High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

More on Trump saying he would rather not use tariffs against China

Trump spoke in an interview with Fox, referring to his phone conversation with Chinese President Xi Jinping:"It went fine. It was a good, friendly conversation" "I can do that," Trump said in the interview when asked if he could make a deal with China over fair trade...

European Central Bank President Lagarde is speaking on Friday

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

The USD has slumped after Trump said prefer no tariff on China – AUD hits 5 week high

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

Trump says would rather not have to use tariffs on China

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

The BoJ is expected to raise rates today – here is when to expect the Statement

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

North Korea may be responsible for breach of the Phemex crypto exchange, US$70mn losses

North Korean hackers may be responsible for the multi-million-dollar breach of the Phemex crypto exchange, according to several blockchain security experts. The Singapore-based platform was hacked on Thursday, resulting in losses exceeding $70 million across multiple...

[테슬라 2월부터~판매가격 대폭인상! 주가 폭등할까? 트럼프 깜짝 발표!!]#재테크#해외주식투자#테슬라#비트코인#3.1경제독립tv

https://www.youtube.com/watch?v=N0J6gDUB-5w [테슬라 2월부터~판매가격 대폭인상! 주가 폭등할까? 트럼프 깜짝 발표!!]#재테크#해외주식투자#테슬라#비트코인#3.1경제독립tv *본 채널은 투자에 대한 조언을 드리지만, 투자는 전적으로 본인의 판단하에 진행하고, 투자에 대한 책임도 전적으로 본인에게 있다는 점을 명심하셔야 합니다 [3년뒤 10억부자 3.1경제독립tv필독추천영상] [1]정기예금 꼭~이렇게 가입하세요~ 이자 40만원~100만원! 더...

PBOC injects 200bn yuan vs. 795bn maturing (Medium-term Lending Facility (MLF) net drain)

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

Singapore’s central bank eased monetary policy for the first time since 2020 – recap

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

PBOC sets USD/ CNY reference rate for today at 7.1705 (vs. estimate at 7.2779)

The People's Bank of China (PBOC), China's central bank, is responsible for setting the daily midpoint of the yuan (also known as renminbi or RMB). The PBOC follows a managed floating exchange rate system that allows the value of the yuan to fluctuate within a certain...

Oil prices slipping further

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

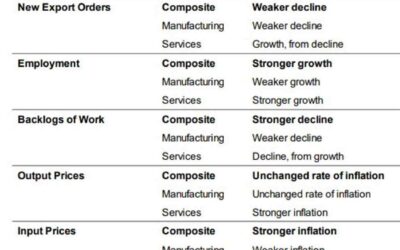

Japan flash manufacturing PMI for January drops to 48.8 (prior 49.6)

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

UK data – GfK Consumer Confidence dropped to its lowest level in over a year

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

PBOC is expected to set the USD/CNY reference rate at 7.2779 – Reuters estimate

People's Bank of China USD/CNY reference rate is due around 0115 GMT.The People's Bank of China (PBOC), China's central bank, is responsible for setting the daily midpoint of the yuan (also known as renminbi or RMB). The PBOC follows a managed floating exchange rate...

Monetary Authority of Singapore will slightly reduce the slope of the S$NEER policy band

Monetary Authority of Singapore is Singapore's central bank. Policy decision statement today, in brief:MAS says no change to the width of the policy band or the level at which it is centred.MAS says it will reduce slightly the slope of the S$NEER policy band.MAS says...

Shanghai plans to bypass China’s tight firewall – trying to attract foreign investment

Hong Kong's South China Morning Post reports that Shangai is considering plans to bypass China's 'Great Firewall'. As part of efforts to attract more foreign investment. *** China's Great Firewall is a state-controlled internet censorship and surveillance system that...

Japan December headline CPI +3.6% (expected +3.4%, prior 2.9%)

Japan inflation data for December 2024, all figures are y/y.Headline overall inflation rate 3.6%Expected 3.4%, prior 2.9%Core Inflation Rate 3.0%Expected 3%, prior 2.7%Inflation Ex-Food and Energy 2.4% prior 2.4%If anyone at the Bank of Japan was waiting to see this...

South Korea closely tracking U.S. administration, global financial markets

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

Ivanka Trump warns of fake cryptocurrency token using her name: ‘$IVANKA’

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

![[테슬라 2월부터~판매가격 대폭인상! 주가 폭등할까? 트럼프 깜짝 발표!!]#재테크#해외주식투자#테슬라#비트코인#3.1경제독립tv](https://my.blogtop10.com/wp-content/uploads/2025/01/ed858cec8aaceb9dbc-2ec9b94ebb680ed84b0ed8c90eba7a4eab080eab2a9-eb8c80ed8fadec9db8ec8381-eca3bceab080-ed8fadeb93b1ed95a0eab98c-ed8ab8-400x250.jpg)