Boxing Day in Europe and Canada, and the hangover day after the Christmas Day holiday in the US. Nevertheless, the US stock market and bond markets will be open all day. The USD is higher vs the major currencies:EUR +0.05%JPY +0.15%GBP +0.27%CHF +0.13%CAD +0.22%AUD...

US futures seen softer in holiday-thin trading

S&P 500 futures are down 0.4% with Nasdaq futures down 0.5% and Dow futures down 0.4% as well. Trading conditions are mired by thin liquidity as we are still in the holiday period for markets. Europe is out for the day and so will Canada, leaving only US markets...

내일부터 시작! 정보유출 막는방법!! 모바일 주민등록증 신청하세요~

https://www.youtube.com/watch?v=yz_VQq-1Abw 12월 27일부터는 신분증 실물이 없어도 스마트폰 하나면 됩니다. 정보 기술의 발달로 모바일 결제 서비스와 전자 지갑 등이 대중화되면서 스마트폰 하나로 편리하게 일상생활을 할 수 있는 시대가 되었는데요. 그런데 내 정보가 혹시 빠져나가는 건 아닌지 보안에 걱정이 되기도 합니다. 자세한 내용 설명드리겠습니다. #모바일주민등록증 #뉴스 #모바일민증 MoneyMaker FX EA Trading...

ICYMI: China’s top legislature set to convene annual session on 5 March next year

This according to the NPC Standing Committee, as announced yesterday. For now, the agenda is said to encompass "reviewing the government work report, and examining the report on the implementation of the annual plan on national economic and social development for 2024...

[테슬라, 500 찍고 2025년, 큰 거 온다!! 비트코인+이것, 트럼프 충격 전망!!]#3.1경제독립tv

https://www.youtube.com/watch?v=4rxVBWD3pwI [테슬라, 500 찍고 2025년, 큰 거 온다!! 비트코인+이것, 트럼프 충격 전망!!]#3.1경제독립tv *본 채널은 투자에 대한 조언을 드리지만, 투자는 전적으로 본인의 판단하에 진행하고, 투자에 대한 책임도 전적으로 본인에게 있다는 점을 명심하셔야 합니다 [3년뒤 10억부자 3.1경제독립tv필독추천영상] [1]정기예금 꼭~이렇게 가입하세요~ 이자 40만원~100만원! 더 받아요!...

Bitcoin price prediction – to cross up $100k

Bitcoin Price Update and Forecast:Bitcoin (BTC/USD) appears poised to cross the $100,000 mark again as current price action aligns with bullish technical indicators on the daily chart. Here’s a quick breakdown:BTCUSD daily chart within the Donchian Channel with...

BOJ governor Ueda: We must raise rates if economic, price developments continue to improve

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

[테슬라, 500!! 2024년 끝낸다!! 비트코인, 1월 충격 가격 전망!! ]#재테크#해외주식#테슬라#엔비디아#비트코인#3.1경제독립tv

https://www.youtube.com/watch?v=MH6CpTC_CUM [테슬라, 500!! 2024년 끝낸다!! 비트코인, 1월 충격 가격 전망!! ]#재테크#해외주식#테슬라#엔비디아#비트코인#3.1경제독립tv *본 채널은 투자에 대한 조언을 드리지만, 투자는 전적으로 본인의 판단하에 진행하고, 투자에 대한 책임도 전적으로 본인에게 있다는 점을 명심하셔야 합니다 [3년뒤 10억부자 3.1경제독립tv필독추천영상] [1]정기예금 꼭~이렇게 가입하세요~ 이자...

People’s Bank of China injects 300 bn yuan in a 1 year MLF at unchanged rate of 2.00%

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

Celebrating the Festive Season with PU Prime’s Christmas Promotion

PU Prime, a leading global fintech company in trading and investment services, is excited to announce a new Christmas promotion, bringing holiday cheer to traders with an exclusive opportunity to win seasonal rewards. This special event offers traders exciting ways to...

Santa Claus stuffs stock market portfolios in a holiday-shortened session

S&P 500 dailyThe shortened US equity market session on Christmas Eve is often a formality but Santa Claus delivered this year. The 0.7% rally yesterday in the S&P 500 was followed with 0.8% today and the post-Fed rout has now been largely erased.S&P 500...

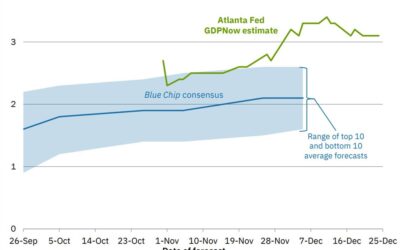

Atlanta Fed GDPNow Q4 growth estimate remains at 3.1%

The Atlanta Fed GDPNow growth estimate for Q4 growth comes in unchanged at 3.1%.In their own words:The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the fourth quarter of 2024 is 3.1 percent on December 24, unchanged from December 20...

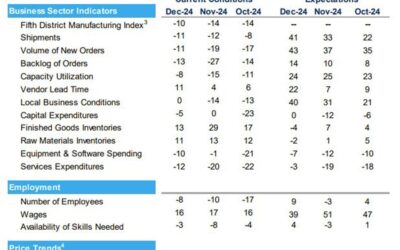

Richmond Fed composite index -10 versus -10 estimate

Prior month -14Manufacturing Activity: Remained in contractionary territory; composite index rose to -10 in December (from -14 in November). Est. -10Component Indexes:Shipments: -11 vs -12 last monthEmployment: -8 vs -10 last monthNew Orders: Improved to -11 vs -19...

Semiconductor surge: Avago leads while tech sector sees mixed outcomes

Stock heatmap by FinViz.com Tue, 24 Dec 2024 14:46:15 GMT📈 Semiconductor Surge: Avago Shines BrightThe semiconductor sector is experiencing a strong upswing today, with Avago (AVGO) soaring by 2.99%. This boost contributes to a positive outlook within the sector, as...

Stocks trading higher in early trading. Shortened trading day with a close at 1 PM

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

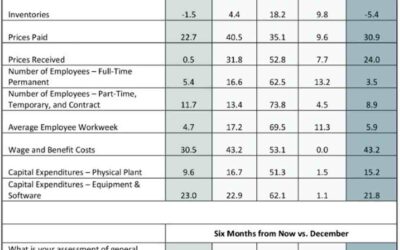

Philadelphia Fed non-manufacturing service activity for December -6 vs -5.9 last month

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

What is moving the market? Where is the market going?

Christmas Eve in the US will include a shorten day in the US. The stocks will close early at 1 PM, the US bond market will close at 2 PM. The USD is mixed vs the major currencies:EUR +0.12%JPY -0.04%GBP-0.15%CHF +0.18%CAD +0.32%AUD +0.27%NZD +0.23%US stocks are mixed...

Reminder: US markets will be closed early on Christmas Eve

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

EUR/GBP will be an interesting pair to watch heading into the turn of the year

EUR/GBP monthly chartFor the longest of time now, the pair has been caught within a 1,000 pips range over the last eight years. And that's just the extremes in certain years. Most of the time, the pair has nestled within a much tighter range during this period. But...

What’s the next step for major central banks in 2025?

Let's dive straight into it with the first meeting date and what market players are pricing in for that.Fed: 29 January (~91% probability of no change, ~9% probability of a 25 bps rate cut)ECB: 30 January (~99% probability of a 25 bps rate cut, ~1% probability of no...

![[테슬라, 500 찍고 2025년, 큰 거 온다!! 비트코인+이것, 트럼프 충격 전망!!]#3.1경제독립tv](https://my.blogtop10.com/wp-content/uploads/2024/12/ed858cec8aaceb9dbc-500-ecb08deab3a0-2025eb8584-ed81b0-eab1b0-ec98a8eb8ba4-ebb984ed8ab8ecbd94ec9db8ec9db4eab283-ed8ab8eb9fbced9484-400x250.jpg)

![[테슬라, 500!! 2024년 끝낸다!! 비트코인, 1월 충격 가격 전망!! ]#재테크#해외주식#테슬라#엔비디아#비트코인#3.1경제독립tv](https://my.blogtop10.com/wp-content/uploads/2024/12/ed858cec8aaceb9dbc-500-2024eb8584-eb819deb82b8eb8ba4-ebb984ed8ab8ecbd94ec9db8-1ec9b94-ecb6a9eab2a9-eab080eab2a9-eca084eba79d-ec9eac-400x250.jpg)