High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

Bank of America with 3 reasons for GBP to strengthen in 2025

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

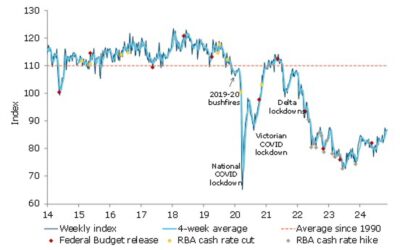

Australian Consumer Confidence, weekly survey, comes in at 86.8 (prior 86.7)

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

US DoJ to pressure Google to sell Chrome – break monopoly

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

TD expect EUR/USD to barely avoid parity, forecast a drop to 1.01

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

Forexlive Americas FX news wrap 18 Nov: USD corrects lower as yields reverse.Stocks mixed

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

ICYMI – Citi base case is for no USD/JPY intervention before 160

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

Impact of immigration restrictions on US economy and forecasts for EUR/USD and USD/CNY

A note via Capital Economics argues:While Trump’s trade policies receive attentionon, immigration restrictions may have a more substantial economic impact, potentially leading to lower growth and higher costs across critical sectors.Capital Eco says, in brief, that...

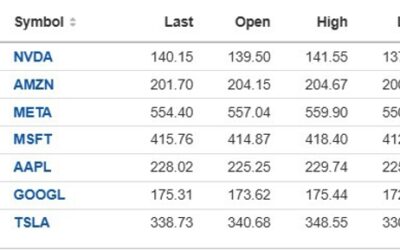

Mixed ending for US stocks to start the new trading week

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

AUDUSD rebounds into a swing area resistance target. What next?

The AUDUSD - like other pairs vs the USD today - has moved sharply lower over the last 6 /7 trading days, over that period, the high price on November 7 reached 0.6687. The low price on Thursday last week reached 0.64402. At the high, the price stalled just ahead of...

Economic calendar in Asia Tuesday, November 19, 2024 – RBA minutes

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

Trade ideas thread – Tuesday, 19 November, insightful charts, technical analysis, ideas

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

Trump Media in advance talks to buy Crypto Platform BAKKT

The FT is reporting that Trump Media is in advanced talks to buy Crypto Platform BAKKT. HMMMM. Of course President-elect Trump is the largest stock owner of Trump media. Shares of DJT are up 10.89% at $31.20Also Pres. Trump is to meet privately with Coinbase CEO Brian...

ECBs Vujcic: The risk of inflation undershooting has picked up

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

WTI Crude oil settles $2.14 higher at $69.16

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

BOEs Greene: UK services inflation is elevated but on a downward path

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

GBPUSD corrects higher and closer to the 100 hour MA at 1.26811.

The GBPUSD is trading higher in is a poaching a key resistance and its 100-hour moving average at 1.2681. Also near that level is the high of a swing area between 1.2654 and 1.26858. Get above that level would be needed for the buyers to have a technical "win" after...

ECB’s Lagarde: Europe is falling behind in innovation and productivity compared to the U.S

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

EURUSD pushing away from its 100 hour moving average

The EURUSD is stretching to the upside with the price now moving away from the 100-hour MA at 1.05659. That MA was broken earlier today after finding sellers against the moving average level on Friday and again earlier today.Although the price traded above and below...

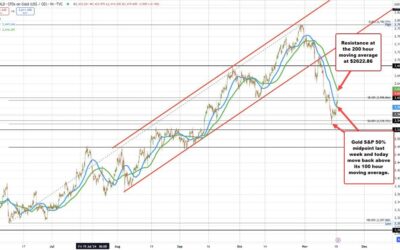

Gold rallies sharply after last week’s tumble of -4.5%. Price is up 1.87% today

Gold is up sharply in trading today after falling -4.52% last week - its worst week since falling 6.03% during week of June 14, 2021.Technically, looking at the hourly chart, the price moved sharply lower last week and in doing so stayed below its 100-hour moving...