Prior 1.3%HICP 1.4% vs 1.6% y/y expectedPrior 1.5%Core CPI Y/Y 1.8% vs. 1.9% priorCore inflation (excluding energy and unprocessed food) was +1.8% (from +1.9% in the previous month) and inflation excluding energy was +1.7% (from +2.0% in November).In 2024, the average...

Eurozone November unemployment rate 6.3% vs 6.3% expected

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

Eurozone December preliminary CPI +2.4% vs +2.4% y/y expected

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

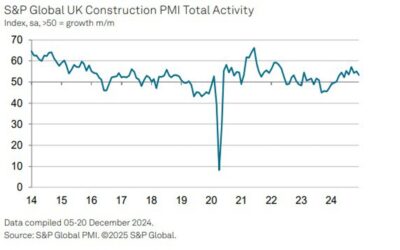

UK December construction PMI 53.3 vs 54.4 expected

Prior 55.2UK construction activity slows to six-month low as house building keeps a drag on the overall sector. Total new work was seen rising at its slowest pace since June but at least business optimism picked up after hitting a 13-month low in November. S&P...

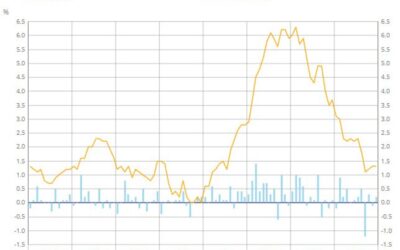

Inflation expectations over the next year rose in November – ECB survey

Inflation expectations for the year ahead rose from 2.5% in October to 2.6% in November, with inflation expectations for 3 years ahead also rising to 2.4% - up from 2.1% in the month before. Meanwhile, growth expectations have turned more negative with the year ahead...

iFX EXPO Dubai 2025 Set to Gather the Online Trading Industry’s Best and Brightest

iFX EXPO Dubai 2025 The No.1 Online Trading Expo in MENAiFX EXPO, creators of international online trading expos, are set to kick off the new year with another edition of their Dubai event. On January 14th, iFX EXPO Dubai 2025 will launch with an iconic welcome party...

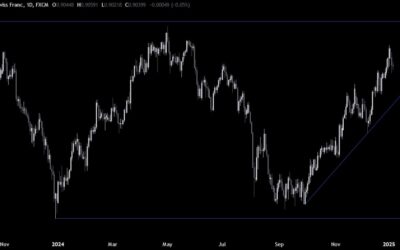

USDCHF Technical Analysis – Status quo ahead of the key US data

Fundamental OverviewThe USD continues to remain supported since the last FOMC decision as the market perceived it as more hawkish than expected. After the rally during the low volume Christmas holidays, we are now seeing a pullback pretty much across the board. The...

Bitcoin Analysis for Today

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

Dow Jones Futures Analysis for Today

Financial Instrument: Dow Jones Futures / E-mini Dow JonesPrice at the Time of Analysis: 42,960Key Levels to WatchBullish Above 43,040Why Bullish Above?A move above 43,040 indicates price is surpassing the Value Area High (VAH) from two days ago, signaling buyer...

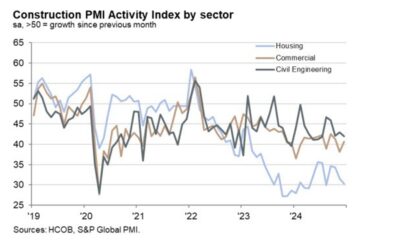

Germany December construction PMI 37.8 vs 38.0 prior

Germany's construction sector closed out the year firmly in contraction territory. The headline reading is an eight-month low as home building activity continues to be the main drag. The outlook for this year is not great as firms are continuing to expect overall...

RTY Futures Analysis for Today

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

USDJPY Technical Analysis – Consolidation ahead of key data

Fundamental OverviewThe USD continues to remain supported since the last FOMC decision as the market perceived it as more hawkish than expected. After the rally during the low volume Christmas holidays, we are seeing a pullback pretty much across the board. The...

Nasdaq Futures Analysis for Today

NASDAQ 100 E-mini Futures Analysis for TodayFinancial Instrument: Nasdaq 100 E-mini FuturesPrice at the Time of Analysis: 21,725Key Levels to WatchBullish Above 21,760Why Bullish Above?A move above 21,760 indicates price is surpassing yesterday’s VWAP and today’s...

European indices hold more sluggish at the open today

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

China seen increasing gold reserves in December

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

S&P 500 E-mini Futures Analysis for Today

S&P 500 E-mini Futures Analysis and Key LevelsFinancial Instrument: S&P 500 E-mini FuturesPrice at the Time of Analysis: 6014The S&P 500 E-mini Futures are currently trading near 6014, reflecting a pivotal moment in the market as price hovers between...

France December preliminary CPI +1.3% vs +1.4% y/y expected

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

Switzerland December CPI +0.6% vs +0.6% y/y expected

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

UK December Halifax house prices -0.2% vs +0.4% m/m expected

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

Japan business lobby head rebuffs wage growth expectations for this year

Takeshi Niinami is the CEO of Suntory but he also serves as the head of the Keizai Doyukai business lobby - one for leading executives - and also the head for Japan's chamber of commerce and industry. He is out saying that wage growth this year at big firms will...