High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

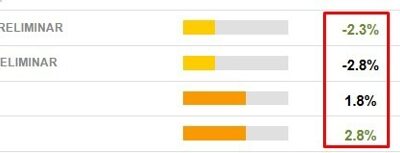

Japan Industrial Production for November (preliminary): -2.3% m/m (expected -3.4%)

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

Japan data: October Unemployment rate 2.5% (expected 2.5%)

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

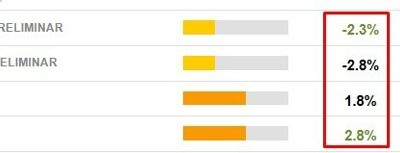

Tokyo area December inflation data: Headline 3.0% y/y (expected 2.9%)

Tokyo area inflation for December 2024.Headline 3.0% y/yexpected 2.9%, prior 2.6%Core (excluding fresh food) +2.4%expected 2.5%, prior 2.2%Core-core (excluding food and energy) 2.4% y/yprior 2.2%***I'd think this will keep the Bank of Japan on track for a January...

Catch up – OPEC+ does not have “the bandwidth to prop prices much higher”

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

Catch up – World Bank raised its 2024 China growth forecast to 4.9%, from 4.8% previously

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

Catch up – Further supportive measures in store for China housing sector in 2025

China Construction News with the report, citing a work conference held by the housing regulator on Tuesday and Wednesday.In summary from the report, overblown adjectives included ...Efforts to stabilize and prevent further declines in China's real estate market will...

Catch up – China revises up 2023 GDP by 2.7% from previous estimate

China's National Bureau of Statistics (NBS) announced the revision on Thursday, following the completion of the fifth National Economic Census:Gross domestic product (GDP) in 2023 was raised by 3.4 trillion yuan to 129.4 trillion (US$17.73 trillion)said the change...

Economic calendar in Asia 27 December 2024 – Japan (Tokyo) inflation, BOJ meeting Summary

Its all go in Japan today, with a long list of releases scheduled for the morning at 8.30 am Japan time (2330 GMT, 1830 US Eastern time) and 8.50 am (2350 GMT, 1850 US Eastern time):As background to the two releases of note:Tokyo area inflation data:National-level CPI...

Trade ideas thread Friday, 27 December, 2024, insightful charts, technical analysis, ideas

It's a patchy week of holidays, official and unofficial. Today definitely falls into the unofficial holiday category. I won't be around much (but that's just between you and me, K?) The best trade idea might be to chill out and recharge, but different people have...

No Santa Claus rally for the oil bulls

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

AUDEUSD skims along near th e low for the year.

The AUDUSD moved higher in the early Asian trading after the Christmas hiatus and the move higher took the price above the 100 hour MA (blu e line currently at 0.6239). The break gave buyers some hope in the short term, but the high price ended up stalling at the...

US sells 7-year notes at 4.532% vs 4.555% WI

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

EURUSD trades to new highs and back above the 50% midpoint on the daily chart

The EUR/USD is edging higher, reaching a new daily high while breaking above the 50% midpoint of the trading range since the September 2022 low, which stands at 1.04053 (see daily chart).On the hourly chart, the pair has been oscillating above and below this midpoint...

Shameless plug. Attacking Currency Trends by Greg Michalowski. A bargain on Amazon

It’s a "quiet" news day today—the day after Christmas (and Boxing Day in many parts of the world). On this "all is calm" day, I wanted to share something you might not know: I’ve written a book that complements my technical analysis work on Forexlive.com.Inspired by...

GBPUSD stays below the 100 hour MA today. Bears stay in control.

While UK traders celebrate Boxing Day, the GBP/USD is under pressure, falling to new session lows and extending its decline further away from the downward-sloping 100-hour moving average. The pair opened the post-Christmas trading day just below the 100-hour moving...

The USDJPY is testing the high from last week

The USD/JPY is trading at a new high for the day, reaching last week’s peak of 157.918—the highest level since July 18. The day began near session lows at 157.122 but saw an acceleration during the early U.S. session, coinciding with the opening of the U.S. debt...

Tech and healthcare hold steady while Netflix dips: A comprehensive view of today’s market

Stock heatmap by FinViz.com Thu, 26 Dec 2024 14:46:01 GMTSector Overview: Tech and Healthcare Show ResilienceToday's stock market heatmap reveals stability in the technology and healthcare sectors amidst broader market fluctuations. While major tech players like...

US stocks open lower – but not as bad as pre-market levels

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

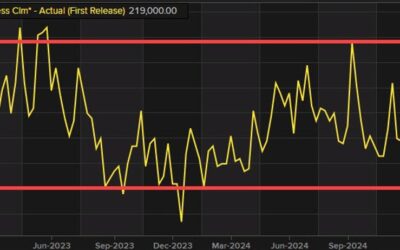

US Initial jobless claims 219K vs 224K estimate

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...