High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

PBOC is expected to set the USD/CNY reference rate at 7.3353 – Reuters estimate

People's Bank of China USD/CNY reference rate is due around 0115 GMT.The People's Bank of China (PBOC), China's central bank, is responsible for setting the daily midpoint of the yuan (also known as renminbi or RMB). The PBOC follows a managed floating exchange rate...

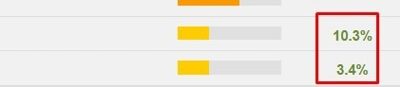

Japan November machine orders rocket higher: +3.4% m/m (expected -0.4%) +10.3% y/y (+5.6%)

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

JP Morgan forecasts a PBOC RRR and rate cut after Lunar New Year

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

PBOC may cut RRR before the Lunar New Year holiday

The 2025 Chinese New Year holiday, also known as the Spring Festival, will be on Wednesday, January 29, and last until Tuesday, February 4. It celebrates Lunar New Year.Chinese media reported last week that the People's Bank of China may cut its reserve requirement...

Nomura are expecting a March Fed rate cut then a US inflationary shock due to tariffs

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

Reminder – US markets are closed on Monday, January 20, 2025

Repeating what I posted last week as a heads up to this. Monday January 20 is the Martin Luther King Day holiday in the US:The two major stock markets - the New York Stock Exchange and the Nasdaq - will be closed on Monday, 20 January 2025Bond markets are closed. The...

Trump spoke at a rally – hinted at action on immigration and energy (nothing on tariffs)

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

Leaks around Trump’s ‘day one’ executive orders have not mentioned tariffs at all

Any rapid imposition of tariffs would be viewed in market as a negative for risk at this stage.As an update to this earlier:in reports on these leaks there is no mention of tariffs.To conclude 'no tariffs to be announced today', based on the leaks we have so far,...

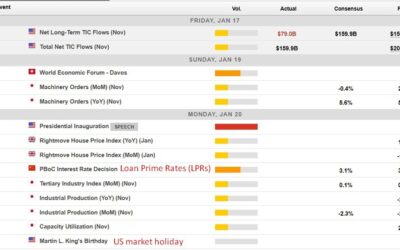

Economic calendar in Asia Monday, January 20, 2025 – PBOC Loan Prime Rate (LPR) day

The People's Bank of China is the focus today, with LPR settings. These are not as critical as they once were. In June 2024, Governor Pan Gongsheng announced a strategic shift, designating the 7-day reverse repurchase (repo) rate as the primary short-term policy...

Trade ideas thread – Monday, 20 January, insightful charts, technical analysis, ideas

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

Trump to issue executive orders on immigration, energy, government hiring policies soon

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

Monday morning open levels – indicative forex prices – 20 January 2025

As is usual for a Monday morning, market liquidity is very thin until it improves as more Asian centres come online ... prices are liable to swing around, so take care out there. Note also that today, Monday, January 20, 2025, is a US market holiday. Guide:EUR/USD...

Newsquawk Week Ahead: BoJ, PBoC, PMIs, UK jobs, Inflation data from Canada, Japan and NZ

Mon: US Presidential Inauguration, PBoC LPR, Eurogroup Meeting; German Producer Prices (Dec)Tue: UK Unemployment/Wages (Nov), German ZEW (Jan), Canadian CPI (Dec), New Zealand CPI (Q4)Wed: South African CPI (Dec), Japanese Trade Balance (Dec)Thu: Norges Bank &...

Weekly Market Outlook (20-24 January)

UPCOMING EVENTS:Monday: PBoC LPR,US Presidential Inauguration Day, BoC Business Outlook Survey, New Zealand Services PMI.Tuesday: UK Employment report, German ZEW, Canada CPI, New Zealand Q4 CPI.Thursday: Canada Retail Sales, US Jobless Claims.Friday: Japan CPI, BoJ...

2025년 추가! 연말정산 할 때~ 앞으로 이것도 공제 받으세요!

https://www.youtube.com/watch?v=Q1zqW7GC56M 문화생활을 즐기면서 내가 얻을 수 있는 금액적 혜택이 없을까? 하고 생각해 보신적이 있으신가요? 오늘은 그런분들을 위해 2025년 추가된 문화비 소득공제 정보를 가지고 왔는데요. 주변에 문화생활하시는 소중한 분들께 영상 공유해주셔서 도움을 주시면 좋을 것 같습니다. #연말정산 #소득공제 #뉴스 MoneyMaker FX EA Trading...

[퇴사1일기념-특집방송] 테슬라 틱톡 인수? 주가 1,000직행? 비트코인 꿈틀, 신고가 돌파 할까?]#재테크#해외주식투자#테슬라#비트코인#3.1경제독립tv

https://www.youtube.com/watch?v=NqgDhANaoOA [퇴사1일기념-특집방송] 테슬라 틱톡 인수? 주가 1,000직행? 비트코인 꿈틀, 신고가 돌파 할까?]#재테크#해외주식투자#테슬라#비트코인#3.1경제독립tv *본 채널은 투자에 대한 조언을 드리지만, 투자는 전적으로 본인의 판단하에 진행하고, 투자에 대한 책임도 전적으로 본인에게 있다는 점을 명심하셔야 합니다 [3년뒤 10억부자 3.1경제독립tv필독추천영상] [1]정기예금 꼭~이렇게 가입하세요~...

A technical view of the major currency pairs going into the new trading week

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

Greenland, Canada and the Panama Canal: What is the real plan here?

Here is my base case.Greenland:This is a real pet project of Trump's. He's a real estate guy, it's the biggest island in the world and there are only 56,000 people there. Denmark is weak, there is already a US base on the island and there are probably a lot of natural...

[테슬라, 트럼프 랠리! 주가 100% 상승!! 비트코인 1.20 깜짝발표, 폭등할까??]#재테크#해외주식투자#테슬라#엔비디아#비트코인#3.1경제독립tv

https://www.youtube.com/watch?v=MqlHlQOawtY [테슬라, 트럼프 랠리! 주가 100% 상승!! 비트코인 1.20 깜짝발표, 폭등할까??]#재테크#해외주식투자#테슬라#엔비디아#비트코인#3.1경제독립tv *본 채널은 투자에 대한 조언을 드리지만, 투자는 전적으로 본인의 판단하에 진행하고, 투자에 대한 책임도 전적으로 본인에게 있다는 점을 명심하셔야 합니다 [3년뒤 10억부자 3.1경제독립tv필독추천영상] [1]정기예금 꼭~이렇게 가입하세요~ 이자...

![[퇴사1일기념-특집방송] 테슬라 틱톡 인수? 주가 1,000직행? 비트코인 꿈틀, 신고가 돌파 할까?]#재테크#해외주식투자#테슬라#비트코인#3.1경제독립tv](https://my.blogtop10.com/wp-content/uploads/2025/01/ed87b4ec82ac1ec9dbceab8b0eb8590-ed8ab9eca791ebb0a9ec86a1-ed858cec8aaceb9dbc-ed8bb1ed86a1-ec9db8ec8898-eca3bceab080-1000eca781ed9689-400x250.jpg)

![[테슬라, 트럼프 랠리! 주가 100% 상승!! 비트코인 1.20 깜짝발표, 폭등할까??]#재테크#해외주식투자#테슬라#엔비디아#비트코인#3.1경제독립tv](https://my.blogtop10.com/wp-content/uploads/2025/01/ed858cec8aaceb9dbc-ed8ab8eb9fbced9484-eb9ea0eba6ac-eca3bceab080-100-ec8381ec8ab9-ebb984ed8ab8ecbd94ec9db8-1-20-eab99ceca79debb09ced919c-400x250.jpg)