I went away for a week to Dubai and it feels like I'm coming back to a different world.The incoming US President launched a memecoin that ballooned his net worth by around $30 billion. That was followed by a similar coin launch from First Lady Malania...

X Open Hub Celebrates Award Win and Successful iFX EXPO Dubai 2025

X Open Hub, an enterprise-grade liquidity and technology provider for the brokerage industry listed by the Warsaw Stock Exchange, envisions an exciting 2025 marked by continued success building on a previous award-winning streak.Between 14-16 January, the company...

ForexLive European FX news wrap: Dollar eases ahead of Trump inauguration

Headlines:Markets:EUR leads, JPY lags on the dayEuropean equities little changed; S&P 500 futures down 0.1%Gold up 0.2% to $2,707.06WTI crude flat at $77.33Bitcoin up 5.3% to $106,527It was a quiet session but understandably so with US markets closed for the long...

From Oath to $TRUMP: Inauguration Day Swears in a President & a Meme Coin Market Frenzy!

$TRUMP Meme Coin Dominates Crypto Markets Amid Frenzy and ControversyThe cryptocurrency world is abuzz as President-elect Donald Trump makes waves with the surprise launch of his official meme coin, $TRUMP. Announced across social media platforms on Friday night, this...

Reminder: US markets will be closed today

It is a US holiday in conjunction with Martin Luther King Day. That means markets will be closed in what is a long weekend of sorts. If you're looking for CME hours, you can check out Eamonn's post earlier here. Anyway, even with it being a holiday there will be...

Copper Technical Analysis – The focus remains on China and Trump’s tariffs

Fundamental OverviewCopper has been rallying steadily since the start of the month as the market is looking forward to improving global growth in 2025. As a reminder, the Chinese Politburo announced last year that it will adopt a “moderately loose” strategy for...

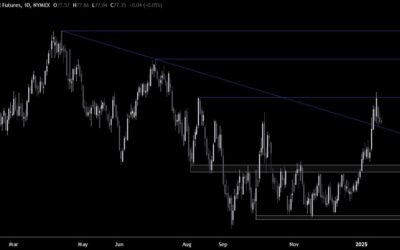

Crude Oil Futures (CL) Analysis for Today

TradeCompass for January 20, 2025: Crude Oil Futures (CL) AnalysisCrude oil futures (CL) are currently trading at $77.14, with the following thresholds:Bullish Above: $77.54 – Signaling upside momentum if crossed.Bearish Below: $76.97 – Indicating a bearish stage if...

Bitcoin at fresh record highs as Trump meme coin sparks buying fever

Love him. Hate him. He certainly does live up to the memes and this time, quite literally. Trump launched his own cryptocurrency over the weekend, dubbed $TRUMP and it has already generated roughly $12 billion in market cap (the high was $14 billion overnight). It is...

SNB total sight deposits w.e. 17 January CHF 445.3 bn vs CHF 445.1 bn prior

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

Crude Oil Technical Analysis – The squeeze paused around the key $80 handle

Fundamental OverviewCrude oil has been rallying steadily since the breakout of the range as the improving US manufacturing activity and the tougher US sanctions on Russian crude triggered a 12% squeeze in a heavily shorted market. The focus now switched to Trump as...

Market Outlook for the Week of 20th – 24th January

On Monday will be a slow day with the Presidential Inauguration taking center stage in the U.S. On Tuesday, key labor market data will be released in the U.K., including the claimant count change, the average earnings index 3m/y and the unemployment rate....

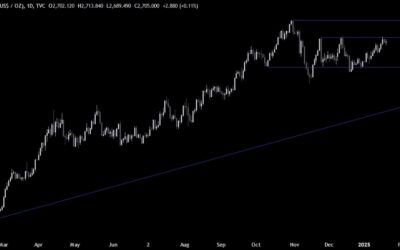

Gold Technical Analysis – Eyes on a potential breakout of the range

Fundamental OverviewGold finally reached the key resistance zone around the 2721 level following better than expected US inflation data and a surprisingly dovish Fed’s Waller last week. Following those catalysts, the price kept on going higher as real yields moved...

European indices little changed at the open today

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

China reportedly set to promote Zou Lan to PBOC deputy governor

The Reuters report, citing sources with knowledge of the matter, says that the appointment will be announced as soon as this week. Once made, Zou is to be the youngest deputy governor at the PBOC.For some context, Zou has a decent history at the central bank having...

Switzerland December producer and import prices 0.0% vs -0.6% m/m prior

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

ECB’s Holzmann: A rate cut is not a foregone conclusion for me at all

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

Germany December PPI -0.1% vs +0.2% m/m expected

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

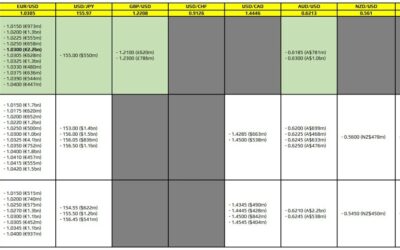

FX option expiries for 20 January 10am New York cut

There is just one to take note of, as highlighted in bold.That being for EUR/USD at the 1.0300 level again. Amid some slight dollar weakness ahead of Trump's inauguration, the expiries here should act as a magnet to keep price action more contained near the figure...

A quiet one on the agenda to start the week

The dollar is down as markets are bracing for Trump's inauguration later in the day. The early signals is that there won't be anything too significant on the tariffs front and that is putting the dollar off slightly. Trump and Xi also had positive talks over the...

ForexLive Asia-Pacific FX news wrap: USD weaker session – no tariff news is good news

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...