High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

US business inventories for November +0.1% versus 0.1% estimate

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

Tech sector rebounds while auto manufacturers struggle

Stock heatmap by FinViz.com Thu, 16 Jan 2025 14:46:12 GMTSector OverviewToday's stock market heatmap reveals a striking contrast in sector performances. The technology sector shows signs of strength, with notable gains, while the auto manufacturing sector experiences...

US futures are implying a mixed open for the US stock market

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

TradeCompass for Nasdaq Futures, Jan 16 2025, 1 minute before the open

TradeCompass for Nasdaq Futures (NQ, March 2025 Contract) – January 16, 2025Current Context:Current Price: 21,4492 (1 minute before the market opens).Activation Level: 21,640This TradeCompass becomes active only if NQ reaches 21,640.Below this level, no directional...

Kickstart the FX trading day for Jan 16 w/ a technical look at EURUSD, USDJPY & GBPUSD

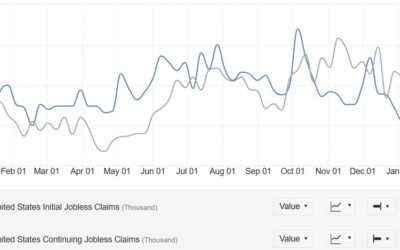

The retail sales control group (feeds into GDP) and Philly Fed Manufacturing index were stronger than expected and that helped to push the EURUSD and the GBPUSD lower (higher USD) but only modestly.The US initial jobless claims saw rebounded higher but remains close...

My 2nd attempt this week on shorting gold

Short Trade Idea for Micro Gold Futures (MGC) – January 16, 2025Trade Setup:This short trade idea on Micro Gold Futures (MGC), curently trading at apx $2740 anticipates a reversal in the range of $2,748-$2,760, a key psychological resistance area, with a total of 30...

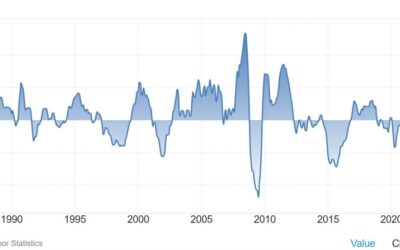

Philadelphia Fed manufacturing index for January 44.3 versus -5.2 estimate

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

US December retail sales 0.4% versus 0.6% estimate.Control group versus 0.7% estimate 0.4%

Prior month 0.7% revised to 0.8%Retail sales headline 0.4% versus 0.6% estimateControl group 0.7% vs 0.4% estimate. Prior month 0.4%Core retail sales ex auto 0.4% vs 0.5% estimate. Last month 0.2%Ex auto and gas 0.3% vs 0.2% last month.More details from the Census...

US December import prices MoM 0.1% vs 0.1% expected

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

US initial jobless claims 217K vs 210K expected

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

US Retail sales, claims due at the bottom of the hour

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

ForexLive European FX news wrap: Dollar mixed ahead of more US data to come

Headlines:Markets:JPY leads, AUD lags on the dayEuropean equities higher; S&P 500 futures up 0.1%US 10-year yields up 2.7 bps to 4.679%Gold up 0.3% to $2,702.83WTI crude down 0.5% to $80.04Bitcoin down 0.5% to $99,212It was a quieter session with just some light...

Further gradual rate cuts will be appropriate if baseline projections hold – ECB accounts

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

AUD Futures Analysis for Today

TradeCompass for AUD Futures Analysis (6A, March 2025 Contract) – January 17, 2025Current Context:Current Price: 0.6213Bullish Threshold: 0.62370This level is just above today's highest VWAP point and slightly above the 1st upper standard deviation of yesterday's...

Nasdaq Technical Analysis – Easing inflation fears boost the market

Fundamental OverviewThe Nasdaq has been rallying steadily this week thanks to positive news both on the tariffs and inflation front. On Monday, we got a news from Bloomberg that the Trump’s team was studying gradual tariffs hikes. On Tuesday, we got a very soft US PPI...

S&P 500 Technical Analysis – Benign inflation data sends the market higher

Fundamental OverviewThe S&P 500 has been rallying steadily this week thanks to positive news both on the tariffs and inflation front. On Monday, we got a news from Bloomberg that the Trump’s team was studying gradual tariffs hikes. On Tuesday, we got a very soft...

Eurozone November trade balance €16.4 billion vs €8.5 billion expected

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

Dollar keeps more mixed on the session thus far

The dollar is keeping steadier and a little firmer against the major currencies bloc but only with one exception again. And that is against the Japanese yen. Falling Treasury yields in response to the US CPI report yesterday drove USD/JPY lower but also as traders...

Russell 2000 Technical Analysis – Top in inflation hysteria?

Fundamental OverviewThe Russell 2000 has been rallying steadily this week thanks to positive news both on the tariffs and inflation front. On Monday, we got a news from Bloomberg that the Trump’s team was studying gradual tariffs hikes. On Tuesday, we got a very soft...