energy stocks fuel market gains as tech struggles

Stock heatmap by FinViz.com Thu, 23 Jan 2025 14:46:14 GMTSector OverviewThe stock market today presents a fascinating dichotomy between the flourishing energy sector and the struggling technology stocks. The heatmap reveals energy giants like Exxon Mobil (XOM) surging...

Alcoa highlights resilient aluminum demand in a good sign for the global economy

Shares of Alcoa are down 1.3% in the pre-market following earnings, largely due to execution challenges but the company paints an solid global demand picture for the industrial economy.Revenues rose 34.3% in the year so some strength is backward looking but going...

The USDCAD remains in its up and down range, but with a modest bullish tilt

IN Adam posts "Why the Canadian dollar will continue to ignore the economic data" and he brings up some key points. In my video above, I complement the post, with a technical look at the USDCAD. Yesterday, the price fell to test the low of the Red Box (and lower swing...

Gold Analysis for Today

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

Why the Canadian dollar will continue to ignore economic data

USDCAD 1 hourUSD/CAD reached a session high at 1.4408 shortly before the release of Canadian retail sales but has been largely unmoved since. Canadian economic data is quickly falling to the backburner in terms of market-moving impact for two reasons:1) Tariff...

Canada November retail sales 0.0% vs +0.2% expected

Prelim November estimate was unchangedOctober sales were +0.6%Retail sales ex-autos -0.7% vs +0.1% expectedPrior ex-autos were +0.1% (revised to -0.1%)Core sales -1.0%December advanced sales +1.6%The December number is important here as it shows a big rebound. Canada...

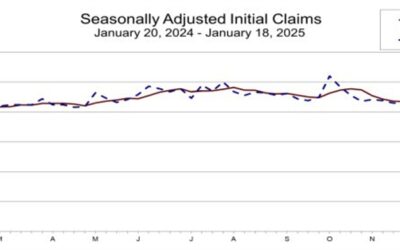

US initial jobless claims 223K vs 220K estimate

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...