High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

Why the Canadian dollar will continue to ignore economic data

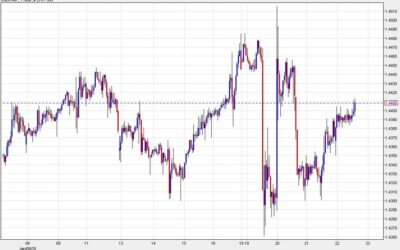

USDCAD 1 hourUSD/CAD reached a session high at 1.4408 shortly before the release of Canadian retail sales but has been largely unmoved since. Canadian economic data is quickly falling to the backburner in terms of market-moving impact for two reasons:1) Tariff...

Canada November retail sales 0.0% vs +0.2% expected

Prelim November estimate was unchangedOctober sales were +0.6%Retail sales ex-autos -0.7% vs +0.1% expectedPrior ex-autos were +0.1% (revised to -0.1%)Core sales -1.0%December advanced sales +1.6%The December number is important here as it shows a big rebound. Canada...

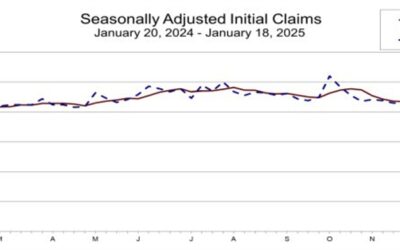

US initial jobless claims 223K vs 220K estimate

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

Nasdaq Futures Analysis Today by TradeCompass

TradeCompass for Nasdaq Futures – January 23, 2025Current Price at the Time of the NQ analysis: 21,894The TradeCompass guides our bullish and bearish thresholds and outlines profit-taking targets to help you navigate the Nasdaq Futures market effectively. Here's the...

Kickstart the FX trading day for Jan 23, w/ a technical look at the 3 major currency pairs

The video above outlines the technicals in play for the 3 major currency pairs, the EURUSD, USDJPY and GPUSD. Generally speaking the price action in each is limited (room to roam?). What are the key levels in each? A quick summary: The EURUSD yesterday stalled the...

ForexLive European FX news wrap: Currencies muted awaiting US jobless claims, Trump

Headlines:Markets:USD leads, AUD lags on the dayEuropean equities higher; S&P 500 futures down 0.2%US 10-year yields up 4.5 bps to 4.643%Gold down 0.3% to $2,747.19WTI crude up 0.4% $75.69Bitcoin down 2.2% to $101,773It was a quiet session again with no major...

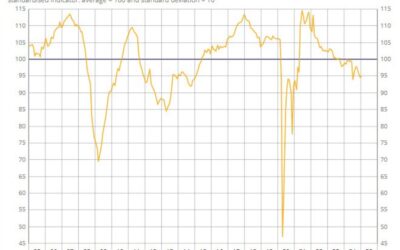

Nasdaq Technical Analysis – The bulls remain in control

Fundamental OverviewThe Nasdaq has been keeping the bid since last week as the softer than expected US inflation data gave the market a boost. We haven’t got any key economic report since then and no comment from Fed speakers given that they are in the blackout...

UK January CBI trends total orders -34 vs -35 expected

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

ECB’s Escriva: We still have restrictive policy

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

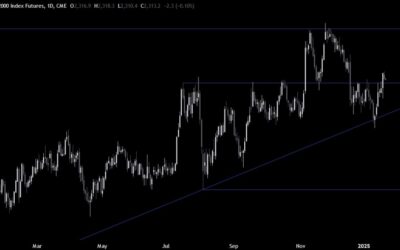

S&P 500 Technical Analysis – A new all-time high is within reach

Fundamental OverviewThe S&P 500 has been keeping the bid since last week as the softer than expected US inflation data gave the market a boost. We haven’t got any key economic report since then and no comment from Fed speakers given that they are in the blackout...

[전국민 민생회복지원금!! 25만원 어떻게 되고있나?지자체별 지원금 지급속보! 2025년 생계급여 지급기준 바뀐다 ]#3.1경제독립tv

https://www.youtube.com/watch?v=IzTfMqvGsPw [전국민 민생회복지원금!! 25만원 어떻게 되고있나?지자체별 지원금 지급속보! 2025년 생계급여 지급기준 바뀐다 ]#3.1경제독립tv [3년뒤 10억부자 3.1경제독립tv필독추천영상] [1]정기예금 꼭~이렇게 가입하세요~ 이자 40만원~100만원! 더 받아요! https://youtu.be/6U8BR4kcPAo [2]통장에 이 돈 당장 빼세요! 만65세, 기초연금탈락! 통장에 얼마 있으면 못받나?...

Heads up: Trump set to address world leaders in Davos later today

Trump won't be there himself but he will be engaging with world leaders at the forum via a video dialogue/conference. The event itself is slated for 1600 GMT but the topics that he will be discussing aren't made clear. As such, one can really expect everything and...

A dovish hike for the BOJ tomorrow?

Given the state of play and the "leaks" since last week, it looks like a BOJ rate hike is imminent. The question is, how are they going to follow that up ahead of the spring wage negotiations in March?As things stand, traders are pricing in ~94% odds of a 25 bps rate...

Russell 2000 Technical Analysis – Tariffs headlines drive the price action

Fundamental OverviewThe Russell 2000 has been keeping the bid since last week as the softer than expected US inflation data gave the market a boost. We haven’t got any key economic report since then and no comment from Fed speakers given that they are in the blackout...

2025년 7천억! 소상공인 자영업자 이자 경감 신청하세요!

https://www.youtube.com/watch?v=t9v-1Mf6So8 대출 받으셨던 분들 많이 힘드시죠? 올해 2025년에 정부와 금융기관에서 7,000억원 규모의 이자 경감 지원을 해준다고 합니다. 어떻게 지원을 해주는지 끝까지 시청해 주시고 주변에 소상공인 자영업자 분들이 계시다면 그분들께 공유해서 도움을 주시면 좋겠습니다. #이자경감 #소상공인 #자영업자 MoneyMaker FX EA Trading...

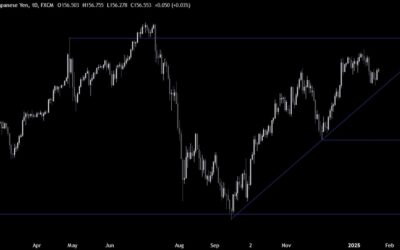

Japanese Yen Futures Analysis Today by TradeCompass

TradeCompass for Japanese Yen Futures (6J - March 2025 Contract) | January 23, 2025Japanese Yen Futures Price Prediction and AnalysisAt the time of this analysis, Japanese Yen Futures (6J, March 2025 contract) is trading at 0.0064270, apx at today’s VWAP and just...

USDJPY Technical Analysis – Focus on the BoJ decision

Fundamental OverviewThe USD has been marginally weaker against the major currencies recently due to lower than expected US inflation figures last week that sent Treasury yields lower and made the market to price in higher chances of a second rate cut by the end of the...

France January business confidence 95 vs 94 prior

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

China says willing to work with US to promote stable development of trade ties

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

![[전국민 민생회복지원금!! 25만원 어떻게 되고있나?지자체별 지원금 지급속보! 2025년 생계급여 지급기준 바뀐다 ]#3.1경제독립tv](https://my.blogtop10.com/wp-content/uploads/2025/01/eca084eab5adebafbc-ebafbcec839ded9a8cebb3b5eca780ec9b90eab888-25eba78cec9b90-ec96b4eb96bbeab28c-eb9098eab3a0ec9e88eb8298eca780ec9e90-400x250.jpg)