Stock heatmap by FinViz.com Thu, 14 Nov 2024 14:46:09 GMTTechnology edges higher: Mixed signals in today's stock marketThe U.S. stock market showed a mix of gains and losses today, with the technology sector presenting some bright spots despite broader uncertainty....

US stocks open flat. Investor sentiment not yet at worrying levels

I highlighted earlier how Tesla call options on Friday were 44% of all options traded in the US market. We're also seeing signs of meme stock interest growing.Those are red flags for sentiment but they also tend to be earlier indicators of euphoria, not the final...

USD/CAD rises above 1.40 for the first time since 2020

The weekly chart of USD/CAD is looking like a big breakout.USDCAD weeklyPerhaps the biggest warning for the loonie today comes from the oil market. Crude is higher today after two days of declines but the IEA is warning about a surprise of 1 million barrels per day of...

EBC and Oxford’s WERD Event Brings Fresh Perspectives on Climate and the Global Economy

EBC Financial Group (EBC), in collaboration with the University of Oxford’s Department of Economics, will convene leading minds from academia and finance on 14 November 2024 for a special edition of the What Economists Really Do (WERD) Series. This event, themed...

Fed’s Barkin: Fed is making great progress but needs to keep it going

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

US equity futures flat. Eyes on Disney

US stock futures are flat just ahead of the open while Treasury yields are slightly lower across the curve. The market is weighing the strength of the post-election rally, which has been impressive but won't move in one direction forever.The big winner in the...

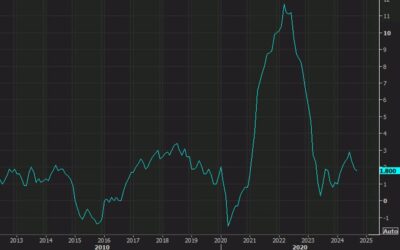

US weekly initial jobless claims 221K vs 223K expected

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

US October producer price index +2.4% y/y vs +2.3% expected

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

BIT Mining Invests in Prosper’s Native Tokens to Support New Focus on Bitcoin Mining

Prosper, a decentralized protocol bridging institutional-grade Bitcoin mining power on-chain and aiming to unlock the potential of Bitcoin through liquidity farming, today announced a new investment in its native project token PROS by one of the leading cryptocurrency...

Fed’s Kugler welcomes easing in inflation expectations

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

BOE’s Mann argues for holding rates firmly until more evidence of diminished inflation

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

ECB accounts: It is still too early to declare victory in the fight against inflation

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

ForexLive European FX news wrap: Dollar ramps higher as post-election run continues

Headlines:Markets:USD leads, CHF lags on the dayEuropean equities higher; S&P 500 futures up 0.1%US 10-year yields down 0.6 bps to 4.445%Gold down 0.7% to $2,555.08WTI crude up 0.4% to $68.71Bitcoin up 3.1% to $91,434The dollar is ramping higher in European...

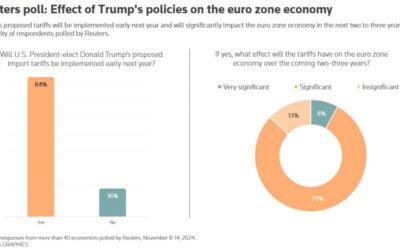

Economists expect Eurozone economy to be hit by Trump tariffs early next year

37 of 44 economists expect Trump's proposed tariffs to be implemented early next year34 of 39 economists expect said tariffs to significantly impact the Eurozone economyAs a result of those expectations, economists are also anticipating the ECB to stick with further...

Fed’s Kugler: If disinflation progress stalls, it could call for a pause to rate cuts

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

NZDUSD Technical Analysis – We are testing a key support zone

Fundamental OverviewThe US CPI yesterday came in line with expectations leading to a bit of a “sell the fact” reaction in the US Dollar. The bullish momentum picked up a bit later though as Fed’s Logan delivered a hawkish comment saying that “models show that Fed...

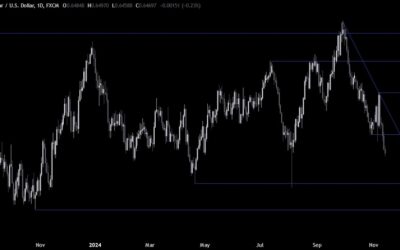

The dollar train continues to march on

All aboard now. The dollar train is marching forward on the session, stretching gains across the board. The post-election momentum continues to play out and it's still not the time to be guessing the top just yet. EUR/USD is now down 0.5% to 1.0508 as it corroborates...

Eurozone September industrial production -2.0% vs -1.4% m/m expected

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

Eurozone Q3 GDP second estimate +0.4% vs +0.4% q/q prelim

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

AUDUSD Technical Analysis – The market expects the Fed to pause soon

Fundamental OverviewThe US CPI yesterday came in line with expectations leading to a bit of a “sell the fact” reaction in the US Dollar. The bullish momentum picked up a bit later though as Fed’s Logan delivered a hawkish comment saying that “models show that Fed...