Via analysts at UBS on US equites. Thye argue there are seven conditions that need to be met for the formation of a stock market bubble.Six of the seven have been met: the end of a structural bull marketprofits under pressureloss of market breadtha 25 year gap from...

New Zealand exports in November higher than in October (imports lower)

New Zealand trade data for November 2024Exports 6.48bn NZDprior 5.61bn Imports 6.92bnprior 7.27bnTrade Balance -437.0mnprior -1658mnAnnual Trade Balance -8.25bnprior -9.07bnNZD/USD not a lot changed on the data release, nestled near US time lows. For the technical...

Forexlive Americas FX news wrap 19 Dec: BOE keeps rate unchanged but is more dovish

Markets:Crude oil $69.14 down -$0.88 or -1.26%Gold up $8.98 or 0.35% at $2593Silver -$0.30 or -1.07% at $29.02Bitcoin down -$2,300 at $97,611In the US stocks, the broader indices gave up gains and closed lower, but the Dow snapped a 10 day losing streak and is closing...

Federal Reserve monetary policy has entered a new phase – may be quite different

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

US broader indices give up gains and close lower on the day

Late selling into the close has pushed the broader indices lower and into negative territory. The Dow held onto small gains - but just barely - and snapped it's 10-day losing streak.The final numbers are showing"Dow Industrial Average rose 15.37 points or 0.05% at...

New Zealand December consumer confidence jumps into optimism! 100.2 (prior 99.8)

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

Economic calendar in Asia – Japanese CPI data & People’s Bank of China rate-setting

The Bank of Japan (BOJ) left its short-term rate unchanged yesterday, while Governor Ueda spoke later:Today we get the latest update on Japan's national inflation data. This has been, and remains, a focal point for BOJ monetary policy decisions, along with wage...

Trade ideas thread – Friday, 20 December, insightful charts, technical analysis, ideas

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

[12월, 이통장 없다면 나만 손해 봅니다! 자격 된다면 꼭 확인하세요]#3.1경제독립tv

https://www.youtube.com/watch?v=1dh10iLlNik [12월, 이통장 없다면 나만 손해 봅니다! 자격 된다면 꼭 확인하세요]#3.1경제독립tv [3년뒤 10억부자 3.1경제독립tv필독추천영상] [1]정기예금 꼭~이렇게 가입하세요~ 이자 40만원~100만원! 더 받아요! https://youtu.be/6U8BR4kcPAo [2]통장에 이 돈 당장 빼세요! 만65세, 기초연금탈락! 통장에 얼마 있으면 못받나?...

Dow on pace to halt its 10 day losing streak

US stocks are modestly higher after the sharp declines during yesterday's trading. Moreover the Dow is on pace to snap its 10 day decline that saw the index fall -6.12% from the high December 5 to the low price reached yesterday. The low price yesterday reached...

Republican Congressman Tom Cole says there’s an agreement on a stopgap funding bill

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

Crude oil futures settles at $69.38, down -$0.64 or 0.91%

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

Mexico central bank cuts its benchmark interest rate to 10% from 10.25%

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

Bitcoin moving down and away from $100K

The price of bitcoin has reached a low of $96782 and bounced modestly. The digital currency currently traders at $98434 down -$1739 or -1.71% on the day. Looking at the hourly chart, the price moved below the 100 and 200 hour MAs yesterday and then corrected higher,...

US sells 5 year TIPS at 2.121% vs WI at 2.065% at the time of the auction

High Yield: 2.121%Compared to the previous auction's yield of 1.67%.Higher than the six-auction average of 1.99%.Tail: 5.6 basis pointsLower than the previous auction's tail of 15 basis points.Lower than the six-auction average of 9.0 basis points.Note: The 5-year...

GBPUSD falls to new session lows

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

Deutsche Bank says the Fed won’t cut rates in 2025

Deutsche Bank is out with a note on yesterday's FOMC meeting and they highlighted a significant shift in tone. While the Fed delivered a 25 basis point rate cut, bringing the federal funds rate to 4-1/4 to 4-1/2 percent, the bank's analysts note that the overall tone...

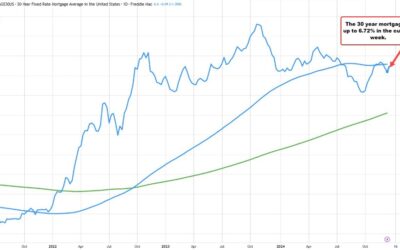

US 30 year mortage rate rises to 6.72% from 6.60% last week.

The rate on the 30-year mortgage in the US from Freddie Mac rose to 6.72% in the current week from 6.60% last week. That is still below the high from November which reached 6.84%. The high for the year was 7.22% reached on May 2, 2024.In other housing data today,...

USDJPY continues the trend move to the upside. Resistance target area reached

The USDJPY has continued the trend move to the upside and in doing so has reached a swing area between 157.55 adn 158.42. The high price has so far reached 157.80. The move to the upside based on Tueday and early Wednesday against the 100 hour MA. The FOMC decision...

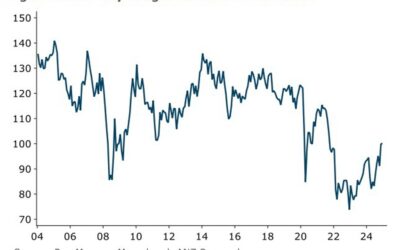

Euro Slips as ECB Eases and Fed Stays Firm

The old continent’s currency took a hard hit this year. Unfortunately, there hasn’t been much support from local policymakers or the economy.The most actively traded currency pair globally, EURUSD, slid below $1.05 on Wednesday after better-than-expected economic data...

![[12월, 이통장 없다면 나만 손해 봅니다! 자격 된다면 꼭 확인하세요]#3.1경제독립tv](https://my.blogtop10.com/wp-content/uploads/2024/12/12ec9b94-ec9db4ed86b5ec9ea5-ec9786eb8ba4eba9b4-eb8298eba78c-ec8690ed95b4-ebb485eb8b88eb8ba4-ec9e90eab2a9-eb909ceb8ba4eba9b4-eabcad-400x250.jpg)