High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

ICYMI – ECB’s Nagel says confident of hitting 2% inflation by mid-year

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

TradeCompass for Bitcoin Futures (Valid for January 22 and 23, 2025)

This TradeCompass provides a comprehensive roadmap for Bitcoin Futures trading, covering both bullish and bearish setups for January 22 and January 23, 2025. Designed for traders seeking disciplined strategies and actionable insights, it includes critical price...

Has the US dollar topped, or is it just resting? Battle of the trend lines.

The steep up trend line for the USD appears to have been broken. The caveat, for me, is the approach to that horizontal one:I am sure readers of ForexLive can do better than me, let me know in the comments!FWIW I am suspecting that while the steep uptrend is over,...

China to boost long-term funds for equity markets

China has introduced several measures to stabilize its stock markets, including allowing pension funds to increase investments in domestic equities. Chinese state carried the report ICYMI.In summary:A directive from the central government, released by the China...

Forexlive Americas FX news wrap 22 Jan.. The USD rises with higher yields. Stocks higher.

it was a quieter day in the US after a couple of days of Trump fireworks. The economic calendar was light with leading indicators falling again after rising for the first time since February 2024. Prior to that rise the index hadn't had a positive number since March...

S&P cannot close at a new high. New intraday high reached.

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

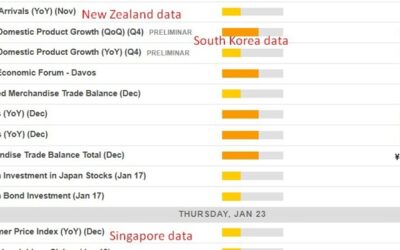

Economic calendar in Asia Thursday, January 23, 2025 – Japan trade data

A bit of a lower tier data day today. Japanese trade data for December 2024 is due but I suspect it won't move the JPY needle too much. The Bank of Japan begin their two-day meeting today. The statement is due tomorrow, Friday Japan time, and a rate hike is widely...

Trade ideas thread – Thursday, 23 January, insightful charts, technical analysis, ideas

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

What economic releases and events will highlight trading in the new trading day

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

The CME will launch Ripple and Solana futures

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

Does the S&P index closed at a new record level?

The S&P index is trading at 6093.40 up 44.13 points or 0.73%. At current levels, it would be high enough for a new record close. The old record close is at 6090.27.Today the price did move above its intraday record level at 6099.97. The high price today was just...

Gary Cohn says Trump doesn’t believe that tariffs will cause higher prices

Gary CohnGary Cohn was a moderating influence in Trump's first term and was his chief economic advisor. He's no longer working with Trump but he can speak to the President's thinking around tariffs as they surely discussed them many times."I think he fundamentally...

Alcoa among companies reporting after the bell

Aluminum giant Alcoa is a good barometer for the industrial economy and global growth. The company will report today after the bell and I will highlight any comments about the health of the world economy.Overall, it's a quieter day of reporting than yesterday, which...

Crude oil settles at $75.44. Tests 200 day MA at session lows

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

MUFG: USD/CAD rise to 1.50-1.60 range on broad 25% US tariffs

USDCAD dailyMUFG warns that a 25% tariff on all Canadian imports by the US could push USD/CAD into a 1.50-1.60 range. While markets remain optimistic that negotiations will dilute or avert the tariff threat, escalation risks loom as the 1st February deadline...

Oracle continues its run to the upside. What now technically for the stock?

In the video above, I take a look at Oracle the day after running higher on fundamental news of a joint venture took the price above the 100 day MA and the 200 hour MA. Both breaks to the upside were bullish technically. Those levels also helped to define risk for...

ECB’s Holzmann says it would be better to wait a bit longer on rate cuts

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

Sam Altman gets combative with Elon Musk on Twitter

There is some head-scratching about yesterday's $500 billion investment in data centers that was touted at the White House. The big question is: whose money is it?The announcement was led by Softbank's Masayoshi Son and that firm only has $134 billion under...

US sells 20-year notes at 4.900% vs 4.911% WI

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...