The Fed cut rates, BUT they took back 2 of 4 cuts expected in September (only expect 2 cuts in 2025). As a result, the market is only pricing in an 8% chance of a cut in January and only 35 basis points of cuts by the end of 2025 (even more hawkish than the Fed). The...

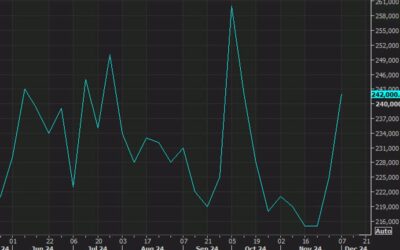

A jump in initial jobless claims would be just perfect

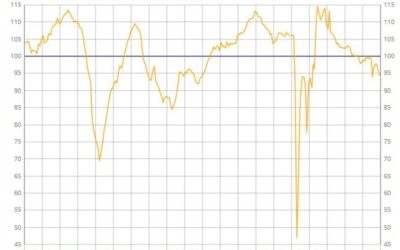

We get a trio of economic data releases at the bottom of the hour including US initial jobless claims (shown above), the Philly Fed and final Q3 GDP.The one to focus on is claims. It caught the market off guard with a jump last week, though it looks like it was due to...

ForexLive European FX news wrap: Yen tumbles on Ueda, BOE keeps rates steady

Headlines:Markets:CHF leads, JPY lags on the dayEuropean equities lower; S&P 500 futures up 0.7%US 10-year yields up 4.4 bps to 4.542%Gold up 1.0% to $2,612.73WTI crude down 0.2% to $70.42Bitcoin up 1.3% to $102,276It was a modestly eventful session as market...

BOE leaves bank rate unchanged at 4.75%, as expected

Prior 4.75%Bank rate vote 6-3 vs 8-1 expected (Dhingra, Ramsden, Taylor voted to cut bank rate by 25 bps)A gradual approach to removing monetary policy restraint remains appropriateWe can't commit to when or by how much we will cut rates in 2025 as economic...

ECB’s Patsalides: I prefer small, gradual rate cuts

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

What to expect from the BOE later and after today’s meeting decision?

On the bank rate vote, here's what the calls are:Barclays: 8-1 vote for a hold but minor possibility it could be as much as 6-3BofA: 8-1 vote for a hold with risks for a 9-0Deustche: 9-0 vote for a holdGoldman Sachs: 8-1 vote for a holdHSBC: 8-1 vote for a holdJP...

Vantage Gears Up for iFX EXPO Dubai 2025: Innovation, Insights, and Empowerment in Trading

January 2025 – Vantage Markets, a leading multi-asset trading platform, is excited to announce its participation at the highly anticipated iFX EXPO Dubai 2025, scheduled for January 14-16 at the Dubai World Trade Centre. As one of the premier global events for the FX,...

Nasdaq Technical Analysis – The dip-buyers enter the market at a key support

Fundamental OverviewThe Nasdaq yesterday sold off aggressively following the FOMC decision as the market perceived it as more hawkish than expected. Overall, apart from some slight tweaks, the Fed was in line with the market’s expectations, and the selloff might have...

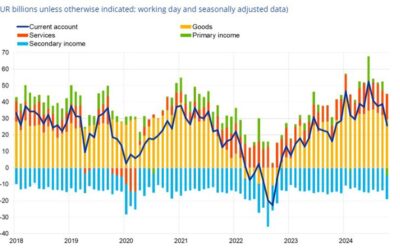

Eurozone September current account balance €26.0 billion vs €37.0 billion prior

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

S&P 500 Technical Analysis – Was that an overreaction?

Fundamental OverviewThe S&P 500 yesterday sold off aggressively following the FOMC decision as the market perceived it as more hawkish than expected. Overall, apart from some slight tweaks, the Fed was in line with the market’s expectations, and the selloff might...

ECB’s Šimkus: Inflation risks are balanced for next year

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

Dollar gives back some of its post-Fed gains

USD/JPY may be at the highs for the day at 156.85 but the dollar is lower against the rest of the major currencies bloc at the moment. The greenback is down around 0.3% to 0.4% across the board, so the losses elsewhere aren't anything too significant as compared to...

Gold Technical Analysis – The bulls held the line

Fundamental OverviewGold dropped briefly below a key support yesterday following the FOMC decision as the market perceived it as more hawkish than expected. Overall, apart from some slight tweaks, the Fed was in line with the market’s expectations, and the market’s...

이제부터 소상공인, 자영업자 새로 생긴 원스톱 서비스! 혜택 알아두세요~

https://www.youtube.com/watch?v=yauUqxt2Ml0 오늘 영상은 주변에 소상공인, 자영업자 지인이 있다면 꼭 공유해주셔서 도움 주시면 좋겠습니다. #소상공인 #자영업자 #뉴스 MoneyMaker FX EA Trading Robot

Ethereum Price Prediction by AI

🚨 Ethereum Price Prediction & ETH Futures Forecast🕒 Important NoteThis Ethereum price prediction is based on current market conditions, at the time of writing, as ETH futures contract is at price $3,693. Key levels below and above this price serve as potential...

France December business confidence 94 vs 96 prior

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

BOJ governor Ueda: Hard to say if incoming data will be sufficient to support January hike

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

BOJ governor Ueda: The big picture on wage trends will become clearer in March, April

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

Eurostoxx futures -1.6% in early European trading

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

Germany January GfK consumer sentiment -21.3 vs -22.5 expected

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...